Key Takeaways

- De-risk market entry with a structured approach to assessing industry risks before committing resources.

- Go beyond growth potential—use risk scores to identify hidden challenges like competition, regulation and economic shifts.

- Secure leadership buy-in with data-backed expansion strategies that balance opportunity and risk.

Over the past 20 years selling IBISWorld, I’ve seen constant improvements, including our most recent addition, ‘Phil’, an AI-powered tool which streamlines research by pulling insights from our industry reports in seconds. While technology is transforming how businesses access information, one thing hasn’t changed: the need for a structured approach to risk assessment.

I’ve worked with countless firms expanding into new markets, and I’ve seen two types of strategies in play – those that rigorously evaluate risk and those that don’t. The difference? One leads to sustainable growth, while the other can lead to costly missteps.

New market entry is exciting, but it’s rarely straightforward. Even in high-growth industries, unseen challenges – economic shifts, competitive pressure or regulatory hurdles – can stall progress. Businesses that rely on intuition or surface-level data often find themselves reacting to setbacks rather than anticipating them. And when leadership teams hesitate due to uncertainty, momentum is lost and opportunities slip away.

This is where IBISWorld’s Industry Risk Scores change the game. For years, I’ve seen strategy leaders, consultants and investors use our Risk Scores to evaluate industry conditions, weigh opportunities against potential downsides and secure internal buy-in with confidence.

Let’s explore together how our Risk Scores provide a structured, data-backed framework for navigating risks and identifying opportunities in new market expansion.

Why market expansion fails without a plan

Risk isn’t always obvious, and that’s what makes it dangerous. A market might seem like the perfect fit, with strong projected growth and promising opportunities. However, what’s beneath the surface? Competitive saturation, shifting regulations, or economic volatility can turn even the most attractive market into an uphill battle. Expanding into new markets comes with uncertainty, so it’s imperative that businesses evaluate competition, regulatory environments and economic factors before committing resources.

I’ve seen companies enter industries based on growth potential alone, only to struggle with unforeseen cost pressures, supply chain constraints or aggressive incumbents. Others secure leadership approval for expansion, but when conditions shift unexpectedly, they find themselves justifying decisions instead of executing them. Success depends on understanding risks, not just market potential.

That is why successful businesses take a structured approach to risk. Rather than relying on intuition or basic data, they quantify potential challenges early, adjust their strategies and build a business case that withstands scrutiny.

That’s exactly where IBISWorld’s Industry Risk Scores help. They assist businesses in moving beyond gut feeling, offering a data-backed framework to assess risk with confidence.

