Key Takeaways

- Spot high-growth industries first – use our Industry Wizard to cut through the noise and find the best opportunities before your competitors do.

- Validate market potential and go beyond trends. Dive into competition, cost structures, and industry life cycles to ensure smarter, more strategic moves.

- Risk Ratings help you separate hype from sustainable growth, so you can reduce risk and improve return on investment.

- ESG insights ensure long-term success by factoring in compliance and investor expectations.

Finding the next big opportunity isn’t just about recognizing a trend - it’s about understanding why it’s happening, whether it’s sustainable, and how to act on it before the competition does. But in a business environment shaped by economic shifts, policy changes, and technological disruption, clarity isn’t always easy to come by.

I’ve seen companies waste months chasing industries that look promising on the surface, only to realize too late that the market was oversaturated, profitability was a mirage, or regulatory challenges were too great. On the flip side, I’ve watched businesses scale rapidly because they had the right insights at the right time, giving them the confidence to move fast and make decisions others hesitated on.

That’s where a strategic, data-driven approach makes all the difference. Our tools are designed to eliminate guesswork and help businesses identify, assess, and capitalize on the best opportunities. Let’s walk through how you can do the same.

Step 1: Find opportunities with the Industry Wizard

Strategic growth starts with clarity, and that can be hard to find in a landscape shaped by shifting regulations, consumer behaviors, and technological breakthroughs. But clarity is the difference between making informed moves and costly missteps. With thousands of industries changing simultaneously, intuition alone isn’t enough.

Pursuing the wrong market can drain resources, stall momentum, and set an organization back months - or even years. To stay ahead, businesses need to look beyond surface-level trends and ask the right questions: Why is this industry growing? How does it align with our strategic objectives? Where will our investment drive the greatest returns?

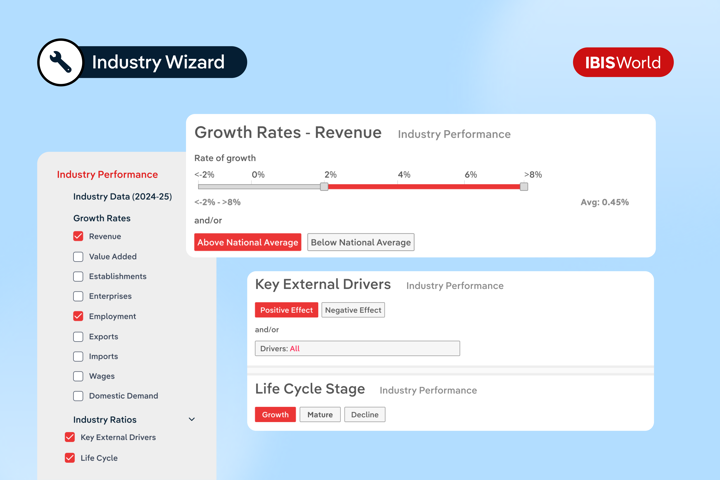

This is where IBISWorld’s Industry Wizard comes in. The tool helps you cut through the noise, and analyze industries based on key financial and operational metrics to spotlight the most promising opportunities. Instead of sifting through overwhelming amounts of data, you get clear, targeted insights that align with your growth strategy, so you can move from research to execution with confidence.

Spotlight on high-growth industries

The real advantage of clarity? It allows you to act quickly and effectively. IBISWorld’s Industry Wizard allows businesses to home in on industries poised for expansion, identifying those driven by various key drivers.

Rather than relying on guesswork, the tool enables users to apply customizable filters, such as growth phase, revenue trends, and key external drivers, to narrow down industries that fit their specific criteria. This means you’re not just reacting to change; you’re anticipating it.

Let’s take a closer look at three industries where IBISWorld’s insights have helped businesses pinpoint high-growth sectors and develop strategies that drive results.

Sports Administrative Services in Australia

With revenue growth of 16.32% and employment growth of 14.32%, the Sports Administrative Services industry in Australia is expanding, driven by increasing spectator and sport participation, as well as strong demand from traditional broadcasting. As more Australians engage with sports (whether as players or fans), the industry continues to benefit from heightened media coverage and growing event viewership. These factors are fueling opportunities for innovation and expansion across the sector.

