The economy slowed during the first half of 2025 as ongoing pressure from tariffs and rising costs began to weigh on performance. Consumer spending increased, particularly for value-added products, which supported some growth despite challenging conditions.

Inflation data sent mixed signals. In June, headline CPI was below 2.0% year-over-year. However, core inflation remained above that level because of sticky prices and tariffs on US goods, preventing a broader recovery. Construction investment split: Residential projects performed well, while nonresidential investment fell as developers faced higher costs and restricted financing in an uncertain environment.

Job gains were mild and overall unemployment declined slightly. Youth unemployment rose because employers focused on hiring skilled, experienced workers and overall job opportunities narrowed in key sectors. The Bank of Canada kept interest rates steady at its last two meetings after two cuts in January and March 2025, choosing caution until conditions changed. Real GDP rose 2.2% annually during Q1, but softer trends in the second quarter led the GDP to fall 1.6% annually in Q2 and drop 0.4% quarter-over-quarter, reversing some earlier gains.

Labour market

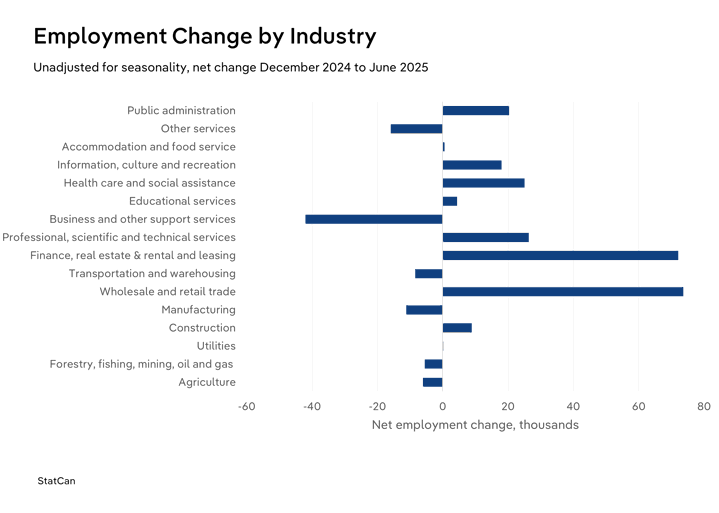

- The labour market showed modest growth from December 2024 to June 2025, with overall employment rising 0.7%. Growth was led by finance, insurance, real estate, rental and leasing and wholesale and retail trade, boosted by fintech investment opportunities and seasonal activity in retail. Temporary expansion in trade-related sectors amid tariff concerns also helped boost growth.

- Unemployment improved during the period, dropping from 7.1% in January to 6.5% in June 2025, primarily driven by increased hiring in retail. However, youth unemployment increased to 14.3% in June 2025 from January 2025, as selective hiring practices limited opportunities for younger workers who lack specific skillsets.

- Job losses occurred in business and management and administrative support services, agriculture and other services like personal and laundry services as companies cut budgets and slowed expansion plans. Small businesses were particularly pressured by ongoing tariffs and inflation, resulting in weaker job prospects within industries closely tied to US trade.

- Wages grew by 1.6% over H1 2024, fueled by a shift toward skill-based roles, increases in minimum pay schemes and higher unionization rates. These factors helped many sectors raise workforce compensation, even as adjustments to pay structures continued across the economy.

Consumer spending

- Amid tariff shifts, consumer spending and household consumption expenditures grew, with H1 2025 spending surpassing H2 by 1.3%. Rising expenditures on goods and services drove this increase as consumers adjusted to economic changes by buying items with long-lasting value.

- With consumers increasingly focused on value-added products, household textiles and financial services saw the most significant spending gains during this selective growth period. Improved housing sales incentivized purchases in these categories as consumers settled into new homes, while inflationary pressures fueled demand for financial management services that offer returns.

- Spending declined for education, recreational and cultural services, while alcoholic beverages experienced significant losses. Consumers shifted away from non-essential categories like alcohol and recreation in favor of cost savings. Lower university enrollment, due in part to government restrictions on immigration aimed at controlling population growth, further reduced spending at educational institutions. Reduced spending on US-related alcoholic beverages in response to the tariff policies has led to a decline in expenditures in these categories during the period.

Inflation

- When factoring together all items, the raw consumer price index grew 1.9% YOY as of June 2025, indicating that inflationary pressures have been on a recovering pathway throughout the period, which comes amid massive improvements in transportation costs. Removing carbon taxes and global buildup of oil supplies helped the country's inflation rates, resulting in lower gasoline prices and outperforming G7 peers, including the US.

