Key Takeaways

- Banking organizations are moving from disconnected tools to unified platforms where market intelligence surfaces automatically within existing workflows.

- Embedding structured industry data into AI agents via APIs, RAG architectures and MCP allows systems to blend internal policies with external market context in real time.

- The impact of integration is measurable: one major bank reduced client meeting preparation time from nearly a week to minutes.

A few years ago, getting industry intelligence meant logging into a research portal, running a search, downloading a PDF, and manually synthesizing what you found with internal data. It worked, but it was slow. And in a world where bankers juggle dozens of client relationships and compliance requirements, slow means unused.

The world's leading banks are now bringing intelligence to where people already work, rather than asking their people to visit another website. They're embedding industry data directly into CRMs, AI copilots, and decision tools, so insights appear in context, at the moment they're needed.

I recently spoke with the product team at an Australian bank about how they've integrated IBISWorld data into their internal platform. What they've built offers a clear picture of where enterprise intelligence is heading, and the practical steps required to get there.

The problem with multiple tools

The bank's relationship managers were drowning in systems. By their own count, frontline bankers had access to over 100 different tools: internal policy databases, CRM systems, compliance checklists, market research subscriptions, and more. Each tool had its own login, its own interface, and its own logic.

The result was predictable. When a banker needed to prepare for a client meeting, they'd spend significant time pulling information from multiple sources, downloading industry reports, and manually piecing together a coherent picture.

"We asked one of our bankers how long it would take to prepare a really robust discussion for a new client," the bank's product owner told me. "They said about a week."

It took this long because it was scattered across too many places. And the problem wasn't just speed — it was consistency. Every analyst synthesized information differently, pulling from different sources, weighing factors differently, arriving at subtly different conclusions about the same industry.

Building intelligence into the workflow

The bank is currently creating a unified interface designed to orchestrate customer interactions through a conversational AI agent.

The architecture follows a pattern we're seeing across enterprises adopting AI. At the foundation, the bank built specialized service domains responsible for specific types of information. One domain handles internal customer data. Another manages policy documents. A third brings external intelligence — including IBISWorld's data — into the bank's systems via API.

IBISWorld's data flows through that third-party service domain in both PDF and structured JSON formats. There is a process that monitors for updates and automatically refreshes their internal data store when new research is published.

On top of this data layer sits an AI agent using a RAG (Retrieval-Augmented Generation) architecture. When a banker asks "Tell me what I need to know about food production trends in Australia," the agent retrieves relevant content from the bank's data stores and reasons over that specific information — not generic AI training data. In the agriculture example, the system pulled from four or five different IBISWorld industry reports and synthesized them into a single coherent response, blended with the bank's internal lending policies.

Every reference includes a citation. Bankers can click through to see exactly which report or policy document a statement came from. This traceability is essential for regulated industries where compliance teams need audit trails and AI outputs can't be unverifiable assertions.

That same meeting preparation that once took up to a week now takes minutes. "Within minutes, you've got a really good multi-page discussion guide a banker can take to their customer," the product owner explained.

The most common feedback from bankers hasn't been about the AI — it's been about simplicity. The biggest barrier to using market intelligence has never been the quality of the research — it's the friction of accessing it.

The credit decision layer

Client meetings were the first use case. The bank is now extending the same architecture into credit decisioning. When a loan application enters the system, AI agents will automatically retrieve relevant industry risk scores, macroeconomic indicators, and sector-specific factors to inform credit assessment.

"We include industry risk scores, macroeconomic risk scores, anything that may influence how we assess a customer's exposure to risk," the product owner explained.

The credit decision workflow will use the same industry intelligence to inform lending decisions. A banker wants industry trends and talking points, while a credit system wants standardized industry risk scores and quantified exposure factors. Both draw from the same structured data foundation, but the presentation and weighting differ by use case.

This modularity is what separates successful integrations from one-off projects. By building a general-purpose data ingestion layer, the bank created infrastructure that serves multiple applications rather than bespoke point solutions. The same industry data that generates a meeting discussion guide also feeds risk models — no additional integration work required. And because the data is centralized and controlled, the bank gets version control, auditability, and consistent definitions across both use cases.

What makes integration work

Having watched multiple organizations attempt similar integrations, a few patterns distinguish the ones that succeed.