Immersive Technology in the UK

The Immersive Technology in the UK industry is on a steep growth trajectory, with revenue growth of 30.04% and employment expanding by 20.04%. The industry is driven by rising IT adoption, increased research and development (R&D) investment, and growing business software expenditure. These factors reflect a broader push toward technological innovation, as businesses invest in cutting-edge solutions to enhance digital capabilities and improve operations efficiencies.

Solar Power in the US

With revenue growth of 26.35% and employment growth of 24.95%, the Solar Power in the US industry is expanding as businesses and governments accelerate investment in renewable energy. Positive key external factors, including tax credits for energy efficiency, rising electricity consumption, and decreasing semiconductor prices, are driving adoption. As energy markets shift toward sustainability and grid modernization, solar power is emerging as a critical pillar of long-term energy strategy.

These examples show how IBISWorld’s Industry Wizard simplifies the process of identifying industries with strong growth potential. By analyzing external drivers and lifecycle stages, it pinpoints where your efforts can deliver the greatest impact.

But identifying high-growth industries is just the start. IBISWorld’s reports go further, uncovering what drives demand, the risks involved, and the competitive landscape - providing everything you need to turn opportunities into results.

Step 2: Deepen your focus with in-depth reports

The next challenge is understanding how to compete, scale, and manage risk within these fast-growing industries. Our reports help businesses move beyond surface-level trends by providing granular insights into competitive forces, life cycle positioning, market volatility and more – all factors that help determine whether a business thrives or gets left behind.

By applying these insights across industries, businesses can evaluate competitive pressures, time market entry, and build resilient strategies, ensuring they make informed, high-impact decisions.

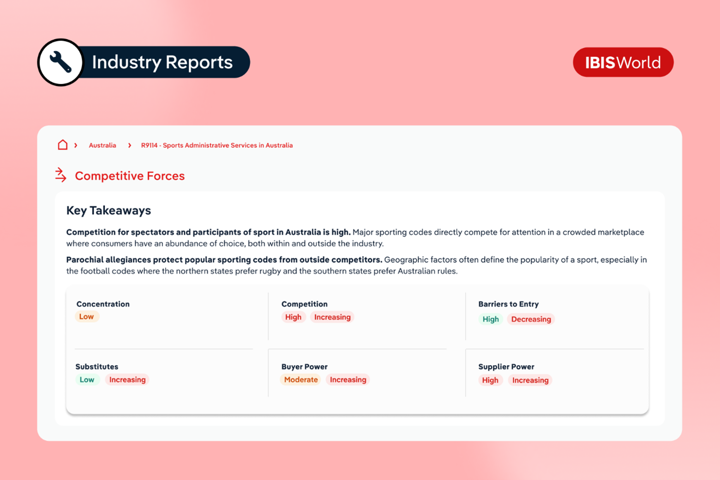

Competitive forces: Navigating crowded markets

In any industry, success depends on more than just demand – it’s about who you’re competing against and where you can differentiate. IBISWorld reports provide visibility into market concentration, buyer and supplier power, and barriers to entry, helping businesses refine their approach in competitive industries.

Sports Administrative Services in Australia

Take the high-growth Australian sport industry, which is crowded and highly competitive, with major sporting codes fighting for spectators, media deals, and participation. Businesses navigating competitive industries can benefit from insights such as:

- Market fragmentation: The industry is split across different codes, limiting the dominance of any single organization. Sports like Australian Rules Football and Rugby league have strong regional followings, making national expansion difficult.

- Barriers to entry: Legal restrictions and community ownership structures limit private investment, meaning new entrants must find alternative ways to build influence.

- Negotiation power: The increasing value of broadcast rights gives major leagues strong bargaining power, while smaller sports must differentiate through alternative revenue streams or grassroots engagement.

These insights are critical not just for sports administrators, but for any business competing in fragmented, highly competitive industries – from media and entertainment to retail and technology. Understanding where power lies and how to position strategically is essential for gaining market share.

