Key Takeaways

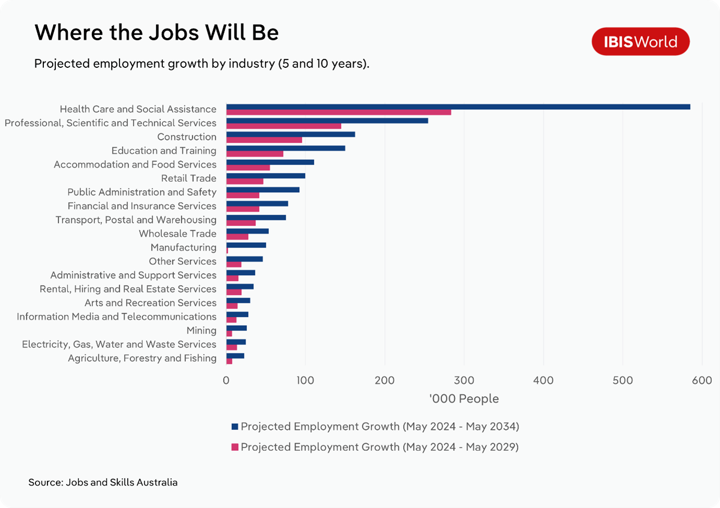

- In healthcare, wage caps and strict staffing ratios are limiting how far providers can scale, even as demand grows.

- Construction firms are seeing strong pipelines but shrinking margins as labor shortages push timelines and costs up.

- Education providers are facing sustained salary growth with little pricing power, putting pressure on already tight margins.

- In professional services, firms are locked into higher wage costs while client pricing expectations stay flat.

Profitability planning is hitting a structural wall, and staffing costs are a big part of it. While material and freight costs have largely stabilized since the pandemic, staffing costs are still climbing, and in many industries, they now make up the bulk of operating expenses. What was initially seen as a temporary wage spike is increasingly revealing itself to be a long-term reset, challenging traditional margin assumptions and growth models. From healthcare and education to professional services, the pressure is structural, not cyclical.

While wage growth is visible on paper, it's also the product of long-term underinvestment in people. A mix of policy choices, stalled migration reform, training bottlenecks and years of weak real wage growth are all contributing to today’s workforce constraints.

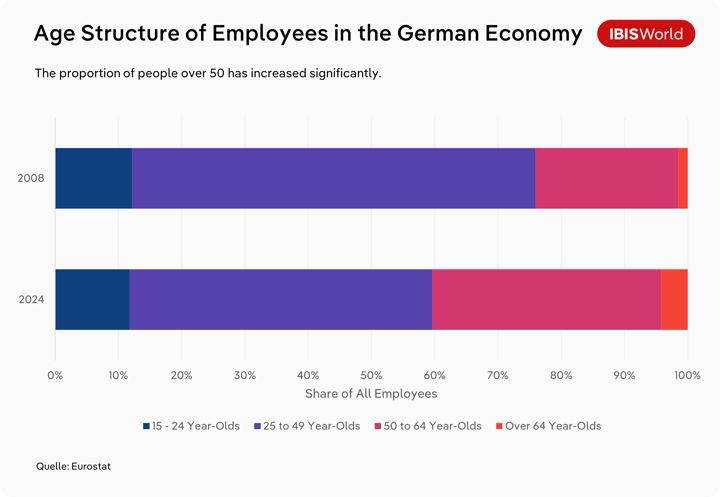

Across Australia, the UK, Germany and the US, the pattern is clear: demand for labor-intensive services is rising, but the workforce to deliver them isn’t keeping pace. For example, in the UK, birth rates have fallen below 600,000 for the first time in two decades, and in Germany, nearly half of all employers are struggling to fill vacancies despite broader economic slowdown.

This is not a short-term imbalance. Aging populations, high attrition, long training pipelines and stalled migration reform are making labor shortages more permanent. Even in the face of AI investment and automation efforts, wage pressure is proving persistent, particularly in sectors where skilled human labor is still essential.

