Key Takeaways

- Benchmark your lending mix against national trends to uncover hidden concentrations.

- Use peer comparisons and segmentation tools to validate borrower performance in context.

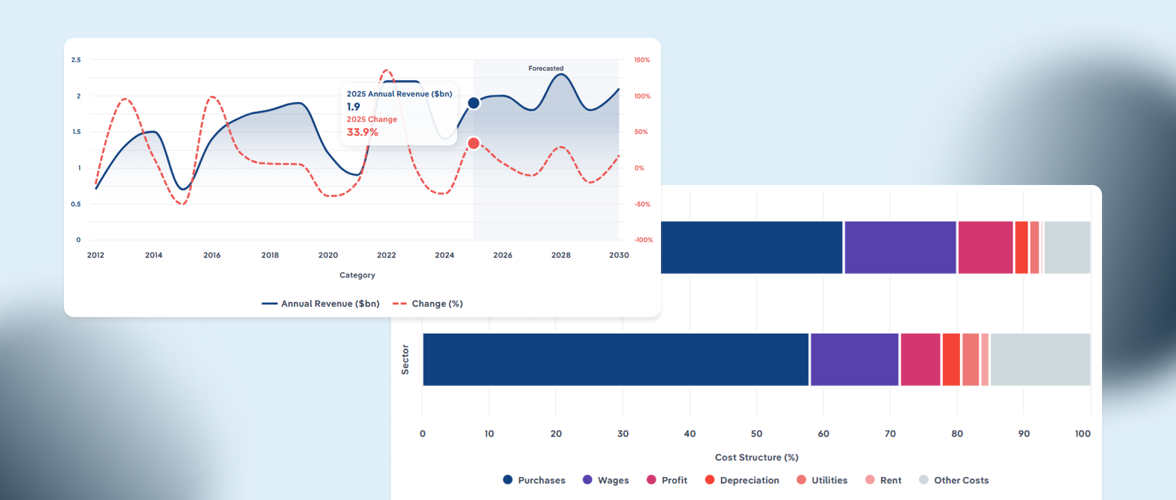

- Spot early warning signs and rebalance exposure proactively with industry forecasts.

- Strengthen internal alignment and client relationships with third-party industry data.

Bankers know that evaluating an individual borrower’s creditworthiness is essential, but that it doesn’t always tell the whole story. To manage risk effectively and maintain portfolio health, credit teams also need to understand how their lending mix stacks up across sectors and over time.

Strong lending volumes alone aren’t enough. Exposure concentrated in declining or volatile sectors can quietly erode portfolio stability. Without the right context, even well-structured deals can carry hidden risks; especially when macroeconomic forces or industry shifts haven’t yet appeared in borrower financials.

That’s why many banks use IBISWorld to gain earlier visibility into portfolio vulnerabilities. Our industry data and tools help banks and credit unions benchmark their loan books against national trends, break down exposure by sector health and identify where concentration risk is building. These insights not only support more confident rebalancing decisions, they also enable stronger internal alignment and more credible, data-backed client conversations.

In this article, we’ll explore how top-performing credit teams:

- Benchmark exposure and spot sector-level risks.

- Assess borrower performance within industry norms.

- Identify opportunities to rebalance portfolios strategically.

- Present recommendations with confidence to senior leaders and credit committees.

Benchmark your lending mix against national lending trends

The first step in maintaining portfolio health is knowing how your current lending mix stacks up. But without external benchmarks, it’s easy to overlook where your book may be concentrated in high-risk industries or out of sync with national trends.

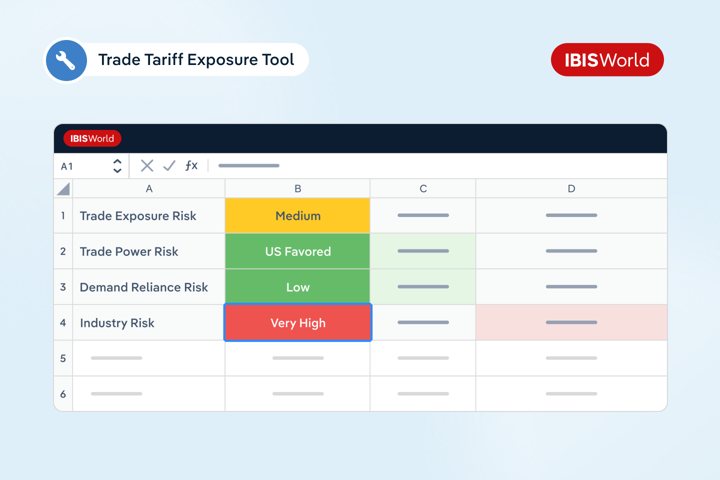

One portfolio team shared how they used IBISWorld to uncover vulnerabilities in their manufacturing exposure. Several of the bank's borrowers were heavily reliant on imported components from regions affected by shifts in U.S. trade policy. Using data from IBISWorld, the team pinpointed the most exposed industries and evaluated how cost pressures or disruptions might affect operations.