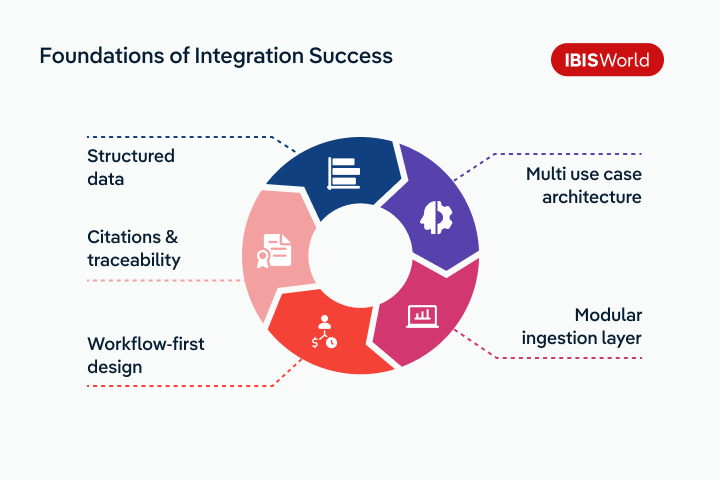

- Structured data is foundational: The bank's system works because IBISWorld's data isn't just narrative text - it's organized into consistent schemas with standardized industry codes, defined metrics, and relational connections. Their agent can query for specific data points, compare across industries, and aggregate multiple reports precisely because the underlying data is structured for machine consumption, not just human reading.

- Citations preserve trust: Every AI-generated response in the platform links back to its sources, which is essential for regulated industries. Bankers need to know where information comes from. Compliance teams need audit trails. Without citations, AI outputs become unverifiable assertions, which limits how they can be used in consequential decisions.

- Start with the workflow, not the technology: The bank didn't build an AI system and then look for problems to solve. They started with a real pain point - bankers spending too much time gathering information - and worked backward to the architecture that could address it. The technology choices (RAG, service domains, agent orchestration) followed from the workflow requirements.

- Plan for multiple use cases: By building a general-purpose data ingestion layer, the bank created infrastructure that supports multiple downstream applications. The same IBISWorld data that powers the banker platform will also power the credit decision workflow. This modularity avoids the trap of building point solutions that can't scale.

Starting the journey

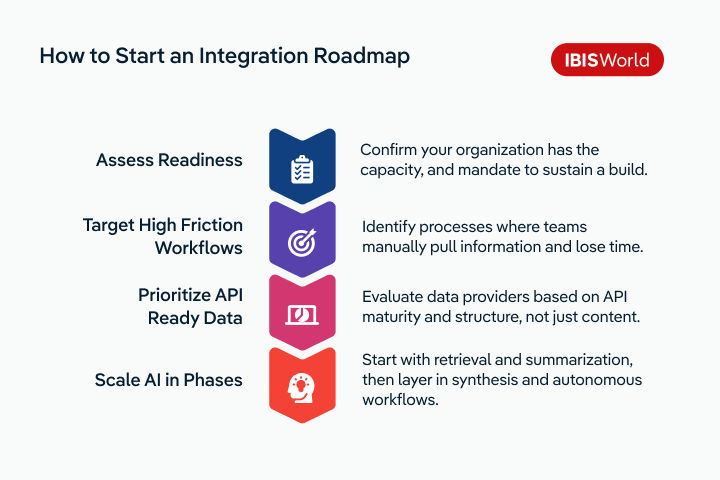

Not every organization is ready to build what this bank has built. They have significant engineering resources, a clear strategic mandate, and years of experience with AI implementation. They estimated the full consolidation of their tool landscape will take four to five years.

But the core pattern is accessible at smaller scales. Organizations can start by:

- Identifying high-friction workflows where people currently gather information from multiple sources manually.

- Evaluating data providers based on API maturity, not just content quality. Can the data be retrieved programmatically? Is it structured consistently? Does it include metadata that AI systems can use for reasoning?

- Building simple retrieval layers that pull relevant content into existing tools—even a basic integration that surfaces industry context in a CRM can reduce friction meaningfully.

- Adding AI reasoning incrementally, starting with summarization and synthesis before moving to more autonomous agent workflows.

The bank I spoke with started this journey seven months ago. They're in production with 100 users and have a roadmap extending years into the future. But the initial value appeared quickly—once the data was flowing and the agent was working, the time savings were immediate.

Final Word

There's a change happening in how organizations think about market intelligence. For decades, the model was simple: research providers published content, and users visited portals to consume it. The interface was the product.

That model is inverting. The most valuable market intelligence is increasingly invisible to end users — embedded in systems they already use, shown in context, blended with internal data. The banker asking about food production doesn't know or care that five different reports contributed to the answer.

The next step in this progression is already emerging. Protocols like Anthropic's Model Context Protocol (MCP) are designed to let AI agents connect directly to structured data sources without custom integration work. Where the bank I spoke with built bespoke service domains and data pipelines - a significant engineering investment - MCP creates a standardized way for any AI agent to query external data at the moment of reasoning. Instead of building a dedicated integration for each data provider, an organization could configure an MCP connection and immediately give their agents access to structured industry research, risk scores, and market indicators. The engineering barrier drops, which means the pattern this bank pioneered becomes accessible to organizations without large platform teams.

The organizations that move fast on these integrations will develop institutional knowledge that compounds over time. They'll learn what works in their context, refine their architectures, and build trust in AI-assisted decisions. Those that wait will eventually follow the same path, but from further behind.

Market intelligence has always been about informing decisions. The change now is where and how that intelligence appears. The future isn't a better research portal—it's intelligence that's so seamlessly embedded in work that you forget it's there.