Key Takeaways

- Labour shortages and wage spikes are eroding borrower resilience across key sectors, even when revenue appears stable.

- Execution risk from workforce gaps is driving margin compression, covenant strain, and delayed repayments, often before financials show stress.

- Lenders must embed labor exposure into credit structuring through smarter stress tests, labor-sensitive covenants, and early operational red flag checks.

Workforce instability is quietly becoming one of the most credit-relevant threats across multiple industries. From construction to care homes, persistent labor shortages and wage escalations are eroding borrower resilience, even in sectors with healthy demand.

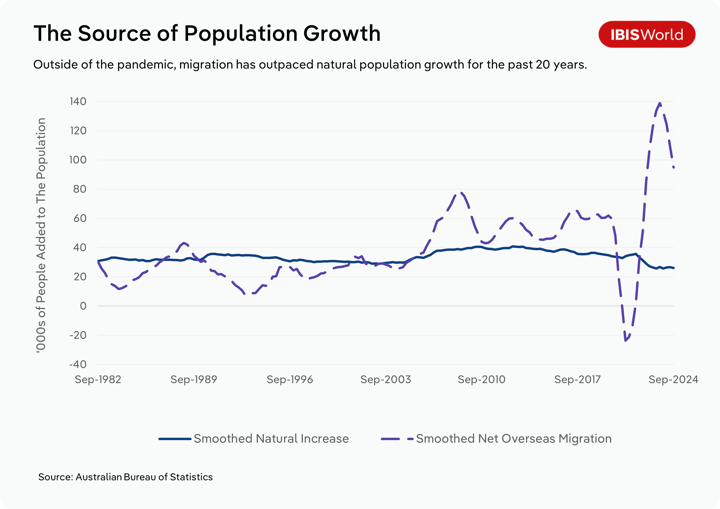

In Australia, the construction sector is short 90,000 workers. In the UK, care worker visa issuances have dropped 81% in just one year, despite the NHS relying on a foreign-born workforce for 20% of its staffing. Germany’s healthcare system is facing one of the EU’s most acute worker shortages, while aged care providers in Australia are grappling with 15% mandated wage hikes on top of already tight margins.

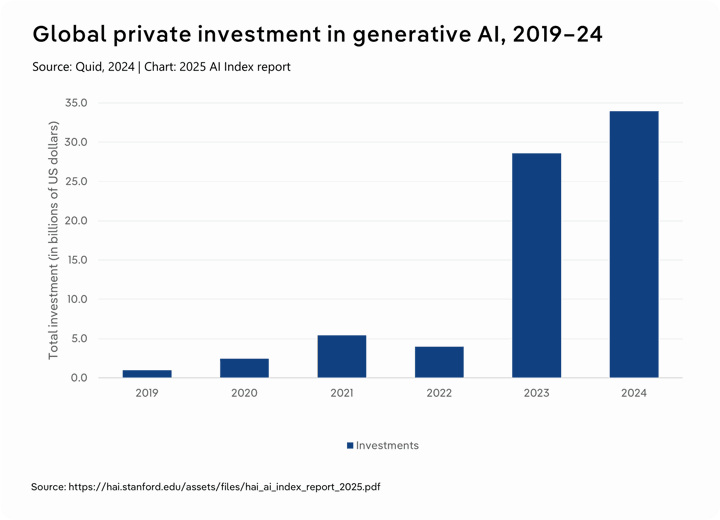

In the US, a different workforce risk is emerging. Hype around artificial intelligence has led some operators, especially in tech, finance, and services, to overestimate near-term automation potential. This gap between perceived and actual capability is fueling staffing miscalculations that can delay hiring, overextend lean teams, or lead to overreliance on unreliable systems—all of which introduce operational fragility that may not be visible in surface-level financials.

The result: growing execution risk, margin compression, and borrower stress, often ahead of any deterioration in topline performance. These pressures can directly undermine repayment capacity, especially for borrowers operating on fixed-price contracts, capped funding models, or project-based income.

Why does labor disruption matter for credit?

When borrowers can’t find, afford, or retain the workers they need, the financial impact ripples quickly: missed milestones, blown budgets, deteriorating margins, and rising short-term liabilities. For lenders, this makes workforce exposure a direct credit risk, especially in labor-heavy sectors with thin buffers.

