Key Takeaways

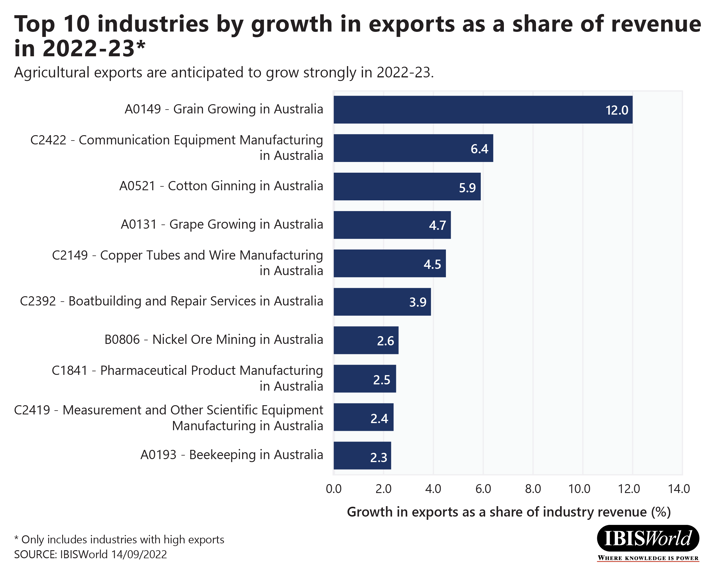

- The COVID-19 pandemic’s disruptions to international trade are easing, presenting exporters with opportunities to expand their international markets.

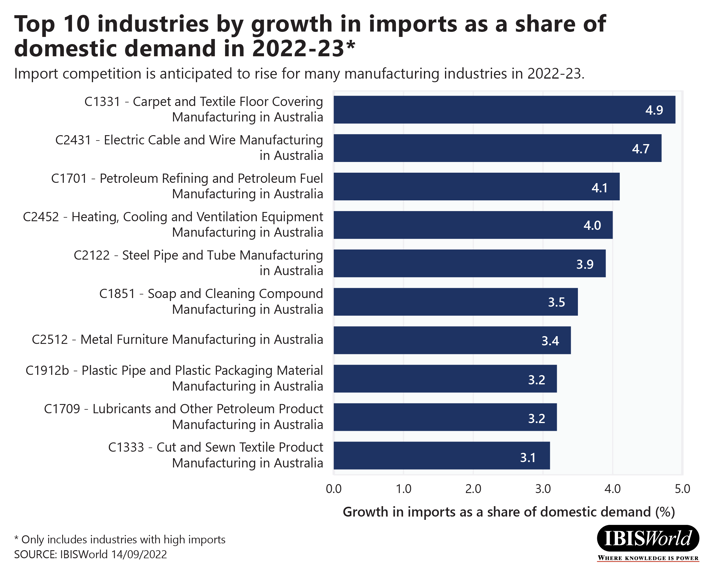

- It is becoming easier to source inputs from overseas again, benefiting producers that import inputs, but hindering industries that face significant competition from foreign manufacturers.

- While it’s evident that international trade has overcome the COVID-19 pandemic’s disruptions, new opportunities and threats have presented themselves to Australia’s importers and exporters, dramatically shifting the appearance of the international trade landscape.

In the first half of 2020, the COVID-19 pandemic unsettled global markets and supply chains. The impact was twofold. Firstly, factories shutting down or operating at reduced capacities weakened production rates, particularly in China, leading to delivery delays and difficulties sourcing products. Secondly, rising demand for goods strained transportation networks that were simultaneously dealing with the effects of infection prevention measures on workforces and operations. The impact on Australia’s industries was varied, with some even benefiting from subdued trade activity.

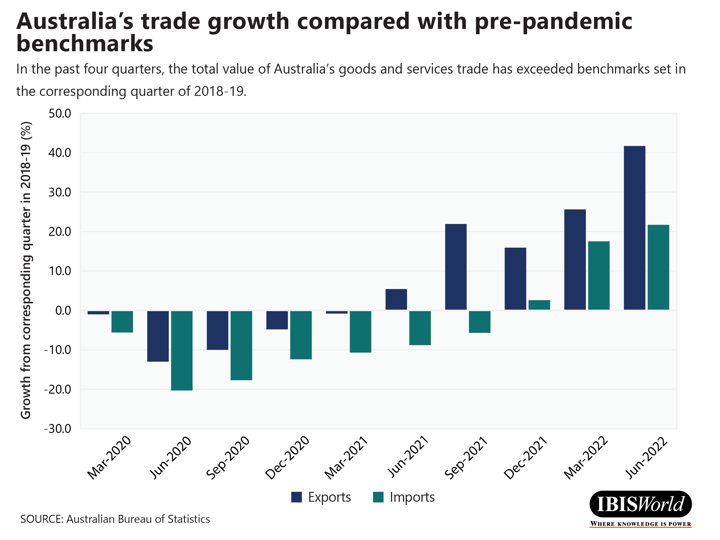

While some of the pandemic’s disruptions linger, there is no doubt that international trade has recovered from a COVID-19 slump. In fact, the value of Australia’s goods and services trade for 2021-22 greatly exceeded benchmarks set in 2018-19. The total value of imported and exported goods and services in 2021-22 was 18.1% higher compared with 2018-19, before the COVID-19 pandemic shocked global trade. Some of this growth can be attributed to rising commodity prices. However, this international trade recovery has largely stemmed from widespread COVID-19 vaccine coverage reducing the prevalence of lockdowns and other pandemic-related restrictions.