Lifecycle analysis: Timing market entry and innovation

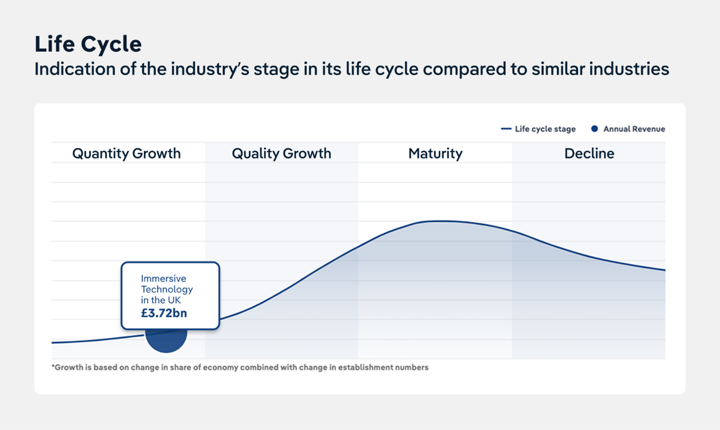

Industries evolve, and timing is everything when it comes to investment and expansion. IBISWorld’s life cycle analysis helps businesses identify whether an industry is in its infancy, growth, maturity, or decline – allowing them to align strategy accordingly.

Immersive Technology in the UK

A high-growth industry like immersive technology presents opportunities, but only for businesses that can navigate its rapid evolution. Key lifecycle insights include:

- Innovation trends: Augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) integration continue to open new applications, making constant adaptation essential.

- Market expansion: Adoption is increasing across industries, creating opportunities in sectors ranging from healthcare to e-commerce.

- Startups vs. consolidation: While new players enter the market, large tech firms are acquiring and scaling solutions, shaping the competitive landscape.

Whether in technology, pharmaceuticals, or finance, understanding an industry’s lifecycle ensures businesses invest at the right time, stay ahead of disruption, and scale effectively.

Volatility and cost structure: Managing risk in dynamic sectors

High-growth industries often come with high volatility, whether due to shifting regulations, supply chain constraints, or unpredictable demand cycles. IBISWorld’s volatility and cost structure insights help businesses plan for uncertainty and build sustainable growth strategies.

Solar Power in the US

The renewable energy industry is growing rapidly, but businesses must navigate regulatory shifts and cost pressures. IBISWorld reports highlight:

- Volatility analysis: Federal tax credits stabilize revenue streams, but state-by-state policy difference create unpredictability.

- Cost structure benchmarks: High capital investment is a barrier, but overproduction of solar panels has helped lower costs in the short term.

- Profitability insights: Shifting tariffs and fluctuating electricity prices require businesses to take a long-term view of investment and pricing strategies.

From energy to manufacturing to construction, industries affected by regulatory shifts or commodity price fluctuations benefit from volatility insights to optimize resources, mitigate risk, and maintain profitability.

Step 3: Assess long-term viability through risk analysis

It’s easy to be drawn to fast-growing industries, but growth alone isn’t enough - you need to understand what could disrupt it.

Often, businesses rush into booming sectors convinced they’re making the right call, only to find themselves struggling when regulations shift, funding dries up, or market conditions change. Early in my career, I worked with a company that expanded aggressively into a high-growth industry, only to realize – too late – that much of that growth was propped up by government incentives. When those incentives disappeared, so did their advantage.

That experience taught me a crucial lesson: Growth is an opportunity, but risk determines whether that opportunity is sustainable.