Here’s how it plays out:

1. Labor costs drive margin compression

In many industries, wages account for 40–70% of total operating costs. When payroll grows faster than revenue, whether from union-driven hikes, overtime, or agency labor, EBITDA erodes quickly. This is particularly acute in sectors like healthcare, construction, and education, where revenue is often capped or fixed by contract.

Credit implication: Borrowers with inflexible pricing structures or low operating leverage may breach coverage thresholds before topline stress appears.

2. Labor gaps delay execution and defer revenue

In project-based sectors like construction or engineering, workforce shortages mean delayed delivery and deferred cash inflows. In services, under-resourcing leads to underutilization: beds go unfilled, clients go unserved, billable hours drop.

Credit implication: Strong pipeline projections can mask soft actuals when workforce capacity can’t scale to match booked work. This increases risk of covenant breaches or refinancing stress.

3. Workforce strain fuels hidden liquidity pressure

When staffing gaps emerge, borrowers often plug them with high-cost stopgaps like agency nurses, subcontractors, sign-on bonuses, or retention premiums. These solutions boost wage lines and pull forward costs, while delaying ROI. In some cases, borrowers may delay tax payments, under-invest in maintenance, or stretch creditors to maintain appearances.

Credit implication: Liquidity cushions thin out quickly, especially in borrowers with uneven revenue cycles. Early signs often include rising wage accruals, deferred capex, or higher short-term debt utilization.

4. Attrition, burnout, and training lags can’t be solved overnight

Even where wage increases attract talent, onboarding and ramp-up timelines can drag. In aged care or skilled trades, it can take months (or years) to replace lost headcount. Meanwhile, morale issues or burnout can trigger rolling exits, compounding costs.

Credit implication: Workforce fragility can turn into an execution spiral, with weakening KPIs hidden behind a stable revenue base, until backlogs grow or service levels break

5. AI isn’t a safety net (yet)

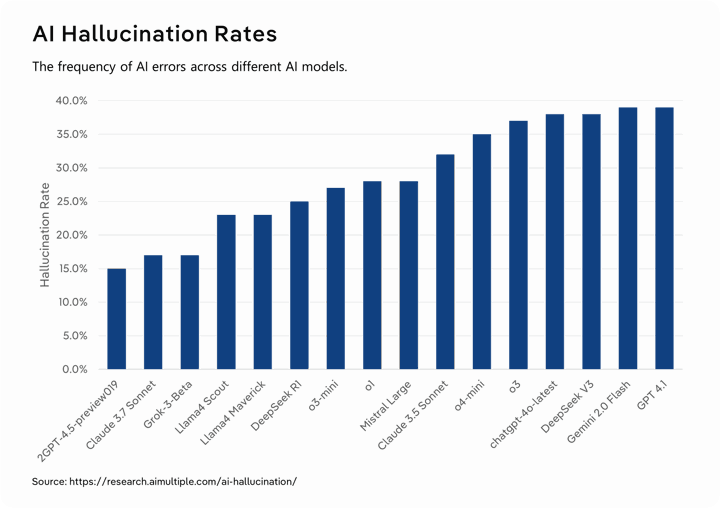

Despite investor optimism, current AI tools can’t reliably replace human labor in complex or regulated environments. Hallucination rates of 35–39%, multi-step task failures, and limited reasoning depth mean that most generative models are better at support than substitution.

Credit implication: Borrowers banking on AI-driven efficiencies in core workflows may be overestimating cost savings or underestimating reliability risk.

Construction: Strong pipelines, weak labor foundations

On paper, construction borrowers often look resilient—backlogs are full, demand is stable, and revenue is rising. But underneath, labor is becoming a critical constraint. Skilled trades are in short supply across most advanced economies, wage bids are rising, and the staffing needed to hit milestones simply isn’t materializing. The result is a growing mismatch between revenue forecasts and delivery capacity, a quiet threat to both liquidity and lender confidence.

Australia

The Australian construction sector is operating near full capacity, but with a structurally fragile labor base. The country needs to add 85,000 electricians by 2050, including 32,000 by 2030, just to meet the demands of its clean energy transition. Apprenticeship completions remain low, with only 54.8% of trainees completing their qualifications within four years. Meanwhile, international migration has become politically constrained due to housing shortages and visa policy changes.

