Key Takeaways

- Bank marketing is no longer about visibility; it’s about earning credibility, building authentic relationships, and aligning every message with growth.

- The most lasting change comes from small, consistent actions and creative collaboration that turn ideas into measurable impact.

- The future of bank marketing will be shaped by precision targeting, smarter use of data, authentic storytelling, and a direct tie to strategy.

In a city known for its rhythm and resilience, the American Bankers Association’s Bank Marketing Conference in New Orleans brought the same energy to the future of banking. Walking in on the first day, I immediately felt the buzz in the room. This wasn’t going to be another stuffy industry gathering. Instead, marketers, executives, and leaders were building together, driving a new vision for how banks connect with customers, build trust, and sustain growth.

What became clear throughout the event is that bank marketing has moved far beyond visibility. In today’s banking environment, marketing is about earning credibility, building authentic connections with customers, and ensuring every message aligns with a broader strategy and growth goals. At the ABA Bank Marketing Conference in New Orleans, I saw these ideas come to life—not just in the sessions, but in the candid conversations that left me rethinking how marketing truly drives growth in banking.

The state of bank marketing

Bank marketing is under pressure like never before. Generational shifts are reshaping what customers expect from their banks, while digital disruptors are raising the bar on convenience and personalization. At the same time, leadership teams are demanding hard proof that marketing efforts directly support revenue and growth. The result? Bank marketers today are asked to do more with less: deliver measurable impact, modernize fast, and still uphold the trust that is central to banking.

This conference aimed to address this challenge: how can banks modernize marketing to stay relevant, competitive, and growth-focused? Far from being weighed down by disruption, the sessions and discussions revealed a spirit of optimism. Attendees shared how they’re leaning into change to build deeper customer relationships and position their institutions for long-term success.

As a first-time attendee, I was excited to underline the synergy between IBISWorld and bank marketing: how our research empowers banks with the clarity, data, and strategic insights they need to navigate uncertainty with confidence. As I spoke to current clients and discussed new challenges, it was inspiring to see how our research is being applied in the field to shape campaigns, sharpen positioning, and strengthen strategy. For us, the conference was an opportunity to listen, learn, and deepen those partnerships while connecting with new voices driving the future of bank marketing.

From the front lines of change: My biggest insights

While the conference explored the big-picture challenges facing bank marketing, the real impact came from the sessions that translated those themes into personal stories, practical lessons, and bold calls to action. Two stood out for me in particular.

Redefining leadership through small, consistent actions

One of the most inspiring moments was the Girl Banker Brunch, led by Natalie Bartholomew (The Girl Banker and Community President at First Community Bank). She moderated a panel with Mickey Belle Shields-Manley (CS Bank), Jennifer Huffman (Atlantic Union Bank), and Christie Huber Obenauer (Union State Bank). Together, they shared their journeys and left the room with advice that was both practical and empowering:

- Lean into being “first,” whether it’s stepping into a new role or breaking new ground for your institution.

- Small actions matter. Consistency, authenticity, and visibility create long-term impact.

- Own your narrative: digitize your presence and design your brand with intention.

- “You belong in the room you’re in.” Surround yourself with the right people and create growth together.

As a first-time attendee, these words resonated deeply. They reinforced that meaningful change in marketing often begins with confidence, intentionality, and the everyday actions that may go unnoticed but ultimately drive real results.

Thinking creatively to solve marketplace challenges

Another standout session came from Duncan Wardle, former Head of Innovation and Creativity at Walt Disney. His keynote, Think Creatively to Solve Marketplace Challenges, was engaging, energizing, and thought-provoking.

Wardle challenged us to replace “no, because” with “yes, and,” turning barriers into opportunities. He reminded us of the power of curiosity, playful ideation, and even absurd “what if” questions to spark innovation. Most importantly, he encouraged us to shift from “my idea” to “our idea,” showing how collaboration unlocks the most powerful solutions.

For me, this session was more than inspiration; it was reassurance. At IBISWorld, we’re growing alongside our clients. Just as banks are reimagining how they serve customers, we’re reimagining how to deliver insights in faster, more flexible, and more actionable ways. Wardle’s message reinforced that innovation doesn’t just belong in product development—it also belongs in marketing strategy, customer engagement, and in the way we help solve client challenges every day.

Four themes defining the future of bank marketing

Beyond the standout sessions, four themes captured not only where bank marketing is heading, but also how banks can lead in an era defined by rapid change. These aren’t passing trends. They’re structural shifts that will determine which institutions thrive.

1. From mass marketing to market precision

The era of broad, one-size-fits-all campaigns is over. Competitive pressure and rising customer expectations are forcing banks to sharpen their focus on niche markets and specialized client groups. Differentiation is no longer optional; it’s the foundation of relevance in a crowded industry. The banks that win will be those that identify overlooked segments, tailor their messaging, and position themselves as trusted experts for specific communities.

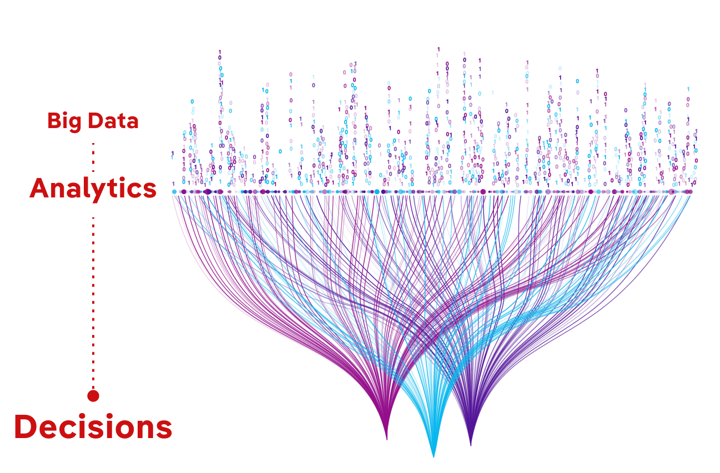

2. From big data to applied intelligence

Every bank has data, but not every bank knows how to turn it into impact. The next wave of competitive advantage comes from transforming data into action: segmenting customers by industry, size, and attrition risk, then using those insights to design personalized outreach and measure what really works. The frontier isn’t collecting more data—it’s operationalizing it in ways that deliver growth.

3. From product messaging to human relevance

Younger generations don’t buy banking—they buy solutions to the financial challenges that shape their lives and businesses. Authenticity, relevance, and connection matter more than product features. Campaigns rooted in real business pressures will always outperform generic, product-first messages. The future belongs to banks that can meet customers where they are, with empathy and insight.

4. From support function to strategic driver

Marketing is now a major boardroom priority. Leaders are being asked to directly support measurable growth objectives, from expanding deposits to accelerating C&I lending. This requires marketing teams to not just “tell the story,” but to shape which markets to enter, which opportunities to prioritize, and how to align campaigns with long-term institutional strategy. The bar has been raised: marketing must prove its role as a growth engine.

Final Word

Leaving New Orleans, I was struck by how boldly bank marketers are embracing change. From precision targeting to authentic customer connection, marketing has clearly moved from a support role to a true growth driver.

For me, the conference was both energizing and affirming. The conversations reinforced how IBISWorld’s insights help banks turn data into action, sharpen their strategies, and build trust with customers.

As a first-time attendee, I came to listen and learn, and I left with a renewed sense of how we can stand alongside bank marketers as they reimagine the future of banking.