- Core inflation rose 3.0% YOY in June 2025. This increase excludes volatile price swings for items and averages the remaining categories that are less volatile. This indicates that, when accounting for price volatility, these indexes haven’t improved enough to prompt a full recovery of prices for all items. Lack of recovery prevents the BoC from making dramatic cuts to stimulate the economy until these prices recover to their ideal rate.

- Increasing inflation is tied to the increasing cost of labour across Canada, making it difficult for companies to reduce costs. especially amid ongoing wage increases due to regulations. Retaliatory tariffs on US imports further increased cost-of-business issues, fueling price increases.

Residential construction

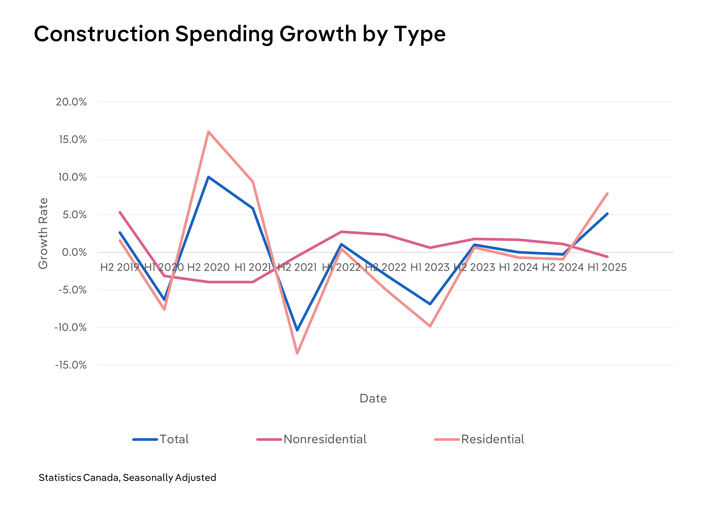

- Investment in residential construction increased by 5.2% from December 2024 to June 2025 and grew 4.2% year-over-year driven by developers gaining visibility on project types and benefiting from stabilized rate cuts that eased borrowing costs, enabling more projects to proceed.

- Housing starts averaged 15.5% growth in H1 2025, led by an 18.6% rise in multi-dwelling property investments. This growth offset a 1.3% drop in single-dwelling projects, as multi-unit buildings addressed ongoing housing shortages and maintained ongoing development activity.

- Yields dropped over the period following rate cuts, decreasing mortgage rates closely linked to 10-year Canadian government bonds, falling from 6.49% in December 2024 to 6.09% in June 2025, creating a more favorable market for homebuyers.

Nonresidential construction

- Nonresidential construction investment declined, falling 3.0% from December 2024 to June 2025 and 2.1% from July to June 2025. Higher tariffs, persistent inflation and reduced market demand made privately funded projects intended to complement a growing economy increasingly difficult, causing developers to delay expansion until conditions become more favorable.

- Industrial and commercial sectors were especially affected, with each respective industry taking on 6.8% and 4.3% investment losses. More office building vacancies have led to increased investment in converting offices into residential condos, diverting capital away from traditional commercial and industrial projects and resulting in minimal to no growth for these categories.

- Institutional building investment instead grew by 5.2%, supported by steady government spending and the expansion of Canada’s medical industry. Growing demand for facilities like medical outpatient centers has helped maintain activity in this segment.

Financials

- Amid ongoing fluctuations, the Bank of Canada cut interest rates from 3.0% to 2.75% in January and March 2025. Still, it held rates steady in April and June 2025 to evaluate tariff impacts, signaling openness to cutting further if economic deterioration deepened.

- Financial markets were volatile: the S&P/TSX index returned 1.5% in Q1 as tariff uncertainty dominated, leading gold to soar 19% as investors sought safety despite stimulative policies.

- Market conditions rebounded in Q2, with large caps gaining 6.8%, mid caps 12.0% and small caps 11.1%. Recovery was driven by the fading of tariff shocks and renewed investment optimism in technologies such as AI, bolstering information technology, consumer discretionary and financials.

Macro outlook

Economic tariffs dominated the first half of 2025. The US imposed tariffs on Canadian goods and Canada retaliated, setting the tone for much of the year. A recent federal court decision found these US tariffs unlawful, but as the Trump Administration appealed to the Supreme Court, the tariffs remained in force, keeping pressure on Canadian growth. Recognizing rising unemployment and shrinking US GDP, Canada repealed many retaliatory tariffs in September 2025, which could ease conditions for Canadian industries. However, a major new US-Canada trade pact still appears unlikely in the near term.