Imports

In 2019-20 and 2020-21, many manufacturing businesses faced difficulties procuring inputs and services required to produce goods. For example, a semiconductor shortage has had a profound impact on firms in the Motor Vehicle Manufacturing industry. Supply shortages like this affect the immediate industry supplying goods from overseas, but they also have a ripple effect through the economy. A drop in car manufacturing globally meant operators in the Motor Vehicle Dealers industry and the Motor Vehicle Wholesaling industry had limited stock to onsell to industries such as the Road Freight Transport industry. This is just one example of a trend that occurred within various sectors of the economy following the COVID-19 outbreak.

What do recovering imports mean for Australian businesses?

Easing trade disruptions come as welcome news for Australian businesses that import their inputs from overseas producers. For example, constrained global supply of building materials, such as timber, steel and glass, has hit operators in the Construction division hard. Limited supply of these inputs disrupted construction activity and placed upward pressure on purchase costs, which account for over half of the Construction division’s cost structure. In particular, these pressures hit the House Construction industry hard, contributing to an upward trend in insolvencies among operators.

Easing trade disruptions should provide an opportunity for importers to procure cheaper inputs by opening up greater choice in foreign suppliers. This expanded choice of suppliers boosts pricing power for buyers and alleviates pressure on industries that rely heavily on imported inputs. Firms that can leverage this increased purchasing power can reduce their production costs and expand their margins.

Conversely, this rise in import activity will negatively affect Australian industries that compete with imports. As rising freight costs and difficulties sourcing goods from overseas hit Australian businesses, many firms increasingly sourced products domestically, growing demand for Australian supplying firms. Several manufacturing industries that compete heavily with imports and primarily supply the domestic market experienced increased revenue in 2020-21, including:

- Cut and Sewn Textile Product Manufacturing

- Footwear Manufacturing

- Medical and Surgical Equipment Manufacturing

- Agricultural Machinery and Equipment Manufacturing

- Mattress Manufacturing

As supply chain disruptions ease, this temporary relief from import competition will likely diminish. However, new relationships between importers and domestic suppliers may provide suppliers with an opportunity to continue these relationships into the future by offering superior service and high-quality products.

Exports

Many businesses in the agriculture, forestry and fishing, mining and manufacturing sectors derive a significant proportion of their revenue from export markets. During the early stages of the pandemic, exporting companies struggled to move products to international markets in a cost-effective and timely manner due to the lack of sea and air freight capacity, constraining revenue.

What do recovering exports mean for Australian businesses?

The gradual easing of disruptions and reconnection of global supply chains provides exporters with an opportunity to benefit from pent-up demand for Australian goods and services. In particular, the Mining division has benefited from strong demand and rising prices. Australia is a net exporter of commodities, with approximately 70% to 75% of the Mining division's output exported each year. Export revenue declined in the agribusiness sector over the two years through 2020-21. However, strong overseas demand for Australian produce and favourable domestic growing conditions are anticipated to drive export growth over the two years through 2022-23.

In addition to recovering supply chains facilitating trade growth, rising prices may benefit durable goods producers that could not sell products during the pandemic’s peak. Some exporters may be able to sell goods for higher prices than they would have two years ago, as inflationary pressure spread throughout the global economy.

While this is good news for exporters, it could be bad news for domestic firms that benefited from exporters supplying the domestic market while their access to international markets was restricted. For example, domestic industries that purchase raw materials from the Mining division and agribusiness sector may be hindered, as their suppliers regain demand and can extract higher prices from overseas buyers. Examples of these affected industries include:

- Iron Smelting and Steel Manufacturing

- Fossil Fuel Electricity Generation

- Gas Supply

- Food product manufacturing industries

- Beverage manufacturing industries

The return of demand from export markets may drive exporting firms to raise prices and reduce supply to domestic firms. These domestic firms need to prepare for this shift and explore their other supply options, such as importing from overseas.

A shifting landscape

While it’s safe to say Australia’s international trade has recovered, the current international trade landscape is by no means ‘normal’. The events of the past three years have significantly affected the composition of Australia’s international trade activity, with consumer behaviour, supply chains and the geographical distribution of trade fundamentally changing. Firms must continue adapting, as the COVID-19 pandemic created many lingering threats to trade activity, such as labour shortages, high freight prices, and the potential for COVID-19 outbreaks to disrupt production internationally, and new threats continue to emerge, such as the Russia-Ukraine conflict and trade tensions with China.