Credit lens: Labor scarcity is already pushing up wages and delaying timelines, particularly on infrastructure and renewable energy projects. Smaller contractors with fixed-price contracts are most exposed to cash flow strain, negative working capital swings, and project-level covenant breaches.

United Kingdom

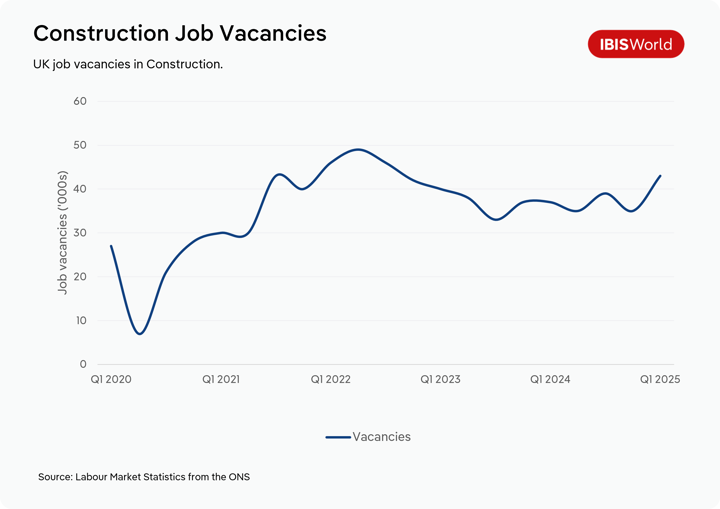

The UK’s construction industry has seen a dramatic loss of EU labor post-Brexit, contributing to wide-scale skill shortages. The Construction Industry Training Board (CITB) projects the industry will need to recruit an additional 225,000 workers between 2023 and 2027 to meet forecasted demand. Young domestic entrants remain limited, with construction roles seen as less attractive amid rising university participation.

Credit lens: Many mid-sized borrowers are relying on shrinking subcontractor pools and inflated wage rates. This can push debt service ratios out of alignment even in periods of solid revenue. Borrowers operating on phased development schedules may face sequential delivery risk, with financing tranches tied to stalled milestones.

Germany

Germany’s climate and infrastructure goals are intensifying construction labor demand. While public and private investment has accelerated, skilled labor availability has not kept pace. The Fachkräftemangel (skills shortage) is particularly acute in construction and technical trades, where vocational pipelines are thinning and retraining timelines are long.

Credit lens: Firms involved in retrofitting, public housing, or clean energy builds may be overextended. Even with solid contracts and liquidity, inability to mobilize staff on time can derail project schedules and violate performance-based loan covenants.

United States

In the US, the construction sector has faced a chronic skilled labor gap since the 2008 downturn, which wiped out much of the industry’s mid-career workforce. As of 2024, over 400,000 construction job openings remained unfilled. The AI investment wave has sparked optimism around automation, but physical build tasks, especially in infrastructure and housing, remain stubbornly manual. Many firms are underinvesting in hiring and workforce training under the assumption that tech will close the gap.

Credit lens: Borrowers projecting margin improvement from tech integration may be masking operational gaps. Lenders should stress-test assumptions around staffing capacity versus booked work, particularly in civil engineering, public infrastructure, and multi-family development.

Hospitality: High demand, vanishing workforce

Hospitality has staged a strong demand recovery across most advanced economies, but operators can’t capitalize on it if they can’t staff up. Persistent labor shortages, rising wage expectations, and heavy turnover are now structural features of the sector. For lenders, this means that top-line momentum can be misleading. The real exposure lies in fragile delivery capacity, unpredictable margins, and borrowers using short-term fixes to patch long-term workforce problems.

Australia

Australian hospitality is feeling the pinch from multiple angles. International student visa holders, who make up a significant share of the sector’s part-time workforce, are now subject to a 24-hour cap on working hours during study terms. At the same time, net migration levels are being constrained by housing supply concerns, and younger Australians are opting for more stable or remote-friendly roles. As a result, many hospitality businesses are struggling to find workers, especially for evening, early morning, or high-turnover roles.

Credit lens: The sector’s traditional model—low fixed costs, high labor flexibility—is starting to backfire. Businesses reliant on part-time labor pools may be unable to meet peak-period demand, limiting revenue recovery and stressing working capital. Temporary staffing fixes like shift premiums or short-notice hiring add further pressure to gross margins.