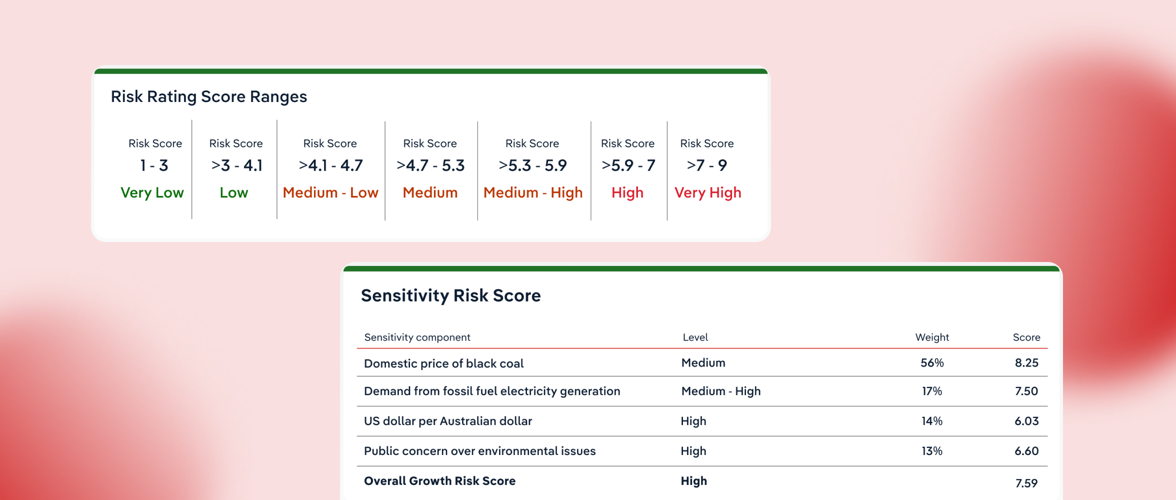

That’s why IBISWorld’s Risk Ratings go beyond surface-level growth trends, analyzing:

- Structural risk: How an industry’s design affects scalability, competition, and profitability.

- Growth risk: Whether an industry’s expansion is sustainable or built on short-term momentum.

- Sensitivity risk: How exposed an industry is to economic cycles, policy changes, and external disruptions.

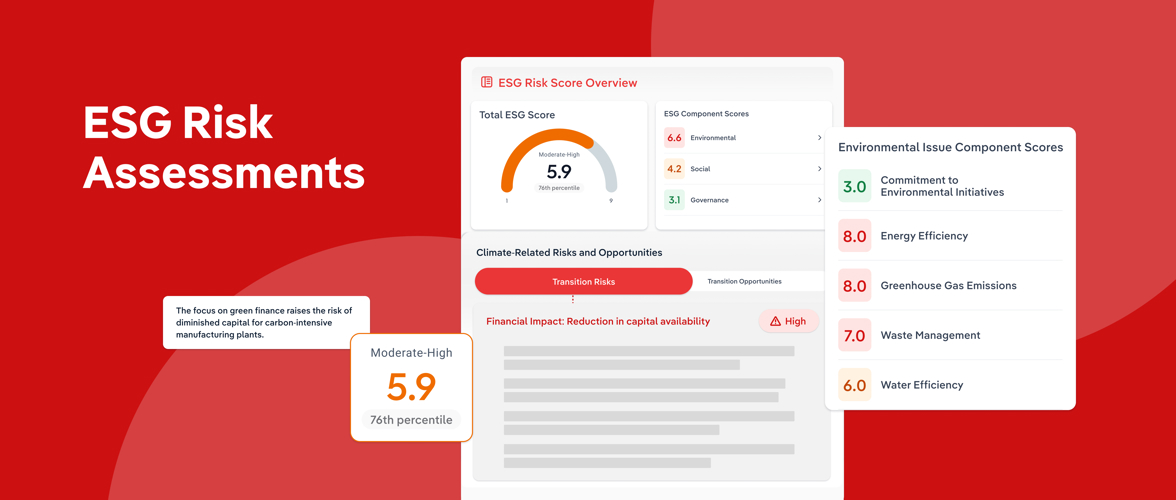

- ESG risk: The sustainability, compliance, and governance challenges that could impact long-term operations.

These risks don’t just affect one industry. They apply across sectors, shaping everything from market entry strategies to investment decisions.

Evaluating market viability

A high-growth industry doesn’t always mean a high-opportunity industry. While some markets expand on solid fundamentals, others rely on external forces—like government subsidies, investor speculation, or temporary demand surges—that may not last. Without assessing structural, growth, and sensitivity risks, businesses risk chasing short-term momentum rather than building sustainable value.

Take Solar Power in the US, an industry that appears to be a safe bet with a very low overall risk score (2.88). While revenue is set to grow by 26.4% in 2025, breaking down its risk factors could reveal if challenges still exist:

- Structural risk: The industry benefits from high barriers to entry and government support, which create long-term stability. However, competition is increasing, putting pressure on pricing and profitability.

- Growth risk: Strong government incentives, falling costs, and increasing adoption make growth highly sustainable.

- Sensitivity risk: While solar competes with natural gas, stable tax credits reduce volatility. However, any future policy shifts or supply chain disruptions could introduce new challenges.

These risk factors apply across industries. Tech startups may scale quickly, but many struggle with profitability once venture capital funding slows. Retail and e-commerce companies operate in low-barrier, highly competitive markets, making differentiation and pricing strategies critical. Manufacturers and construction firms face commodity price fluctuations, supply chain risks, and economic cycles that impact stability.

