Key Takeaways

- Commercial Real Estate (CRE) exposure is becoming harder to justify—diversification into C&I is increasingly essential for risk compliance.

- Industry research reveals resilient sectors and supports faster, more defensible credit decisions.

- Embedding sector data into workflows improves credit memo quality and accelerates cross-team alignment.

Diversification isn't optional anymore; it's operational risk management.

In a market defined by higher-for-longer rates, regulatory scrutiny, and continued stress in commercial real estate, many institutions are reassessing their portfolio strategies. The CRE-heavy model that once generated predictable margin now poses a concentration risk that’s harder to ignore and harder to justify to regulators and boards.

That’s why Commercial and Industrial (C&I) lending is making a comeback. Not as a trendy shift, but as a structural necessity for risk-weighted balance sheet strength. But let’s be clear: this isn’t new territory for credit teams. You already know the benefits of diversification. The real issue is execution:

- Which sectors are resilient, not just growing?

- Which industries offer defensible credit stories today, not based on past performance, but forward-looking indicators?

- And how do you scale this insight across underwriting and origination without slowing down the lending process?

These aren’t theoretical questions. They show up in real conversations with loan officers, in credit memos that need more than surface-level comps, and in committee meetings where you’re expected to justify new sector exposures with confidence.

That’s where targeted industry intelligence becomes a practical edge. With the right data, you can reduce blind spots, uncover overlooked opportunities, and strengthen defensibility in every deal that steps outside your institution’s historical comfort zone.

Why the shift to C&I lending matters

For underwriters managing portfolio concentration and credit defensibility, expanding into C&I isn’t just diversification; it’s risk management with margin upside.

Here’s what matters from a credit and workflow perspective:

CRE risk has become a flashpoint

Cap rate spreads—a key margin buffer—have compressed to just ~180 bps over 10-year Treasuries, down from ~393 bps in 2015. That erosion, combined with rising valuation risk and refinancing pressure, makes CRE exposures harder to defend and slower to adapt.

What was once a stable, low-touch asset class now demands closer scrutiny with less room for error.

By contrast, C&I lending is more stable and carryable, requiring less capital lock-up and offering faster flexibility when conditions shift. In today’s regulator-watched environment, that structure is a strategic advantage.

Stickier relationships

C&I borrowers don’t just need capital. They bring deposits, cash management, payroll services, and transaction volume, giving lenders a broader, more resilient revenue stream beyond interest income.

More margin flexibility

Unlike CRE, where fixed rates and term locks dominate, C&I loans often float or reprice more frequently. In this rate environment, flexibility is critical to preserving spread and to adapting quickly if conditions shift.

Better local alignment

C&I lending reflects what’s actually happening in the economy: local businesses hiring, producing, and investing. Aligning your portfolio here means staying closer to regional growth and political interest (e.g. SBA incentives, reshoring trends).

More active, more resilient relationships

C&I lending keeps banks more actively engaged with clients. Unlike CRE loans, which often sit passively on the books until maturity or refinance, C&I portfolios involve frequent repricing, tighter monitoring, and deeper operational insight. This isn’t just a structural difference—it’s a risk management edge.

While C&I loan growth remained relatively flat (0–1%) in 2024, it reflected steadier fundamentals and lower volatility. By contrast, CRE loan growth slowed to just 1.3%, and delinquency in office CRE surged to 7.8% by Q3 2024—a clear signal of mounting stress in that segment.

Bottom line: C&I gives you more levers to manage risk, defend margin, and justify loan decisions, especially when paired with solid industry fundamentals.

Four blockers that slow C&I diversification and how to fix them

Even when the strategic case for diversification is clear, several real-world barriers keep portfolios from shifting fast enough, especially in credit environments that reward caution.

1. The “rearview mirror” problem

Historical loan performance data only tells part of the story. It often overlooks sectors undergoing structural change, whether decline or reinvention.

Without forward-looking signals, credit teams remain over-indexed on “familiar” industries, even if those industries are weakening. That makes credit memos harder to defend when defaults rise or forecasts miss the mark.

The Q2 2024 SLOOS shows exactly how this plays out. Banks are cautiously easing some loan terms—not because they’re optimistic, but because competitive pressure and sector-specific risks are forcing their hand. That nuance doesn’t show up in historical data, which is why underwriters need forward-looking, sector-aware insight to justify exposure.

Fix: Incorporate industry outlooks that capture macro shifts, cost pressures, and market volatility before they show up in borrower performance.