This insight transformed a routine review into a strategic discussion.

The team was able to engage clients early around supply chain planning, guiding mitigation efforts before financials were affected. It helped position the bank as a trusted advisor, not just a lender, strengthening both client relationships and risk oversight.

Regularly benchmarking internal exposure against national lending trends gives credit teams a clearer view of emerging risks and hidden concentrations. It also helps connect the dots across industries: how supplier challenges might ripple across borrowers or how geopolitical changes might affect sector-level resilience. The earlier those connections are made, the more time there is to respond thoughtfully.

But benchmarking isn’t just about spotting risk.

It also helps credit professionals interpret borrower performance more accurately within context. For example, a company with slim margins may appear weak at first glance, but if that’s typical for the sector, it might actually reflect strong management.

The earlier those connections are made, the more time banks have to respond with confidence and rebalance exposure before stress shows up in borrower data.

Interpret borrower performance in context

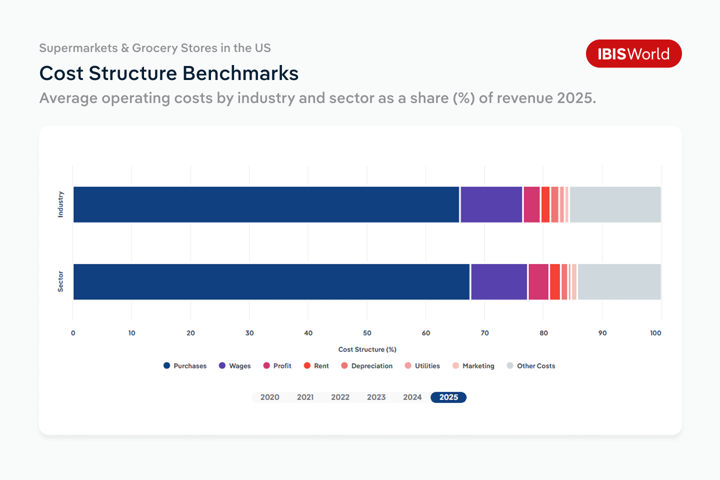

A borrower’s financials never tell the full story without context. Industry dynamics, cost structures, and sector-specific norms can make a big difference in how performance should be interpreted.

Take the U.S. Supermarkets industry. On paper, a profit margin of just 3% might seem like a warning sign. But in this sector, low margins are typical due to high volume and price sensitivity. Without benchmarking, credit teams might overestimate borrower risk and pressure businesses to make unnecessary changes.

IBISWorld’s Cost Structure Benchmarks reveal what’s normal. In this case:

- Wage costs for supermarkets sit at 10.7%, slightly above the broader sector average of 9.79%.

- Purchase costs are lower at 65.8%, compared to 67.54% across the sector.

- Profit for the industry, 3%, and the sector, 3.64%, are closely aligned.

This combination points to efficient operations, not underperformance.

Other banks we work with have embedded IBISWorld’s risk ratings and industry forecasts into their portfolio review process. These tools provide an added layer of insight when financials look steady on the surface but industry volatility is growing behind the scenes.