Industry Risk Scores reduce expansion uncertainty

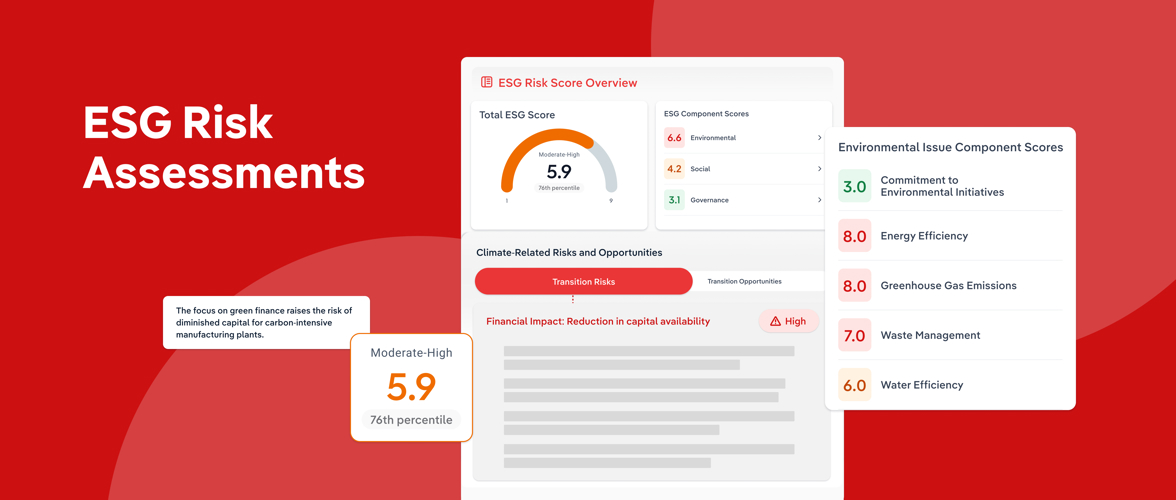

Our Industry Risk Scoring system evaluates the difficulty of operating within a specific industry. The score is based on a forward-looking analysis of the next 12 to 18 months, enabling businesses to benchmark a company against the broader industry environment, identify and anticipate non-financial challenges to make informed decisions.

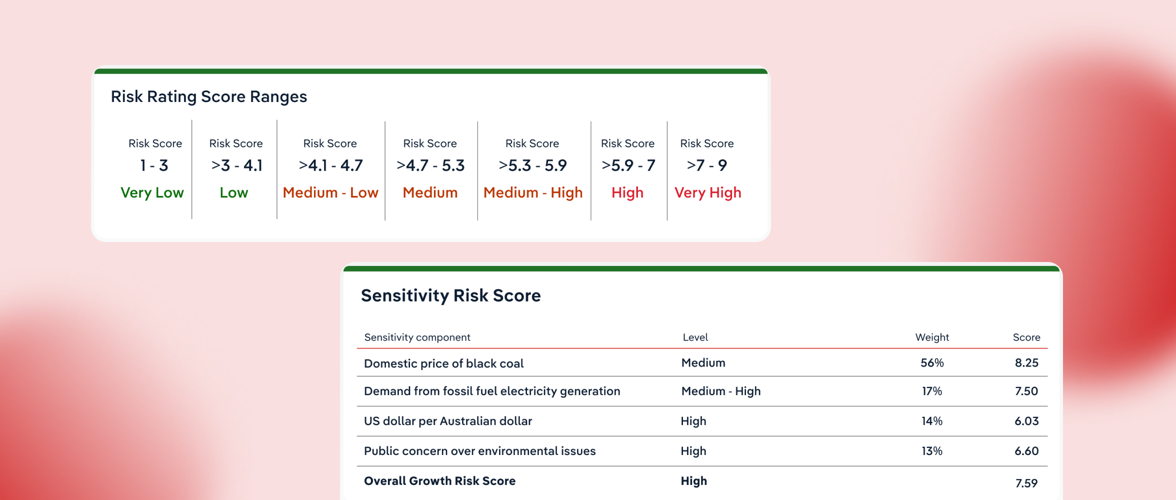

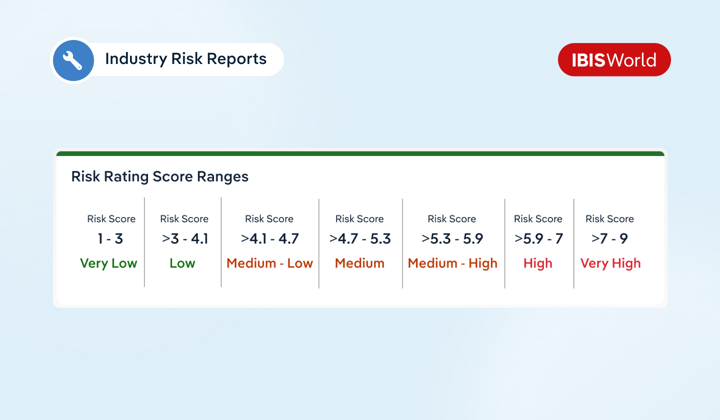

This comprehensive risk assessment is expressed numerically, from 1 (lowest risk) to 9 (highest risk), and is calculated by combining three major risk categories:

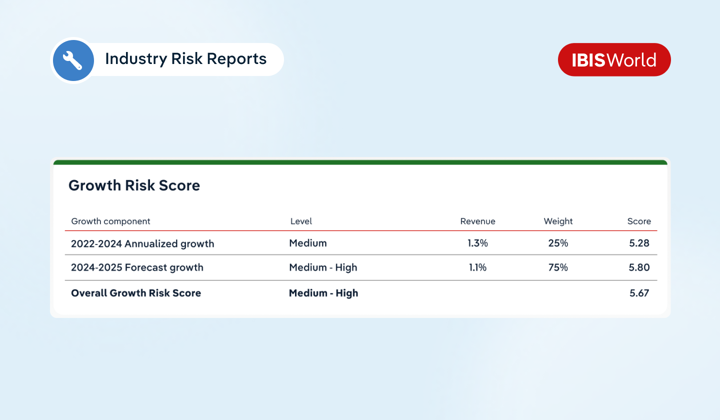

Growth risk

The Growth Score evaluates an industry’s historical and projected revenue growth trends, ensuring businesses don’t just enter fast-growing markets – they enter the right ones.

For example, the US Movie Theatre industry experienced a dramatic rise and fall in recent years. After a major collapse during the pandemic, revenue rebounded at a CAGR of 22.4% through 2025. However, long-term risks remain, with growth slowing to just 1.1% in 2025 as streaming competition is threatening traditional theatre attendance.

Without analyzing Growth Scores, a company might see only the recent rebound – missing the underlying volatility. By using IBISWorld’s Growth Score, businesses can differentiate between a short-term recovery and a sustainable long-term trend, ensuring expansion strategies are based on stability, not just momentum.

Structural risk

Internal factors like competition, trade exposure and barriers to entry play a critical role in market viability. The Structural Score evaluates these factors, highlighting industries with manageable competition and support from external entities.

However, not all industries offer a level playing field. A fragmented market with room for differentiation presents a different level of risk than one dominated by established players with strong market control.

For example, the UK Supermarkets industry faces extreme competition, making it difficult for new entrants to gain market share. While consumer demand for groceries remains stable, the market is heavily concentrated among major players like Tesco, Sainsbury’s and Asda, forcing new competitors to differentiate through pricing, product selection or technology.

The competition score for UK supermarkets is 9.00, reflecting aggressive pricing and customer retention strategies. Meanwhile, barriers to entry are high due to significant capital requirements, supply chain investments and planning permission regulations.

In any industry, IBISWorld’s Structure Score helps businesses assess these challenges before expanding. Even in markets with strong demand, internal factors—such as high barriers to entry, dominant incumbents or supply chain complexities—can make profitability difficult. Companies that fail to evaluate these structural risks early may struggle to compete effectively or achieve sustainable growth.

Sensitivity risk

Even the best market entry strategy can be disrupted by external factors beyond a company’s control. The Sensitivity Score assesses an industry’s vulnerability to economic shifts, commodity price fluctuations and regulatory changes, helping businesses anticipate challenges rather than react to them.

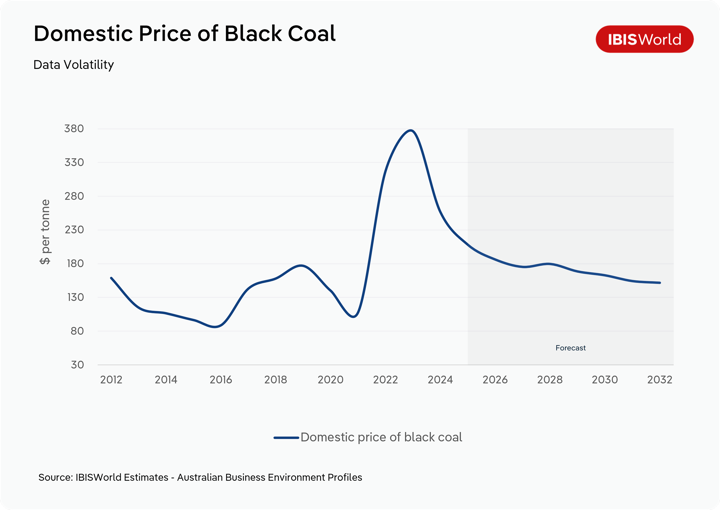

For example, Australia’s Coal Mining industry is highly exposed to price volatility and external risk factors. The domestic price of black coal is projected to fall 18.9% in 2024 to 2025 due to weaker demand from China and increasing competition from renewables. However, the market has also seen surges in previous years, such as a 61.3% price spike in 2016-17 caused by sudden Chinese production cuts.

