Key Takeaways

- In the next couple of years, artificial intelligence is set to drastically shorten underwriting timelines, reduce fraud and boost efficiency for financial institutions and online merchants.

- Real-time settlement through fintech will improve cross-border commerce and open new revenue streams like micro-tipping and pay-per-use services.

- Deeper collaboration between e-commerce and fintech—integrating AI, blockchain and seamless checkouts—will define business competitiveness over the next few years.

Over the past decade, the global digital economy has advanced at breakneck speed, propelled by widespread internet access, rapid smartphone adoption and continuously evolving consumer expectations. E-commerce has given rise to online marketplaces that bridge continents and time zones, while fintech has modernised payments, lending and compliance globally.

As we head forwards into 2025 and 2026, we can expect these sectors to converge more deeply, creating a seamless digital environment where purchasing, financing and shipping happen in near real-time. Businesses that integrate advanced fintech solutions—like instant underwriting or real-time settlement rails—into their e-commerce models will likely gain a decisive edge.

At the same time, new regulatory policies and cross-border fintech corridors will shape how organisations navigate international expansion and compliance. With many technology costs falling and consumer expectations rising, there has never been a more critical time to grasp the opportunities—and challenges—of the digital age.

The rise of the digital economy

The digital economy can be described as the ecosystem in which goods and services are created, distributed and consumed via online platforms. It is driven by data-centric processes, cross-border connectivity and an unrelenting demand for convenience.

In the United States large-scale online marketplaces continue to see double-digit increases in sales each year. For example, Amazon, the largest online retailer, went from an annual revenue of $74.452 billion in 2013 all the way to $574.785 billion in 2023 with an immense average year-on-year growth rate of 22.96%.

In Europe, the rapid proliferation of smartphones and evolving consumer trust in digital payments like Google Pay, Apple Pay and PayPal are popular, especially in France, the UK and Nordic countries, which have spurred immense growth in online purchasing.

Meanwhile, Australia’s well-developed logistics and payment networks have empowered small and medium-sized enterprises to offer fast delivery and efficient payments for cross-border shipments. A recent example is a new cross-border collaboration in 2024 between The Bank of New York and the Commonwealth Bank of Australia, enabling rapid payments.

This transformation is part of a broader shift in global connectivity, which has turned even the smallest ventures into potential international players. A fashion start-up in Melbourne, for instance, can now sell to customers in London or New York within days, leveraging global fulfillment networks that manage shipping, returns, and currency conversions. Such democratization of market access has also spurred mobile-first solutions in emerging economies, where populations bypass traditional banking systems in favour of e-wallets and localized fintech apps. Countries like Kenya, Tanzania, and Ghana highlight this trend, with mobile-based payments experiencing widespread adoption and popularity.

Looking ahead to 2025 and beyond, consumer behaviours such as smartphone-based shopping are set to intensify. Meanwhile, innovations like AI-driven underwriting and blockchain-based supply chain verification are likely to transition from experimental technologies to mainstream solutions across various markets. Businesses that adapt to these technological shifts should focus on enhancing user experience—such as through frictionless checkouts, one-click payments, and streamlined supply chains—while also staying ahead of emerging regulatory frameworks like Europe’s AI Act. Those who succeed in these areas will gain a competitive edge over firms entrenched in outdated paradigms.

E-commerce growth: Opportunities and strategies

E-commerce has come a long way from static product pages and clunky checkout processes. Today, many fintech innovations—from BNPL services to AI-based fraud detection—play central roles in the e-commerce user experience. By the end of 2025, these integrations will become more sophisticated, transforming how people search, purchase and finance online goods and services.

Across the United States, the United Kingdom, and Australia, the fintech landscape continues to evolve rapidly, driven by innovation and technological adoption that reshape financial services and commerce. In the United States, fintech startups like Stripe, Plaid, and Upstart are redefining the boundaries of payments, open banking, and machine learning. The introduction of real-time settlement systems, such as FedNow, represents a significant leap forward, offering faster money transfers and reduced clearing times. This shift not only enhances consumer convenience but also streamlines operations for businesses, fostering a more agile financial ecosystem.