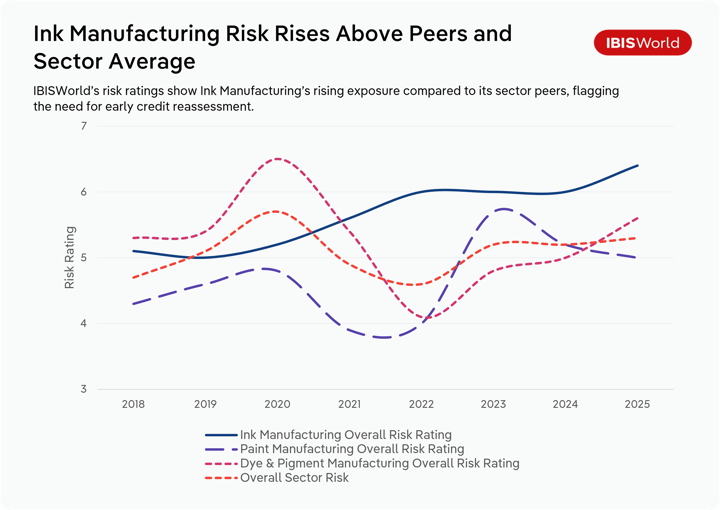

Segment borrowers and surface risk within industries

To manage exposure effectively, it helps to see how borrowers compare to peers. Industry benchmarking tools and financial ratio comparisons let credit professionals evaluate borrower performance in the context of other companies within the same industry. That benchmarking can highlight red flags (or surface strengths) that might otherwise go unnoticed.

This context changes how credit teams interpret borrower health. Declining margins at a single company might raise concerns, but when peers across the industry face similar pressure, it often reflects broader market conditions rather than management issues.

Take Ink Manufacturing in the US as an example. While the broader chemical manufacturing sector has seen mixed risk trends, IBISWorld’s risk ratings show that Ink Manufacturing has steadily climbed above both its peers and the sector average. This signals a rising exposure that might not yet be reflected in borrower financials but warrants closer scrutiny.

By layering external risk benchmarks over internal loan performance data, credit teams gain earlier visibility into where portfolio risk may be building. This helps them take timely action, whether that means reassessing exposure, increasing monitoring or preparing contingency plans.

On the other hand, outperforming borrowers in high-risk sectors often indicate stronger business models. These companies may warrant expanded support or deeper lending relationships.

IBISWorld’s risk ratings, for example, show Paint Manufacturing recovering more quickly than Ink Manufacturing, even though both operate in the same sector. Banks using this intelligence can steer portfolio strategy toward more resilient segments within challenged industries.

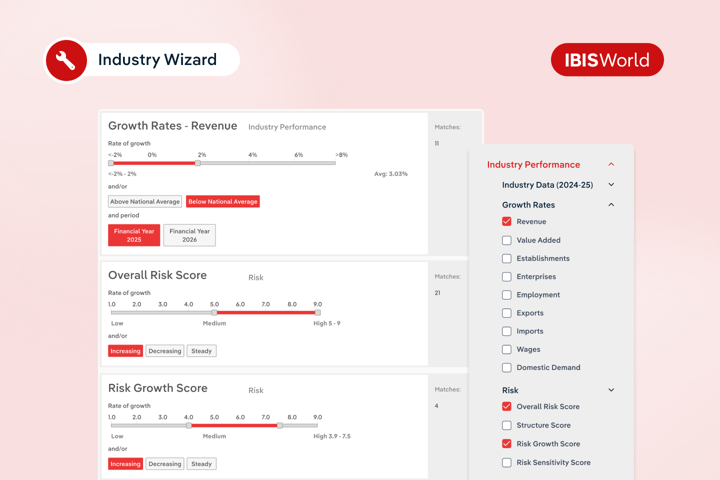

To support deeper analysis, banks and credit unions rely on tools like the Industry Wizard, which allows teams to:

- Screen industries based on risk level, growth rate or performance.

- Drill into key ratios like wages-to-revenue or revenue per employee.

- Pinpoint sectors aligned with strategic lending goals or deposit strategies.

This approach helps credit teams move beyond assumptions and apply a data-informed lens to every borrower and every sector. It leads to better risk visibility, sharper prioritization and more confident decision-making.

Rebalance proactively and support strategic growth

Spotting risk is only the first step. Protecting long-term portfolio health requires action. Rebalancing exposure (before losses occur) can make the difference between a resilient portfolio and one that is vulnerable to economic shifts.

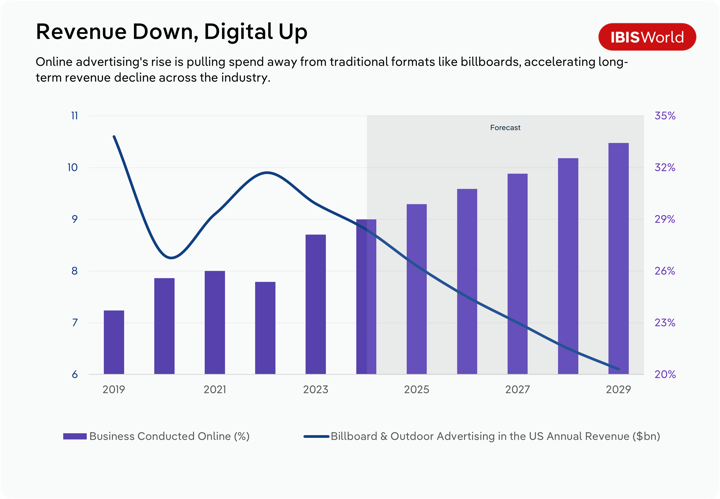

One credit team used IBISWorld’s industry forecasts to evaluate exposure across their book. They spotted a concentration of borrowers in an industry vulnerable to structural decline: Billboard & Outdoor Advertising in the US.