United Kingdom

Hospitality businesses across the UK are still struggling to fill front-line roles, particularly in food service and accommodation. A sharp decline in EU workers after Brexit has left many operators reliant on a narrower and less experienced domestic labor pool. Vacancy rates remain well above pre-2020 levels, while minimum wage increases and rising employer contributions are inflating cost bases. Older workers and overseas staff, once reliable sources of labor, have not returned at scale.

Credit lens: Operators may show strong demand on paper but lack the labor to deliver at full capacity. Cash flow can be volatile as venues cut service hours or limit bookings due to staffing gaps. Wage pressure, particularly for weekend and evening shifts, is contributing to margin compression, especially in small chains or independents with limited pricing power.

Germany & Europe

Across parts of Europe, including Germany, hospitality employers report difficulty filling both back-of-house and customer-facing roles. Many workers exited the industry during pandemic shutdowns and haven’t returned. Despite rebounding tourism and domestic demand, hotels and restaurants are often running under capacity simply because they can’t staff all shifts. Older employees are retiring, and the replacement pipeline isn’t keeping up.

Credit lens: Businesses may underperform revenue targets not due to lack of demand, but inability to serve it. Fixed costs remain while variable labor costs increase. In multi-site operators, uneven staffing can lead to internal cross-subsidization that drains cash unexpectedly.

High churn, low buffer business models

Hospitality borrowers often operate with thin working capital, limited credit lines, and high sensitivity to wage fluctuations. Unlike capital-intensive industries, they can’t defer labor without directly cutting revenue. Attrition is high, training is informal, and competition from government and logistics roles is pulling away part-time talent.

Credit lens: Even well-managed operators face acute exposure to workforce availability. For lenders, that means scrutinizing actual delivery capacity and labor planning, not just projected sales.

Tech & ICT: Wage pressures, automation illusions

Tech and ICT borrowers often appear healthy on the surface—high topline growth, strong demand pipelines, and scalable business models. But beneath that, structural labor risk is building. A global skills shortage, rising wage floors for specialist roles, and an overestimation of near-term automation gains are quietly eroding margins and delivery capacity. For lenders, this creates a risk profile where historical financials can obscure fast-developing operational strain.

United States

US tech firms are navigating a contradictory landscape: aggressive AI investment paired with persistent hiring friction. While companies are promising efficiencies from generative AI, the technology remains limited. Large language models still fail at 35–42% of multi-step and basic reasoning tasks, undermining their usability in client-facing or critical processes. Meanwhile, demand for high-skill talent, such as data engineers, cybersecurity analysts, cloud architects, continues to outpace supply, keeping wage growth elevated.

Credit lens: Borrowers relying on automation-driven cost reduction may be masking a brittle delivery model. Revenue per employee may look strong, but project overruns, unfilled roles, or contractor overuse can quietly strain margins. Staffing assumptions behind growth forecasts should be stress-tested for realism.

Australia

Even after high-profile global layoffs, Australia’s ICT sector remains wage-inflated. Public sector digitization programs, cloud migration efforts, and private sector modernization are driving demand for skilled talent. Roles in cybersecurity and data engineering remain well above pre-pandemic salary baselines, with mid-level professionals commanding premium compensation. Many firms, especially consultancies and hybrid tech-service providers, face a structural trade-off between revenue growth and margin stability.

Credit lens: Borrowers may be chasing scale without cost control. High headcount intensity and reliance on billable staff make delivery risk-sensitive to retention and utilization. Lenders should evaluate whether wage increases are being passed through to clients or eroding profit quietly over time.

UK & Europe

Across the UK and EU, tech service providers are experiencing pressure on two fronts: delayed client decision-making and high turnover among technical staff. Burnout is driving attrition in mid-career roles, and platform teams are increasingly stretched, particularly in cybersecurity, data services, and digital transformation. While AI is being piloted, most applications still require human supervision, narrowing actual labor savings.

Credit lens: Lenders should be cautious when borrowers position AI as a substitute for staff. Most deployments are still assistive, not autonomous, meaning labor cost savings may be limited, while retraining and quality assurance costs rise. In smaller firms, losing even one or two key personnel can disrupt project pipelines.

The talent cost trap

Unlike pure SaaS platforms, many ICT businesses, especially consulting, managed services, and cloud integrators, rely heavily on human capital to deliver value. But hiring has become expensive, onboarding timelines are long, and reskilling lags behind technology adoption. Some firms are backfilling talent gaps with high-cost contractors or offshoring, but both come with risks: delivery inconsistency, client dissatisfaction, and margin leakage.