The United Kingdom, a leader in fintech innovation, has also embraced real-time payments through its Faster Payments Service. This system, coupled with progressive open-banking regulations, has created an environment of healthy competition among e-wallet providers and digital lenders. These advancements have strengthened the UK’s position as a global fintech hub, providing consumers and businesses with seamless, secure, and efficient financial solutions.

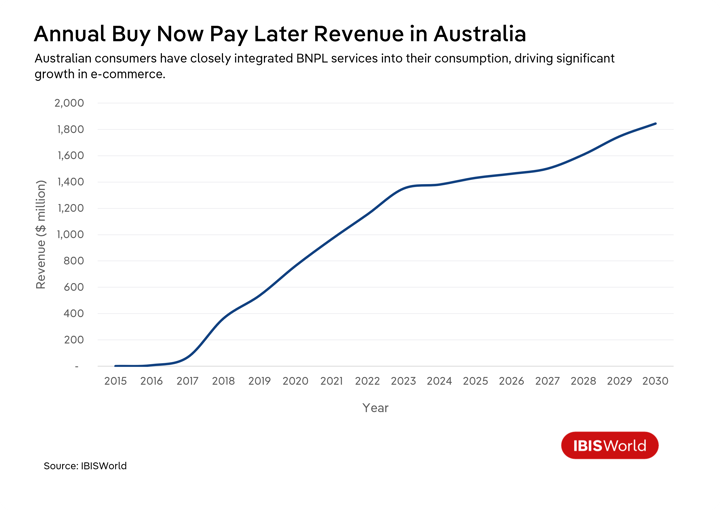

In Australia, the rapid adoption of buy-now-pay-later (BNPL) services such as Afterpay and Zip has set the nation apart as a key player in fintech-driven commerce. Both consumers and businesses have integrated BNPL into their online shopping experiences, driving significant growth in e-commerce. This trend highlights how fintech innovations can align closely with consumer behaviours to reshape industries.

Underpinning this growth across regions are several critical drivers of e-commerce. Mobile technology has become indispensable, with millions of consumers relying on smartphones for product discovery, comparison, and purchases. The ubiquity of digital payments, including contactless cards and e-wallets, has further removed barriers at checkout, enhancing conversion rates and simplifying the buyer journey. At the same time, the rise of innovative platforms that promise next-day or even same-day shipping has shifted consumer expectations, making rapid delivery an integral part of the online shopping experience.

Together, these developments paint a picture of a dynamic and interconnected fintech ecosystem where innovation and consumer-centric solutions drive progress across the United States, the United Kingdom, and Australia. As these markets continue to evolve, the interplay between technological advancements and user expectations will remain a defining force, setting the stage for the next wave of transformation in global commerce and financial services.

Strategies to expand in the e-commerce market

- Localisation: Tailoring offerings to local markets is critical. This includes language localisation, understanding cultural nuances and integrating preferred local payment methods like region-specific e-wallets in Europe. At the same time, US and Australian consumers might expect a robust credit card ecosystem or BNPL options.

- Omnichannel Approach: Integrating online, mobile, and in-store experiences with customer-focused fintech provides a seamless customer journey, enhancing engagement and loyalty. This helps retailers build brand loyalty and cast the widest net for potential customers.

- Data-Driven Marketing: Leveraging analytics to understand customer behaviour enables personalised marketing campaigns, improving engagement and conversion rates.

- Customer Engagement: Encouraging sign-ups to collect customer emails and phone numbers establishes direct communication channels, fostering relationships and preselects for people already interested in your goods or services.

The role of fintech in the digital economy

Fintech is the engine behind many of the most significant changes in global commerce. It supports cross-border trade and everyday consumer transactions by providing faster payments, more transparent lending and improved fraud prevention. Below, we explore major e-commerce and fintech trends expected to play out over the next few years, structured around predictions for 2025, each accompanied by insights into why it matters, the logic behind it and practical advice for businesses.