Beyond pricing, coal mining companies face risks from shifting government policies, trade restrictions and environmental pressures. The industry remains heavily impacted by global energy transitions, as many economies phase out fossil fuels in favor of renewables.

Businesses targeting commodity-driven industries like coal must either develop hedging strategies, diversify operations or pivot to sectors with more predictable long-term demand.

Simply stated, leveraging IBISWorld’s risk scores and analysis into market entry strategies ensures decision-makers have a clear understanding of both internal and external industry dynamics before pursuing new opportunities.

How Risk Scores guide smarter market entry decisions

Understanding risk factors is one thing – applying them effectively is another. Once businesses have a clear picture of industry risk, the next step is using that insight to compare opportunities, anticipate challenges and build a risk-adjusted market entry strategy.

This is where our Risk Scores provide a data-backed framework to assess market conditions, mitigate uncertainty, and turn insights into action. So, how can they be applied to market entry strategies?

Compare multiple industries side by side

Growth potential alone doesn’t dictate success—some industries experience rapid expansion but come with high operational risks. IBISWorld’s Risk Scores allow businesses to evaluate industries holistically, balancing opportunity with risk before committing resources.

Identify hidden risks early

A high Growth Score doesn’t always mean a great opportunity. Before expanding, businesses should check the Structure Score for market saturation, competition intensity, and barriers to entry. Additionally, the Sensitivity Score helps identify external risks—such as economic downturns or regulatory volatility—that could disrupt long-term success.

Build risk-adjusted expansion strategies

Even industries with high growth potential may require specific risk-mitigation tactics. For example:

- If an industry has high competition, businesses may consider acquisition instead of a direct market entry.

- If an industry is sensitive to economic fluctuations, companies might diversify across multiple regions to minimize risk.

- If barriers to entry are low, businesses should move quickly to establish a foothold before competitors flood the market.

Support leadership decision-making

Expansion plans often stall because executives lack confidence in the viability of new markets. IBISWorld’s objective, data-driven risk scores help secure leadership buy-in by providing a structured approach to risk assessment that removes uncertainty.

By following these steps, businesses can make data-backed expansion decisions, avoiding costly missteps and ensuring their strategy is built on a foundation of clarity and confidence.

How a restaurant chain used risk scores to expand

While these steps provide a structured approach to market entry, how do they work in practice? Businesses across industries are using our Risk Scores to de-risk expansion and make smarter strategic moves.

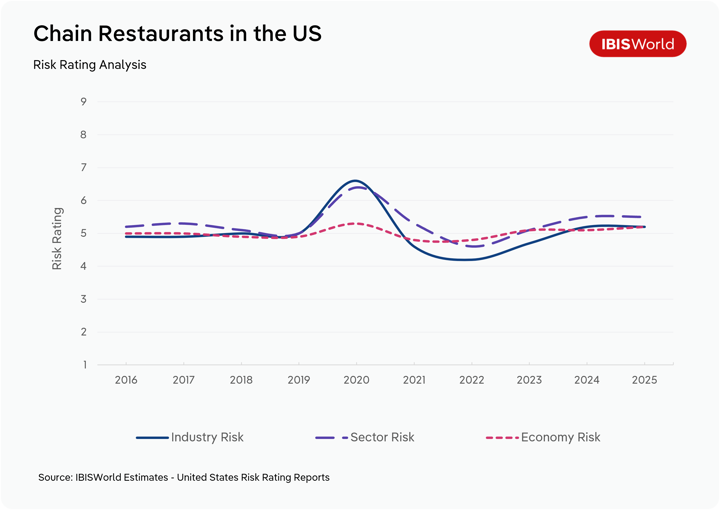

One example is a fast-casual restaurant chain I worked with that was looking to expand from the West Coast into the Midwest. The leadership team saw clear potential in the region but needed to validate their assumptions before committing significant investment. They turned to IBISWorld’s Industry Risk Scores to gain a more structured, data-backed understanding of the market.