For strategic planners, this means one thing: margin assumptions can no longer be based on historical trends or topline opportunity alone. Where are labor cost pressures becoming a structural risk to profitability, and how can teams look to build smarter and more realistic growth strategies?

Rethinking cost baselines in a tight labor market

Answering that starts with understanding where labor cost pressure is structurally altering cost baselines and making some growth strategies harder to execute.

Across multiple economies, staffing costs are rising even as other input costs stabilize. In the UK, rising labor costs (from a 6.7% minimum wage hike to higher payroll taxes) are already changing hiring decisions, prompting businesses to reduce staff and pause planned hiring. Similar patterns are emerging elsewhere: in the US, job openings continue to outpace unemployment, particularly in technical roles, while employers in Germany and Australia are struggling to fill essential positions despite broader economic slowdowns.

The demographic pressures behind this shift are changing workforce supply on multiple fronts:

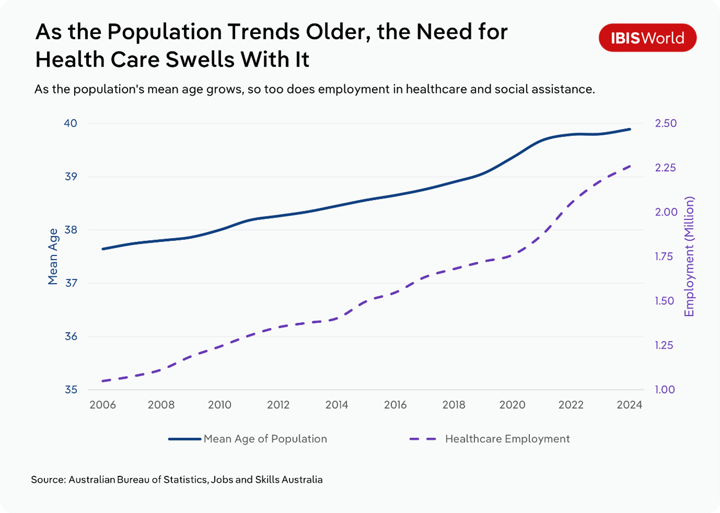

- Aging populations are reducing the number of available workers, while increasing demand for labor-intensive services like healthcare.

- Declining birth rates mean fewer new entrants to the workforce each year.

- Rising net exits from the workforce, with the UK now seeing more people retiring than entering work.

- Migration policy, once a pressure valve, is no longer keeping pace as visa caps, housing constraints and political opposition are slowing reforms across advanced economies.

Taken together, these pressures are changing what growth looks like. Even in sectors with strong demand, rising labor costs and limited workforce supply are making it harder to scale. Understanding where these constraints are most acute is key to building strategies that hold up in practice.

Healthcare: Demand without scalable delivery

Few sectors are under more pressure from labor costs than healthcare. Wages already account for the majority of spending, and providers have limited ability to cut back due to strict staffing requirements. At the same time, rising demand from ageing populations is colliding with workforce shortages, making it harder to expand care delivery.

Across Australia, the UK and Germany, job vacancies in healthcare remain stubbornly high, even as funding and policy efforts aim to boost capacity:

- In Australia, healthcare, education and construction were among the largest sources of job vacancies in 2024, collectively accounting for tens of thousands of open roles.

- In Germany, aged care had fewer than one jobseeker per open role in 2025, signaling severe pressure on staffing and care delivery.

- In the US healthcare sector, strict licensing rules and safety standards limit automation, so hospitals and care providers still need large teams, even as wages rise.

Labor is not just the largest cost in healthcare, it’s the least flexible. Hospitals and aged care providers must meet strict staffing ratios and care mandates, limiting scope to reduce headcount as demand grows.

Funding models add further pressure. In Australia and the UK, capped reimbursements limit wage flexibility. In the US, FDA oversight and licensing requirements constrain labor-saving options, even in private systems.