AI will reshape core banking and underwriting

Artificial intelligence, particularly advanced language models, is set to transform core banking and underwriting by automating tasks such as fraud detection, compliance, and risk evaluation. Processes that once took weeks can now be completed in minutes, reducing costs and enabling real-time credit decisions. By analysing vast datasets—like employment records or dispute logs—AI minimizes default rates while improving operational efficiency. Banks such as HSBC, Wells Fargo, and JP Morgan Chase are already using AI tools to detect money laundering, analyse data, and streamline contract reviews, emphasizing its growing importance in maintaining a competitive edge.

This shift is fuelled by rising demand for faster, more accurate risk assessments and breakthroughs in AI technology that make processing large, unstructured datasets cost-effective and reliable. As institutions face mounting losses from fraud and unpaid debts, the rapid adoption of AI becomes essential.

However, businesses must navigate both opportunities and risks. Early investment in explainable AI, coupled with forming ethics boards and ensuring transparency, is critical. Partnering with AI-focused fintech startups can enhance capabilities without heavy in-house development. By prioritizing compliance and building trust, financial institutions can leverage AI to optimize operations, foster customer confidence, and stay ahead in a fast-evolving financial landscape.

Payment rails will advance towards real-time and micro-transactions

Over the next few years, payments are expected to shift toward near-instant settlement for domestic and cross-border transactions. Systems like FedNow in the US and the UK’s Faster Payments Service are paving the way for global adoption, streamlining financial processes and enhancing e-commerce cash flow. At the same time, micro-transactions under $1 are becoming more common, driven by business models in gaming, content streaming, and creator tipping, opening new revenue streams for businesses.

Real-time payment rails offer transformative benefits, enabling faster, low-cost transactions and meeting rising consumer expectations. Brazil’s Pix system illustrates this trend, processing millions of transactions daily and demonstrating how quickly businesses and consumers embrace instant payment systems. Advances like Stripe’s Instant Payouts and Visa’s investments in sub-second remittance networks further highlight the growing feasibility and demand for instant access to funds.

For businesses, adapting to real-time payment systems is essential. Partnering with payment gateways that support instant payouts and integrating micro-payment options can attract more customers and create additional revenue. Leveraging instant settlements also helps optimize cash flow management for tasks like inventory planning and marketing. By embracing these innovations, businesses can remain competitive and cater to evolving consumer preferences.

Regulatory pressures will intensify around AI and digital assets.

By 2025–2026, stricter global regulations on AI-driven financial products and digital assets will focus on transparency, data privacy, and anti-money laundering (AML) compliance. Companies that fail to adapt risk severe penalties, while those prioritizing compliance can gain a competitive edge. Probes into crypto exchanges like Binance and legislation such as Europe’s AI Act, which mandates explainability for high-stakes AI applications, reflect increasing regulatory scrutiny. In the US, agencies like the CFPB and SEC are stepping up oversight of fintech lenders, signalling the potential for further regulations, including capital reserve requirements.

These measures aim to address systemic risks and protect consumers from data misuse, bias, and breaches. High-profile incidents, such as the T-Mobile data breach, have heightened public demand for stronger safeguards, driving lawmakers to enforce robust accountability frameworks.

To navigate this environment, businesses should establish compliance frameworks early, including AI ethics committees and transparent decision-making processes. Proactive measures, such as seeking legal expertise and documenting due diligence, can build trust with customers and stakeholders while mitigating risks. In an increasingly regulated market, embracing transparency and compliance offers a crucial advantage for staying competitive and fostering long-term growth.

Globalisation tensions will spur regional fintech corridors.

Geopolitical tensions, particularly between China and Western economies, are driving a realignment of global trade networks. By 2025, regions like the US–India and EU–Southeast Asia are expected to see growing demand for fintech solutions that handle currency exchange, local compliance, and payment systems. As trade alliances shift, fintech innovations will help businesses adapt to these changes and seize new opportunities.

This shift is already visible, with companies relocating factories and seeking new markets due to tariffs and regulatory barriers. For example, Wise (formerly TransferWise) has capitalized on this trend by offering transparent cross-border fees and becoming the first foreign firm to access Japan’s payment clearing network.