2. Blunt risk buckets

Emerging industries often don’t fit neatly into legacy NAICS categories. Some high-potential niches get lumped in with volatile peers, inflating risk perception.

This leads to missed opportunities, especially in sectors that are structurally sound but poorly segmented.

Fix: Use sub-sector data that drills deeper than the code: margins, competitive dynamics, regulatory shifts, and growth drivers.

3. Misalignment between credit and origination

RMs are incentivized to bring in deals. Credit is incentivized to say no to anything unfamiliar. Without shared sector intelligence, both sides stick to their comfort zones.

That internal friction slows down diversification and keeps the pipeline filled with legacy exposures.

Fix: Give both teams access to the same sector-level insights so they can evaluate new industries on common ground.

4. Scaling new sector expertise is hard

Even when a promising new sector is identified, the lift to train credit teams, rewrite models, and adapt risk frameworks is significant, especially for mid-sized banks with lean teams.

Fix: Use third-party industry research as a plug-in for sector-level underwriting, cutting down the ramp time while still keeping standards high.

How industry research defends every C&I deal

Industry research isn’t just background context. For credit teams under pressure to justify new exposures and rebalance portfolio risk, it’s a frontline tool—one that sharpens decisions, strengthens memos, and builds internal alignment without slowing down deals.

Used correctly, industry data helps underwriters:

- Validate deal rationale with third-party support, not just borrower assumptions.

- Pre-empt credit committee questions with defensible risk markers.

- Discover durable sectors early, before they hit bank-wide radar.

- Avoid blind spots that historical loan performance or internal expertise may miss.

It’s not about replacing experience. It’s about scaling experience across the team, especially in sectors your bank hasn’t traditionally covered.

Why traditional data falls short

Too often, industry inputs in credit work are treated as check-the-box summaries, limited to broad NAICS descriptors or dated macro outlooks. That level of insight isn’t enough when you're making sector bets that will sit on your books for five to seven years.

What underwriters need is data that shows how industries perform under stress, evolve over time, and respond to the forces shaping today’s economy—labor shortages, rate cycles, regulatory shifts, and global disruption.

What high-value industry data should deliver

The right kind of research surfaces actionable signals fast. It should help you answer:

- How exposed is this industry to cost pressure, wage inflation, or input shortages?

- Is it riding durable structural trends or reacting to temporary demand spikes?

- Are there regulatory tailwinds (e.g. incentives, subsidies) or headwinds (e.g. restrictions, litigation risk)?

- Is the market fragmented and volatile or concentrated with stable margins?

These factors matter when you're writing credit justifications, defending loan terms, or explaining why a new sector deserves exposure. They also matter when you’re preparing to push back. For example, if an LO brings in a borrower with aggressive forecasts in a declining industry.

To add dimension: sectors like behavioral health clinics, aftermarket auto parts, and industrial automation often check multiple defensibility boxes.

This isn’t about forecasting the future; it’s about removing guesswork from the present.

Embedded early, scaled across teams

When industry insight enters the deal cycle early, it accelerates the entire process. Teams can agree faster, credit risk models become sharper, and origination stays focused on high-potential sectors that align with your institution’s strategy.

Most importantly, this approach gives you confidence that you’ve documented key risks and opportunities, before they become post-mortem talking points.

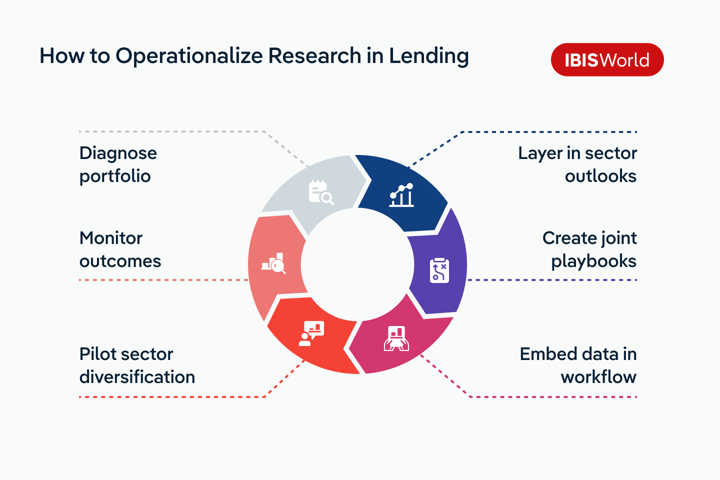

How to operationalize industry insight in lending strategy

Strategic portfolio shifts don’t happen because someone ran a market study. They happen when credit officers have better visibility, shared language with origination, and fast access to defensible data—all without slowing down core workflows.