Their Growth Score confirmed a steady 1.7% CAGR through 2029, reinforcing sustained demand for casual dining. However, the Structural Score flagged high competition in major metro areas, meaning differentiation would be critical to profitability. The Sensitivity Score revealed favorable macroeconomic trends, including rising disposable income and increased domestic travel, both of which could drive foot traffic.

With these insights, they adjusted their expansion strategy. In highly competitive urban markets, they adopted a franchise model, reducing operational risks while establishing a presence. In suburban areas with lower competition, they invested in corporate-owned stores, maximizing long-term profitability. They also fine-tuned pricing models based on local labor costs and supply chain dynamics to ensure a sustainable rollout.

The result? A smarter, risk-adjusted expansion strategy that secured executive buy-in and positioned the company for long-term success.

However, making data-backed expansion decisions is just one part of the equation—securing leadership approval and navigating uncertainty are equally critical. Even with a strong market opportunity, businesses must justify their strategy to stakeholders and ensure they have a plan for managing future risks.

This is where a structured, well-supported business case becomes essential.

Winning stakeholder buy-in and reducing risk

When entering a new market, leadership approval is often the final hurdle—and the most difficult one to clear. Even when the growth potential is clear, stakeholders need more than optimism to greenlight an expansion. They need a business case grounded in data, one that not only highlights the opportunity but also accounts for the risks that could derail success.

Building a solid business case

A well-prepared expansion plan doesn’t just answer "Where should we go next?"—it answers, "Why is this the right move, and how do we know it will succeed?", and this is where Risk Scores provide an edge.

They allow businesses to quantify industry risks, benchmark opportunities against alternatives, and present a strategy that balances reward with risk. Rather than relying on selective data points or assumptions, businesses can use IBISWorld’s Growth, Structure and Sensitivity Scores to:

- Provide executive teams with a clear risk-reward analysis, ensuring all factors—competition, barriers to entry and economic sensitivities—are accounted for.

- Compare multiple industries side by side, demonstrating why one market offers a stronger long-term fit than another.

- Streamline internal approvals by presenting a structured, risk-adjusted strategy that withstands scrutiny.

Expansions that are backed by comprehensive risk assessments don’t just secure leadership buy-in—they also speed up the approval process, ensuring businesses don’t miss out on time-sensitive opportunities.

Planning for contingencies

However, securing approval is just one part of the process. The businesses that thrive in new markets aren’t just prepared to expand—they’re prepared for what comes next. Without a plan to navigate external disruptions, even the best-laid strategies can be derailed.

Supply chain disruptions, regulatory changes, and economic downturns are just a few of the unpredictable forces that can impact new market success. Without a plan for these challenges, businesses risk falling into reactive decision-making—adjusting strategies on the fly rather than staying ahead of risks.

Our forward-looking data helps businesses build proactive contingency plans that allow for agility in volatile conditions. Companies that integrate risk-adjusted strategies can:

- Identify potential external threats before they arise, allowing leadership teams to pivot when necessary.

- Adjust expansion strategies in real time, mitigating potential setbacks before they impact profitability.

- Strengthen investor and stakeholder confidence by demonstrating preparedness for unexpected market shifts.

Even with a well-structured business case, external risks can still emerge. The most successful businesses don’t just plan for where they want to be—they prepare for potential obstacles along the way.

Final Word

IBISWorld’s Industry Risk Scores help businesses expand with confidence by providing a structured, data-driven approach to assessing risk and opportunity. Whether entering a new market or securing stakeholder buy-in, companies that rely on clear, forward-looking insights can navigate uncertainty, mitigate risk, and make smarter strategic moves.

Market conditions will always shift, but with the right data, businesses can turn risk into opportunity and drive long-term growth.