This transformation is driven by two factors: trade disruptions that push businesses to explore alternative corridors and digital growth in emerging markets that increase demand for advanced fintech services. These changes create opportunities for fintech companies to offer tailored solutions for cross-border payments and financing.

To capitalize on these trends, businesses should monitor shifting trade routes and form strategic local partnerships, especially in Asia, where super-apps like Grab and Gojek dominate. Customizing fintech solutions to regional needs will help companies navigate these evolving markets and strengthen their competitive position.

Consolidation and M&A: Bigger players absorbing innovative startups amid the AI wave

The mid-2020s are witnessing a surge in mergers and acquisitions as mega-banks, card networks, and global tech giants acquire promising fintech and AI startups. This trend mirrors the late 1990s Internet boom, where potential was high but tempered by speculative excess. AI, currently at a similar inflection point, is driving incumbents to secure innovative technologies to stay competitive in a volatile market.

Recent acquisitions, such as PayPal’s $4 billion purchase of Honey and FIS’s acquisition of Bond Financial Technologies, highlight the strategic value of integrating AI and fintech into existing operations. These moves allow established players to expand into new areas like e-commerce while startups gain the capital and resources to scale.

This trend is fuelled by the dual need for survival and innovation. Incumbents face pressure to adapt or risk obsolescence, while investors seek returns by securing scalable AI tools and cross-border capabilities. However, not all startups will survive the boom-and-bust cycle, and those that do will reshape industries.

Startups should focus on demonstrating tangible value, while incumbents must scout acquisitions that align with their product roadmaps and compliance strategies. Navigating this rapidly evolving market will require strategic planning and partnerships to thrive in an AI-driven future.

Cross-sector collaboration: e-commerce and fintech synergy

E-commerce and fintech are already intertwined, but their synergy will become even more critical in 2025. As online retailers explore new ways to personalise shopping experiences—through AI chatbots, tokenised loyalty programs, or integrated fast payment systems and BNPL—fintech innovations ensure secure and instantaneous transactions.

Picture a consumer in London who shops online for electronics. Within minutes, AI search gets the customer to their desired product quickly; AI-driven underwriting determines the shopper’s credit limit and seamlessly offers a BNPL plan or lighting fast payment at checkout. The payment then settles instantly through a real-time fintech payment system, creating an efficient cycle for both the merchant—who receives immediate confirmation—and the customer—who benefits from flexible financing. This frictionless loop, augmented by AI-based fraud detection, highlights how e-commerce and fintech can collaborate to boost sales user and business satisfaction.

Global e-marketplaces like Amazon have rolled out embedded lending solutions, granting vendors or small business owners immediate credit lines tied to their sales volumes. Elsewhere, partnerships between e-commerce and fintech leaders like Shopify and Stripe demonstrate how fintech and e-commerce can successfully link to help enable small to medium online businesses. These examples illustrate how industries merge to simplify transactions and strengthen customer loyalty.

Final Word

The overarching message for 2025 is clear: e-commerce and fintech are no longer optional add-ons but indispensable economic pillars. The predictions outlined—from AI reshaping core banking and underwriting to intensifying regulatory scrutiny, M&A and shifts in global trade corridors—underscore how dynamic and interconnected these sectors have become. Over the next few years, we should expect AI underwriting to become standard, payment rails to operate nearly instantaneously, and micro-transactions to unlock new revenue streams.

For business leaders, these changes present both opportunities and challenges. Those who thrive will be those who embrace compliance, invest in scalable AI-driven solutions and remain nimble amid geopolitical shifts. Integrating frictionless payments and real-time financing at the checkout, localising product offerings and forging strategic partnerships with fintech innovators can provide the competitive edge necessary to stand out in an increasingly crowded space and cast the widest net to reach the greatest number of customers.

Ultimately, the long-term potential of e-commerce and fintech lies in the ability to first reach and then deliver unmatched convenience, trust and personalisation to consumers. By aligning technology strategy, regulatory readiness and global market intelligence, businesses can position themselves at the forefront of the digital economy.