For businesses expanding into new markets, risk analysis isn’t about avoiding challenges—it’s about anticipating them. If growth is driven by real market demand, strong fundamentals, and long-term investment, the opportunity is sustainable. If growth depends on temporary conditions or external funding, businesses need to reassess whether the industry can deliver long-term returns.

Why sustainability and compliance matter

Beyond traditional risk factors, industries must navigate Environmental, Social, and Governance (ESG) risks, which shape regulatory requirements, investor confidence, and consumer expectations. Businesses that fail to address ESG risks may face compliance issues, reputational damage, or operational disruptions, which could threaten long-term viability.

Immersive Technology in the UK

The UK Immersive Technology industry is a fast-growing sector, but ESG challenges are becoming critical considerations for long-term stability. Environmental responsibility is increasingly important, with companies exploring ways to market VR and AR for sustainability initiatives, such as using immersive tech to visualize climate data.

Social risks are also growing, with only 10% of senior IT positions in the industry held by women, pushing companies to address workforce diversity and inclusion. On the governance side, legal frameworks are still evolving, meaning IP protection, copyright laws, and data privacy regulations create uncertainty for businesses navigating compliance requirements.

Sports Administrative Services in Australia

The Australian Sports Administrative Services industry is growing, but physical risk from extreme heat is becoming a critical ESG challenge that organizations must address to for long-term stability. Rising temperatures and the increasing frequency of heat waves present significant health and safety concerns for athletes, officials, and spectators. Without proper risk mitigation, sports administrators face potential disruptions, legal liabilities, and reputational damage.

Managing this risk requires a proactive approach. Heat policies must be updated and clearly communicated to athletes, coaches, and officials to minimize risk. Even scheduling may also need greater flexibility to account for extreme conditions, reducing the financial impact of cancellations. If not managed effectively, extreme heat could increase operational costs, decrease participation rates, and negatively impact revenue.

While these ESG risks are industry-specific, their impact is universal. Consumer goods companies are under pressure to reduce emissions and improve waste management. Tech firms face scrutiny over data privacy, AI ethics, and fair labor practices. Financial institutions must align with ESG investment standards to attract capital.

Ignoring ESG risks is no longer an option. Investors, regulators, and consumers expect businesses to align with sustainability goals and responsible governance. Companies that proactively address these challenges will build stronger reputations, mitigate regulatory risks, and secure long-term resilience in an evolving market landscape.

Why risk analysis matters

Risk analysis isn’t about avoiding industries—it’s about choosing the right opportunities and preparing for potential challenges. Business leaders responsible for identifying growth opportunities need to move beyond growth metrics to evaluate the real drivers behind industry success.

By assessing structural, growth, sensitivity, and ESG risks, businesses can:

- Make data-driven decisions that prioritize long-term stability over short-term gains.

- Anticipate regulatory, economic, and competitive shifts before they impact profitability.

- Identify industries with sustainable demand rather than those riding a temporary wave.

- Strengthen ESG strategies to meet investor and consumer expectations.

Whether expanding into a new market, launching a product, or refining a business strategy, risk analysis helps businesses stay ahead of industry shifts, mitigate uncertainties, and position themselves for lasting success.

Final Word

Finding the right industry to expand into, or compete within, requires more than just chasing high growth rates. It demands a deeper understanding of what’s driving that growth, whether it’s sustainable, and how to navigate risks effectively.

IBISWorld’s Industry Wizard streamlines the search for high-growth industries, providing clarity on market opportunities based on revenue trends, lifecycle positioning, and key external drivers. But identifying growth isn’t enough - our industry reports go deeper, breaking down competitive forces, cost structures, and volatility, helping businesses craft informed, strategic approaches. And with Risk Ratings and ESG Scores, businesses can assess long-term viability, ensuring they’re not just stepping into a fast-moving industry, but one that aligns with their capabilities, risk tolerance, and sustainability goals.

By integrating these tools, businesses can move beyond gut-feel decisions, mitigating uncertainty and confidently seizing the right opportunities. In an unpredictable economy, success isn’t just about spotting trends—it’s about understanding them, anticipating challenges, and turning insights into action.