How have supply chains changed?

For a long time, firms’ primary concerns when managing their supply chains were efficiency and cost reduction. The COVID-19 pandemic has forced businesses to rethink this strategy as they became aware of how vulnerable their supply chains were to global disruptions. While cost reduction is still imperative, supply chain agility and resilience have become increasingly important to ensure firms can quickly respond to unforeseen events and avoid disaster.

Firms can improve their resilience by diversifying their supply networks. It is important to not only assess risk at the primary source, but to assess risk at multiple levels of the supply chain. The use of digital supply networks can help businesses reduce the vulnerability of their supply chains. Importers and exporters have increased visibility within their supply chains by accelerating supply chain digital transformation trends. This allows them to gain accurate and timely information, which is vital to making quick and effective decisions.

How has consumer behaviour changed?

At the beginning of the pandemic, many thought that a decline in trade activity would lead to deglobalisation and a fall in consumer spending. Over the past two years, trends have emphatically proven those predictions wrong. According to the ABS, household spending increased by 18.4% over the 12 months to July 2022, despite inflation and rising interest rates increasing cost of living pressures on consumers.

The Household Spending Index now exceeds pre-pandemic benchmarks in every spending category. Strong demand for goods trade, in addition to the after-effects of the COVID-19 pandemic, has pushed up freight prices worldwide. High freight prices continue to challenge businesses engaged in international trade, often pushing them to pass those cost increases downstream to avoid tightening profit margins.

How has the geographical distribution of trade changed?

The geographical distribution of Australia’s trade has changed significantly. In 2018-19, China accounted for 36.0% of Australia’s exports, dropping to 32.1% in 2021-22. Trade tensions have led to rising tariffs, and in some cases total bans, on some Australian products. This shift has forced some importers to find alternative trade partners.

Countries in the Asia-Pacific region have been Australia’s strongest growing trade partners over the past decade, and this trend accelerated during the COVID-19 pandemic. Many of the countries in this region are some of the fastest growing economies in the world and are likely to continue becoming significant trade partners for Australia over the next decade. Importers and exporters that target these markets may be able to find new opportunities to lower costs and establish reliable trade partnerships.

Final Word

The COVID-19 pandemic caused many structural changes to international trade, and while it’s still unknown which will last over the next five years, it is certain the landscape won’t shift back to what it was in 2018-19. Growth will likely slow over the next few years as the effects of the post-pandemic rebound dwindle. Nevertheless, Australia is likely to remain a highly trade-dependent nation. New risks and opportunities for businesses will continually arise as a result of Australia’s highly globalised economy.

Follow IBISWorld on LinkedIn to keep up to date with our latest insights and market research guides.

IBISWorld reports used to develop this release:

- Motor Vehicle Manufacturing in Australia

- Motor Vehicle Dealers in Australia

- Motor Vehicle Wholesaling in Australia

- Road Freight Transport in Australia

- Carpet and Textile Floor Covering Manufacturing in Australia

- Electric Cable and Wire Manufacturing in Australia

- Cake and Pastry Manufacturing in Australia

- Petroleum Refining and Petroleum Fuel Manufacturing in Australia

- Boiler and Tank Manufacturing in Australia

- Heating, Cooling and Ventilation Equipment Manufacturing in Australia

- Steel Pipe and Tube Manufacturing in Australia

- Soap and Cleaning Compound Manufacturing in Australia

- Metal Furniture Manufacturing in Australia

- Lubricants and Other Petroleum Product Manufacturing in Australia

- Grain Growing in Australia

- Cotton Ginning in Australia

- Grape Growing in Australia

- Copper Tubes and Wire Manufacturing in Australia

- Pharmaceutical Product Manufacturing in Australia

- Measurement and Other Scientific Equipment Manufacturing in Australia

- Beekeeping in Australia

- Aircraft Manufacturing and Repair Services in Australia

- Wood Chipping in Australia

- Copper Ore Mining in Australia

- Construction in Australia

- House Construction in Australia

- Mining in Australia

- Agribusiness in Australia

- Cut and Sewn Textile Product Manufacturing in Australia

- Footwear Manufacturing in Australia

- Medical and Surgical Equipment Manufacturing in Australia

- Agricultural Machinery Manufacturing in Australia

- Mattress Manufacturing in Australia

- Iron Smelting and Steel Manufacturing in Australia

- Fossil Fuel Electricity Generation in Australia

- Gas Supply in Australia

- Value of merchandise trade exports

- Value of merchandise trade imports

- Total merchandise imports and exports

- Total mass of exports by sea

- Domestic price of timber

- World price of natural gas

- World price of steel

- World price of coking coal

- World price of steaming coal

- Total value of world trade