Credit lens: When staff costs grow faster than billable rates, operating leverage declines. Lenders should look closely at margin trends, headcount fluctuations, and whether revenue per employee is rising fast enough to keep up with wage inflation.

Practical lending framework: How to underwrite workforce risk

Labor exposure doesn’t always show up in the income statement, but it hits repayment capacity fast. Whether the borrower is short on talent, overspending on retention, or banking on unproven automation, lenders need to factor workforce fragility directly into risk assessments and loan structures.

Here’s how to embed labor awareness into credit workflows.

1. Ask the right questions early

Before diving into ratios, start with forward-looking signals:

- How dependent is the borrower on skilled or regulated labor?

- Can they pass wage increases through to clients or funders?

- Are there constraints on scaling headcount — visas, training timelines, union limits?

- Is AI or automation being used to replace staff or just support them?

If the borrower struggles to answer clearly, that’s a red flag.

2. Stress-test for labor cost shocks

Margins can vanish fast when wages rise ahead of revenue. Model scenarios using:

- +5–10% annual wage growth.

- Flat or capped revenue assumptions.

- Delayed hiring or attrition in key roles.

See what happens to EBITDA margins, DSCR, and cash flow under labor stress. In many labor-heavy sectors, it only takes a 3–5 percentage point move in payroll to trigger covenant strain.

3. Watch these ratios

Certain metrics reveal labor stress early, well before a default shows up on paper. Monitor for:

- Wages-to-Revenue: Red flags emerge when payroll exceeds 50–60%, especially in sectors with capped or regulated pricing (e.g., aged care, education).

- Revenue per Employee: If this is flat or falling while headcount rises, delivery efficiency is deteriorating, a sign wage inflation isn’t translating into productivity.

- Contractor vs. FTE Expense: A rising contractor share often signals talent shortages, rising cost per hour, and overreliance on short-term fixes.

- Staff Turnover Rate: Annual turnover above 20% in core delivery roles (e.g., nurses, technicians, tradespeople) typically precedes project delays or service gaps.

- Operating Margin: Shrinking margins despite revenue growth indicate that labor costs are outpacing pricing power or client billability.

Track these against sector benchmarks, not just borrower history, to spot fragility before coverage ratios slip.

4. Identify behavioral signals of workforce strain

Borrowers under labor stress often show subtle signs before they flag it in reporting.

- Unusual delays in delivery or fulfillment.

- Frequent changes to business hours or capacity.

- Increased short-term borrowing or working capital use.

- Reduced capex or postponed maintenance.

- Overuse of subcontractors, agency staff, or gig platforms.

These are all signs that fixed costs are rising, flexibility is eroding, and buffers are thinning.

5. Structure loans with labor risk in mind

Loan terms should match workforce volatility. When labor is the key constraint, consider:

- Shorter tenures with more frequent performance reviews.

- Covenants tied to wage metrics or labor cost ratios.

- Disbursement milestones linked to staffing benchmarks, not just revenue.

- Escalation clauses or margin buffers for borrowers on fixed-price contracts.

- Reserves or contingency requirements for sectors with rising award wages.

6. Reward operators who plan ahead

Some borrowers are managing workforce risk well and they should stand out.

Look for:

- Clear retention and upskilling strategies.

- Active workforce planning — not just reactionary hiring.

- Contingency models to source labor or reduce reliance on contractors.

- Evidence of realistic AI deployment (supportive, not fully substitutive).

These borrowers tend to ride out labor disruptions better and bounce back faster. Where the fundamentals are sound, a labor-aware structure can be the difference between a covenant breach and a contained blip.

Final Word

Labor isn’t just an input—it’s a credit variable. When borrowers can’t staff, can’t retain, or misprice workforce risk, the financial damage shows up fast: missed milestones, rising short-term debt, falling margins. These risks are especially acute in sectors with tight pricing models, project-based cash flows, or high exposure to regulated wage environments.

For lenders, embedding workforce awareness into credit analysis isn’t optional—it’s now core to protecting portfolio performance. By stress-testing labor assumptions, watching margin and headcount signals, and structuring deals that reflect operational fragility, credit professionals can stay ahead of hidden borrower strain and back the operators most equipped to deliver through volatility.