Here’s how to make that real in a lending environment that values speed just as much as rigor:

1. Start with a portfolio diagnostic

The first step in rebalancing risk is knowing where you're currently exposed, not just at the borrower level, but across sectors and sub-sectors.

Run a diagnostic that:

- Breaks out portfolio exposure by industry and geography.

- Flags overconcentration in legacy sectors (e.g. construction, traditional retail, CRE-adjacent contractors).

- Identifies sectors with low exposure but solid fundamentals (e.g. industrial automation, specialty logistics, elder care).

This isn’t a research exercise. It’s a tool to help prioritize where credit committees should focus next and where origination teams may need a new playbook.

2. Layer in forward-looking sector screens

Growth is only helpful if it’s defensible. Use industry data to filter potential sectors by:

- Resilience to rate hikes, labor pressures, and supply chain instability.

- Secular tailwinds like digitization, aging demographics, or energy transition.

- Stable competitive structures like low fragmentation, strong pricing power.

- Regulatory alignment (e.g. subsidies, mandates, or protected segments).

These filters turn “interesting sector” conversations into data-backed credit strategies. For example, instead of just noting that a borrower operates in manufacturing, surface that it’s in “precision components for medical devices” —a sub-sector with high barriers to entry, steady demand, and margin stability.

3. Create shared playbooks for credit and origination

C&I diversification dies when origination and credit don’t speak the same language. Equip both sides with simple, usable intel:

- Sector snapshots with risk factors, margin bands, and lending precedent.

- Common red flags (e.g. operating leverage triggers, sensitivity to input costs).

- Structuring tips: appropriate advance rates, covenants, pricing tiers.

- Sample questions to validate borrower narratives early.

You don’t need 50 pages. You need just enough context to reduce second-guessing and speed up internal alignment.

4. Embed industry data in the lending workflow

Don’t make credit teams go hunting for insights. Bring industry data into the tools and templates they already use.

Examples:

- Pull risk scores and margin comps directly into memo templates.

- Pre-load sector commentary that explains current headwinds or tailwinds.

- Use benchmarks to validate borrower projections or challenge aggressive assumptions.

- Include volatility indexes or repayment patterns in pricing decisions.

This saves hours, eliminates repetitive manual research, and makes memos more consistent across the team.

5. Pilot sector diversification in a controlled way

You don’t have to commit the entire balance sheet to a new industry. Start small:

- Identify 1–2 promising sectors using industry screens.

- Define credit criteria aligned to risk appetite.

- Run a 6-month pilot with small-ticket deals.

- Track early performance, underwriting exceptions, and team feedback.

This de-risks the learning curve and builds internal confidence, while generating real-time deal experience that you can scale.

6. Monitor outcomes and refine

Treat this like any other lending initiative: track what’s working and refine your approach.

- Are new sectors performing as expected?

- Are credit memos stronger? Approvals faster?

- Is there alignment between what RMs bring in and what credit signs off?

Feed these insights back into your sector screens and playbooks. This turns diversification into a living strategy, not a one-off shift.

Bottom line: Diversifying your C&I book doesn’t mean taking uncalculated risks. It means combining sharper industry insight with structured internal coordination, so every new deal is both opportunity-driven and risk-aware.

Final Word

Diversifying a loan portfolio isn’t about chasing the next hot sector or reacting to headlines. It’s about methodically identifying where risk is concentrated, where opportunity is credible, and how to make those shifts in a way that strengthens your credit posture. That kind of decision-making doesn’t come from instinct alone. It comes from having the right data in the right hands at the right time.

In today’s environment, industry intelligence belongs in the workflow, not the appendix. It should be embedded in the deal screen, the credit memo, the committee conversation, wherever lending decisions are being made. When used strategically, it becomes a lever for faster alignment between credit and origination, sharper memo defensibility, and smarter exposure management across the institution.

The real win isn’t just a more balanced portfolio. It’s a portfolio you can stand behind: one backed by documented rationale, tested against independent data, and built to weather whatever comes next. The institutions that succeed won’t be the ones making the most bets; they’ll be the ones making the best-justified ones. And that starts by making industry research a core part of how you lend.