Strategic plans built on service growth or capacity expansion will need to confront this rising labor constraint directly. Even providers with strong demand and funding access are now facing limits to delivery due to cost and staffing availability.

Planning actions to consider

Reframe margin forecasting in regulated sectors

In publicly funded systems or insurance-based markets, reimbursement rates are often fixed. Even modest wage increases can't always be passed through to revenue. Margin forecasts should be reviewed with this constraint in mind.

Avoid treating demand as a proxy for viability

Aging populations and increased care needs make healthcare look like a growth engine. But without workforce elasticity, rising demand doesn't automatically translate to scalable or profitable delivery. High-demand sub-sectors where labor capacity is already maxed out warrant closer scrutiny.

Time expansion around workforce availability

Rather than pushing growth plans across the board, consider sequencing investment into regions or sub-sectors with stronger workforce pipelines. Workforce supply should become a gating factor in go/no-go decisions.

Planning questions to ask

- Are funding models flexible enough to absorb continued wage growth, or are margins capped by reimbursement constraints?

- Where are staffing mandates or workforce shortages likely to limit service delivery or expansion?

- Are current forecasts treating labor availability as a risk scenario, or building it into base-case planning?

- How much of the projected growth in care services is actually scalable under current cost and workforce conditions?

Construction: Activity is up, margins are down

Construction demand is holding strong in many economies, but labor constraints are eating into profitability. Across Australia and the UK, government infrastructure pipelines remain active, though funding and delivery capacity vary, while in Germany, long-term priorities like energy transition are still driving demand for skilled labor, even amid broader economic strain.

But even in markets with strong project pipelines, margins are tightening. The issue isn’t demand, it’s delivery. A shortage of skilled trades and project managers is pushing labor costs up and timelines out, placing structural pressure on profitability:

- Australia’s construction sector is under mounting cost pressure, with commercial builders reporting that trade shortages are now the top driver of cost overruns.

- In Germany, the construction sector is facing acute labor shortages. Some trades have fewer than one jobseeker per vacancy, with 36% of workers already aged 50 or older.

- In the UK, structural workforce shortages are making it harder to deliver on housing and infrastructure targets, with tighter migration policy compounding long-standing gaps in skilled trades.

What’s more, the construction sector is heavily project-based, meaning profit is only realized once work is completed. As labor shortages stretch out delivery timeframes and increase contractor rates, the risk of margin compression builds over time. Even where input costs like steel and timber have moderated, labor-driven overruns are keeping project returns below expectations.

For teams assessing the construction sector, headline growth figures may give a false sense of security. Strong activity pipelines are only part of the story and cost-side constraints are now a major factor in determining profitability and risk.

Planning actions to consider

Factor timeline risk into return projections

With labor shortages extending build times, traditional models for ROI and project turnaround may no longer hold. Stress-test project-level profitability under longer delivery scenarios, especially in markets with tight labor pools.

Weigh labor availability as a strategic gating factor

Consider workforce supply as a core input in project prioritization. Regions with deeper labor pools or stronger training pipelines may support more viable delivery schedules and lower cost escalation risk.

Check whether project budgets reflect today's labor costs

If bids were priced before labor costs spiked, they may no longer be realistic. Projects with fixed budgets are especially at risk of cost blowouts if wages keep rising.

Planning questions to ask

- Are projected margins built on current labor rates, or outdated cost baselines?

- How exposed are your projects to trades or specialist roles in short supply?

- Do your delivery schedules account for labor-driven delays, or assume best-case scenarios?

- Are cost estimates flexible enough to absorb wage increases mid-project?

Education: Rising costs in a price-capped sector

The education sector is another area facing rising labor costs with limited room to recover them. Wages have always been the largest line item in education, but cost pressures are intensifying. Across multiple countries, salary growth for educators and support staff is outpacing both inflation and funding increases:

- In Australia, average earnings in education have grown significantly in recent years, outpacing many other sectors.

- In Germany, educators are one of the most in-demand occupations.