Beyond trade, immigration policy tightened. The Temporary Foreign Worker Program was restricted to sectors facing severe labor shortages, reversing previous practice. In parallel, the Economic Mobility Pathways Pilot for skilled refugees was extended to December 2025 and made permanent, focusing migration intake on skill needs and expanding the domestic talent pool to tackle shortages. These reforms are designed to align immigration with labor market gaps.

Efforts to combat Canada’s housing shortages intensified. In September 2025, the government created the agency Build Canada Homes, pledging $13.0 billion for housing construction to build 500,000 homes each year for the next decade. These projects are intended to lower developers' costs, boost investment optimism and expand residential supply underpinned by direct government support.

Risk ratings

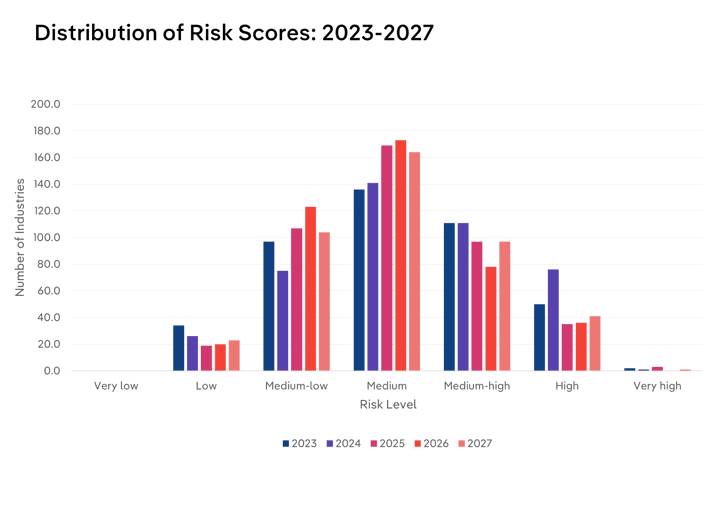

- Rising inflation driven by supply chain disruptions pushed risk levels higher across Canadian industries in 2023, resulting in 37.9% of sectors being rated as medium-high risk or above.

- By the end of 2024, inflation had returned to the Bank of Canada’s target range. However, unemployment increased and the cost of key items like housing remained unrecovered, making housing the top expense for most consumers. These ongoing issues moderated consumer spending. Compounding this, businesses faced persistent challenges filling skilled positions, leading to labor shortages and raising the share of industries at medium-high risk to 43.7%.

- Continued tariff disputes with the United States and China are expected to exert pressure on the economy. However, the impact of earlier rate cuts, the removal of many retaliatory US tariffs and more moderate consumer spending will likely provide some relief. Nearly 31.4% of industries in 2025 are projected to fall into the medium-high risk category.

- Canada’s renegotiation of the USMCA is anticipated to provide near-term relief by setting the terms of trade with two of Canada’s biggest trading partners, which are Mexico and the United States. At the same time, ongoing negotiations with countries in the Asia-Pacific and South America on new trade agreements could broaden Canada’s market access. Should these deals materialize, the percentage of industries rated as medium-high risk could fall to 26.5% by 2026.

Sector highlights

Mining: US tariffs on Canadian products extend directly to the mining and energy sectors. With the US targeting items like steel and Canadian energy, these industries which are heavily dependent on US trade, face new costs that make their goods less competitive abroad. Until a favorable trade agreement is secured or new partners emerge, industries reliant on the US market must adjust to contracting sales opportunities, dampening growth prospects well into the period. Because of this, oil drilling, gas extraction and mineral and phosphate mining are expected to remain especially vulnerable throughout the year.

Retail Trade: Retail spending is expected to remain subdued as persistent inflation forces consumers to be more budget-conscious, making business growth challenging for retailers. While Canada has rolled back many tariffs on US products, consumer budgets remain stretched and US auto tariffs are still in place, making it harder for the vehicle market to recover. The combination of tariffs affecting cars and ongoing inflation has slowed growth even further, especially with new Canadian tariffs on Chinese EVs weighing on demand. These pressures cause particular difficulties for auto parts stores and new car dealers, who will likely experience higher stress in the coming period.

Construction: Even as nonresidential spending slows, residential construction is positioned to perform strongly thanks to ongoing government support and more favorable housing conditions. Home prices are softening and interest rates are declining, giving buyers more opportunities and fueling demand for new construction. The government’s focus on large-scale, multi-unit housing is a response to Canada’s chronic housing shortage, with further support from increased federal and provincial infrastructure investment. Mark Carney’s administration has designated fast-tracked port upgrades and Northern roadway projects as key priorities for the year, providing a further boost. With these expanded public commitments, apartment and condominium construction and heavy engineering construction are set to see increased activity throughout the coming period.