This raised concern.

Our data projects a 7.3% revenue decline over the next few years, driven by advertisers shifting to more cost-effective and target online platforms. Despite some short-term gains post-COVID, the long-term outlook remains negative, with rising operating costs and declining demand putting sustained pressure on margins.

With this insight, the team reassessed whether ongoing exposure to the segment aligned with their risk appetite. They gradually reallocated lending toward industries with stronger growth prospects and more durable business models. The result was a better-balanced portfolio and greater confidence in the bank’s ability to weather future disruption.

This kind of forward-looking oversight allows credit teams to adapt before financial stress appears in borrower data. IBISWorld's industry forecasts offer an early signal of where pressures may build, giving banks time to course-correct rather than react under pressure. These signals can be especially important when internal performance indicators look stable but broader economic shifts are already underway.

Another bank we support shared how integrating forecast data into their regular portfolio reviews helped them stay ahead of emerging risks. Over time, their approach evolved from reacting to risk to planning strategically with foresight. Their portfolios became more diversified, performance more stable and internal confidence stronger.

Embedding this practice into your credit workflow supports:

- Early identification of sector-specific risks.

- Timely adjustments to exposure limits.

- Better resource allocation for monitoring and engagement.

As economic cycles tighten and regulators increase expectations around credit governance, building this discipline into routine reviews gives lenders a competitive edge. It enables smarter lending decisions, greater resilience and more effective credit governance.

Present lending strategy with confidence

Communicating credit decisions effectively is just as important as making them. Whether you’re recommending a portfolio shift, adjusting exposure thresholds or advocating for a cautious lending call, your case is stronger when it’s backed by independent third-party data.

Pairing internal borrower data with industry benchmarks, forecasts and risk indicators adds valuable perspective and depth. This outside view helps shift discussions from opinions or assumptions to evidence-based analysis, which is especially important when recommending major portfolio changes or adjusting exposure limits that may differ from past trends.

Consider the US Commercial Real Estate industry. The shift to remote work has dramatically reduced demand for office space, but the impact hasn’t played out evenly across locations or asset types. One credit team used IBISWorld’s data to highlight how long-term demand softness in central business district office leasing was likely to affect a subset of their clients.

With that context, they recommended revising exposure thresholds and adjusting risk-weighted pricing—well before vacancy rates began hitting financials. By presenting the case with industry data in hand, the recommendation gained fast approval and internal buy-in.

Chief credit officers we’ve spoken with have emphasized the value of independent data in streamlining credit committee discussions. When proposals are grounded in external insight, they are easier to defend and more likely to receive buy-in.

IBISWorld supports this process by helping credit teams:

- Build more persuasive, data-backed lending strategies.

- Align risk and lending perspectives across credit, portfolio, and leadership teams.

- Strengthen governance and reduce delays caused by internal debate or subjective assumptions.

Ultimately, integrating industry intelligence into the credit process not only leads to better lending decisions but also strengthens credit professionals’ roles as strategic advisors to their clients. With better data, they can more clearly explain risk, justify recommendations and shape lending strategies that are grounded in market reality.

Final Word

IBISWorld’s industry intelligence helps banks manage portfolio risk with clarity and confidence. By benchmarking the lending mix, interpreting borrower performance in context and using forward-looking data to guide strategy, banks can strengthen both day-to-day decision-making and long-term portfolio resilience.

Teams who build these checks into routine credit reviews are better positioned to act early, reduce concentration risk and maintain a balanced portfolio.

This shift, from reacting to emerging problems to anticipating them, represents a critical evolution in portfolio management. It transforms the credit function from gatekeeper to strategic partner, helping banks align risk appetite, growth ambitions, and governance expectations more effectively.

Understanding what’s in your portfolio (and why it matters) is the foundation of resilient credit strategy. IBISWorld is here to help you get there.