- In the UK, ongoing teacher shortages are driving salary increases even as public funding stagnates.

This pressure is compounded by rising service expectations. From mental health support to individualized learning, the student-to-staff ratio is expanding, not contracting. Institutions are being asked to do more, with more staff, but with little pricing flexibility.

Even private institutions face limits. While they can theoretically increase fees, competitive pressures, regulatory oversight and capped student funding (like loan limits or subsidies) still limit their pricing power. In the US for example, affordability concerns are changing enrolment patterns, with some students delaying or opting out of higher education altogether. This is creating revenue pressure for institutions, even as staffing and service expectations remain high.

Education is a prime example of a high-demand, low-flexibility sector. Labor is both critical and constrained, and many institutions are finding that margin compression is becoming structural, not cyclical.

Planning actions to consider

Pressure-test budgets in fee-capped environments

If tuition or funding is capped, wage increases can’t always be passed on. Check if financial models still hold up under current staffing costs.

Don’t scale what you can’t staff

Strong student demand doesn’t mean you can grow. Check if local talent pools can support expansion before committing to new enrolments or campuses.

Build rising wages into your long-term plans

Even small pay bumps add up. Factor in steady labor cost growth when planning future budgets, not just one-off increases.

Planning questions to ask

- Are margin forecasts based on realistic assumptions about wage growth and staffing needs?

- How exposed are current delivery models to rising staff-to-student ratios?

- Can current or future pricing strategies absorb higher wages without eroding competitiveness?

- Are expansion plans aligned with workforce availability, not just demand?

Professional services: Competing for scarce skills

In knowledge-heavy sectors like ICT, engineering and consulting, wage pressure is being driven by a fierce fight for talent.

Professional services firms rely on highly skilled labor that’s in short supply across much of the globe.

- In Australia, ongoing demand for ICT specialists has collided with workforce shortfalls, driven by long training pipelines and migration caps.

- In Germany, 79% of ICT employers reported being unable to fill roles due to talent shortages.

- In the US and UK, skilled labor shortages in sectors like ICT and consulting are fueling competition for technical talent, adding pressure on firms to raise salaries and secure key roles.

Many firms are now locked into elevated wage bands to retain staff, while also facing pressure to meet client expectations on price and delivery. Unlike cyclical wage rises that can be absorbed or reversed, these cost shifts are becoming baked into long-term operating models.

While these services are often high-margin, that cushion is thinning. As labor costs climb and clients resist fee increases, firms must find new ways to protect profitability without sacrificing delivery standards.

Planning actions to consider

Map long-term wage inflation into contract pricing

Fee structures based on pre-inflation labor costs may no longer be viable. Renegotiating pricing or adding inflation-adjustment clauses can help maintain margin integrity over multi-year contracts.

Assess capacity growth through productivity, not headcount

With hiring constrained, productivity improvements (through tech enablement, process standardization or knowledge-sharing systems) may offer more scalable and cost-effective capacity gains.

Diversify revenue by offering scalable or tech-enabled services

Expanding into services that are less reliant on hourly labor, such as software-as-a-service, platform models or self-service advisory tools, can ease dependency on talent pipelines while broadening revenue streams.

Planning questions to ask

- Are client contracts structured to absorb long-term wage growth?

- Where can delivery models be redesigned to reduce labor intensity?

- What’s the ROI on productivity tools versus continued hiring?

- Which roles are critical to protect margins—and which can be rescaled?

Final Word

Labor cost inflation is no longer a short-term budgeting challenge. Across key sectors like healthcare, education, construction and professional services, staffing costs are rising faster than revenue and creating pressure points that traditional planning models don't account for.

Even where demand is strong, cost structures are shifting. This is turning previously reliable sectors into higher-risk plays, especially when pricing is fixed or delivery depends on hard-to-scale teams.

For strategic planners, the takeaway is clear. Resilience now means more than managing expenses. It requires rethinking how labor fits into your long-term cost base, building margin pressure into forecasts, and aligning growth strategies with workforce realities from day one.