Key Takeaways

- Client growth conversations stall when performance is discussed without external reference points.

- Without industry context, sales discussions rely on opinions, anecdotes, and internal metrics that feel inconclusive.

- The most persuasive growth conversations do not argue harder. They reframe the question using credible industry perspective.

Most client growth conversations start with good intentions.

Sales teams come prepared with pipeline updates, activity metrics, conversion rates, and internal benchmarks. Decks are polished. Talking points are rehearsed. The data is accurate.

And yet, the conversation often goes nowhere.

Clients nod politely. Questions surface about relevance. Momentum fades. The discussion ends with vague agreement and little conviction that anything meaningful has changed.

When growth conversations fall flat, it is tempting to blame messaging, delivery, or timing. But more often, the issue is structural rather than performative.

The conversation lacks industry context.

Without it, growth claims feel abstract. Targets feel arbitrary. Recommendations feel opinionated rather than grounded. Even strong internal performance struggles to translate into a compelling external narrative.

Sales conversations do not fail because clients are skeptical by default. They fail because the frame of reference is missing.

Why internal performance alone rarely convinces clients

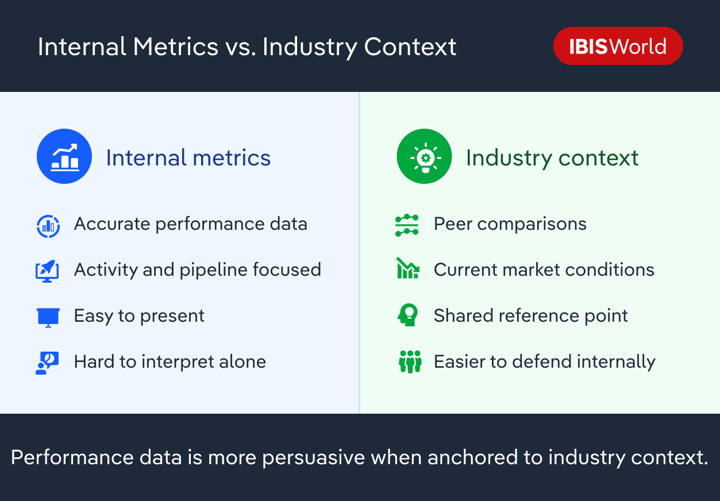

Most sales discussions rely heavily on internal metrics.

Revenue growth. Lead volume. Win rates. Account penetration. Quarter over quarter improvement. These measures are familiar and necessary. They show progress. They demonstrate effort.

But on their own, they do not answer the question clients are actually asking.

Is this good, bad, or typical given what is happening in our industry?

Without an external baseline, internal performance floats in isolation. Ten percent growth can sound impressive or underwhelming depending on what clients believe is happening around them. A flat pipeline can feel alarming or acceptable depending on broader market conditions.

When sales teams present internal results without industry context, they unintentionally ask clients to supply the interpretation themselves.

That is where conversations start to drift.

Clients fall back on instinct, anecdote, or recent headlines. The discussion becomes subjective. Agreement becomes conditional. Confidence weakens, not because the numbers are wrong, but because they are incomplete.

The hidden role of industry context in persuasion

Industry context does more than provide background. It changes how information is received.

When performance is anchored to sector trends, growth conversations shift from justification to interpretation. The discussion moves from what happened to what it means.

Context answers questions clients may not voice directly.

Are these results strong relative to peers?

Is this challenge company specific or industry wide?

Is this opportunity structural or temporary?

Without credible industry reference points, sales teams end up defending recommendations rather than exploring them. Every claim invites debate. Every suggestion requires extra explanation.

The absence of context forces persuasion to work harder than it should.

Strong growth conversations feel easier not because they avoid complexity, but because they reduce ambiguity.

When confidence depends on storytelling instead of substance

In the absence of industry context, sales conversations often lean more heavily on narrative.

Stories about similar clients. Anecdotes from other accounts. General statements about market momentum. These can be engaging. They can even be persuasive in the short term.

But they are fragile.

Clients may listen, but they rarely anchor decisions to stories alone. Especially when stakes rise, they look for something more defensible. Something that can be shared internally. Something that survives scrutiny after the meeting ends.

This is where many growth conversations quietly lose influence.

The discussion feels convincing in the room, but difficult to restate with confidence later. The logic relies too much on trust in the seller rather than evidence grounded in the client’s operating environment.

When follow up questions arrive, the conversation has to be rebuilt from memory rather than reinforced by data.

Why clients push back even when they agree

Sales teams often interpret client hesitation as disagreement.

In reality, hesitation usually signals uncertainty.

Without industry context, clients may conceptually agree with a recommendation while still feeling unable to justify it internally. They struggle to explain why now is the right time. Why this investment makes sense relative to peers. Why inaction carries risk.

That discomfort shows up as delay, deferral, or requests for more information.

From the outside, it looks like resistance. From the inside, it is a lack of external grounding.

Industry context gives clients language, not just insight. It provides a shared frame they can use to socialize decisions beyond the sales conversation itself.

Without that frame, even good ideas feel harder to move forward.

Four factors that quietly determine whether growth conversations land

Most client growth conversations succeed or stall before anyone realises a decision is being made.

Not because of what is said, but because of what is missing.

When industry context is present, four underlying factors tend to be addressed, even if they’re never labelled or discussed explicitly.

Industry momentum

Clients want to understand whether current conditions are expanding, stabilising, or tightening. Growth recommendations feel very different depending on whether the broader market is accelerating or absorbing pressure.

Relative performance

Internal results only become meaningful when placed alongside relevant peers. Without that comparison, performance exists in a vacuum and invites interpretation rather than clarity.

Structural versus company specific forces

Clients need to know whether challenges stem from internal execution or broader industry constraints. That distinction shapes urgency, accountability, and willingness to invest.

Forward implications

Industry context helps translate today’s conditions into tomorrow’s consequences. Growth conversations gain traction when clients can see not just what is happening, but where it is likely to lead if nothing changes.

When these factors are missing, conversations feel unfinished. Recommendations sound reasonable, but not inevitable. Momentum slows because the logic lacks an external anchor.

Industry context does not answer every question, but it resolves enough uncertainty to let decisions move forward.

When growth conversations become easier, not louder

The strongest sales conversations rarely feel forceful.

They feel clarifying.

Industry context removes the need to oversell. It allows sales teams to align with what clients are already sensing but struggling to articulate. It turns vague concern into structured understanding. It transforms opportunity from aspiration into informed choice.

Importantly, it also changes the tone of the discussion.

Instead of pushing growth, sales teams are interpreting conditions together with the client. The dynamic shifts from persuasion to partnership.

That shift is subtle, but powerful.

Why industry context is a sales capability, not just a research input

Industry context is often treated as supplementary. Something to reference if time allows. Something to add late in the process to strengthen a proposal.

In reality, it is foundational.

It shapes how clients interpret every metric, every claim, and every recommendation that follows. Without it, sales conversations ask clients to take more on faith than they are comfortable with.

With it, growth discussions become easier to engage with, easier to defend, and easier to act on.

Final Word

Client growth conversations do not fall flat because sales teams lack insight or effort.

They fall flat because insight without context feels unfinished.

Industry context does not make sales conversations more complex. It makes them more credible. It gives clients a reference point that turns internal performance into external relevance.

The most effective growth conversations are not the ones with the most data or the strongest pitch.

They are the ones that help clients clearly see where they stand, relative to the world they operate in, and why that matters now.

Without that perspective, even the best sales conversations struggle to move forward.

With it, momentum tends to follow naturally.