Key Takeaways

- Behind every update to the Trade Tariff Exposure Tool is a rigorous process of interpreting dense trade policy, standardizing thousands of HTS codes, and verifying complex tariff logic.

- IBISWorld analysts must navigate a constantly shifting regulatory environment, translating legal language and cross-referenced notes into accurate, decision-ready tariff data.

- The tool’s clarity and reliability come directly from the judgment, experience, and line-by-line expertise applied to each tariff revision.

About a year ago, when Donald Trump announced plans for a sweeping new tariff agenda, the business community felt an immediate jolt. The prospect of broad import duties on goods from Canada, China, Mexico, and the European Union triggered uncertainty across supply chains. Suddenly, leaders everywhere were asking the same question: How exposed are we to tariffs?

Answering that question proved difficult. Tariff data is technical, fragmented, and rarely intuitive. Some companies turned to consultants or customs brokers. Others guessed based on past experience. Most were left trying to interpret thousands of pages of tariff schedules on their own.

This environment prompted IBISWorld to build the Trade Tariff Exposure Tool.

Designed for teams across supply chain, strategy, procurement, underwriting, and investment, the tool offers instant visibility into which tariff actions apply to specific industries. The US version relies on a proprietary mapping of NAICS industries to the Harmonized Tariff Schedule (HTS), helping users identify at-risk inputs, understand cost drivers, and respond to changes in real time. The goal is straightforward: turn one of the most complex regulatory datasets in the world into something clear, usable, and decision-ready.

Clients experience the polished final product. What they rarely see is the work behind it.

I spent a few days with Gabriel Seiler, our analyst who maintains the US Tariff Tool, to understand how a single revision makes its way from government release to something business leaders can rely on.

What I learned is that he operates inside one of the most complex and relentless regulatory systems in the global economy, charting clarity where most see chaos.

Day 1, 9 AM: A new HTS revision drops

When I arrive at Gabriel’s desk, he already has the US International Trade Commission’s HTS archive open. It’s barely nine o’clock when he spots the day’s catalyst.

“Revision Twenty Five is live.”

There’s no alert, no announcement: just a fresh line in the archive indicating yet another update to the Harmonized Tariff Schedule.

Revision 25 deals with wood products, though this takes some groundwork to discover: softwood timber, lumber, furniture, and cabinets. Straightforward on the surface, but in the HTS, nothing is ever simple. A single revision can trigger ripple effects across headings, temporary provisions, and notes, especially in Chapter 99, which governs temporary tariff actions.

“People think of tariffs as one number,” Gabriel says. “But every change touches the entire schedule in some way.”

He downloads the Change Record, a short table listing which headings were modified. It looks unassuming, but it’s only the starting point.

The meaning behind these changes lives in the Federal Register. Gabriel opens the presidential proclamation referenced in the record and scrolls to the annex: a dense legal text that lays out the actual modifications. It’s written in a style that blends law, economics, and classification rules.

"Today's changes are all under Chapter 99, which has been typical of just about every update this year," he notes. "It's a complicated process, but we built the tool to handle these specific modifications."

Chapter 99 is the HTS’s maze of temporary tariff measures: retaliatory tariffs, suspended duties, exemptions, and special actions. Its notes cross-reference each other constantly using only codes and note locations without any descriptive text. Updating the tool requires reading the annex, the current revision, and the previous one side by side to understand how a single change flows across the entire structure.

As Gabriel begins interpreting the new headings, he takes plain-language notes. These aren’t for users, but they’re how he navigates dozens of interlocking rules and exceptions.

Watching him work makes one thing obvious: the tool’s simplicity is built on meticulous, behind-the-scenes complexity.

Day 1, 11 AM: Interpreting the annex and navigating chapter 99

By eleven Gabriel has the Change Record, the annex, and two versions of the HTS open across his screens. This is where the work shifts from finding the changes to understanding them.

He reads through the annex deliberately, highlighting additions and deletions and tracing each reference deeper into Chapter 99. The language is thick with conditional phrases and nested provisions.

“You have to understand what it’s really saying,” he explains. “Not just what it literally says.”

He finds the text of the newly added Note 37—the anchor of Revision 25’s additional wood product tariffs. Note 37(a) describes a new 10.0% tariff and references General Note 3(c)(i), which Gabriel recognizes as the treatment of commodities under trade agreements. In this case, the new tariffs apply regardless of coverage by existing trade deals. Other references in the added Note 37 further clarify exceptions, conditions, or alternative rates.

“Everything connects to something else,” he says. “It’s like untangling a knot.”

He flips between the annex, the Excel version of the HTS, and the previous revision, checking phrasing and locating cross-references.

Interpretation—turning legal text into working knowledge—is the part no automation can replace.

Day 1, 1 PM: Extracting and standardizing the affected codes

By the afternoon Gabriel understands what the new rules mean. Now he needs the actual HTS codes affected by the revision: the pieces the tool can work with.

“Most updates ultimately come down to which codes are touched,” he says. “If the codes are wrong, everything downstream is wrong.”

Revision 25 imposes new duties on softwood timber and lumber under 22 eight-digit commodity codes. A handful of them are neatly listed in Note 37(b), with the others located later throughout Note 37.

But many revisions present codes in different formats: four-digit, six-digit, eight-digit, or ten-digit. Each requires a different method:

- Eight-digit codes go straight into his workflow.

- Ten-digit codes need to be trimmed.

- Four- or six-digit codes must be expanded into all associated eight-digit subheadings.

“It sounds simple,” he says, “but the HTS isn’t designed for convenience. You have to standardize everything.”

He uses formulas to strip periods, remove duplicates, and preserve leading zeros. A single formatting mistake can cause the code to break downstream.

Once cleaned, each code is added to the “New Tariffs” tab—one row per code—along with reporter country, partner country, new additional duty rate, effective dates, and a binary “active” switch.

“These codes look simple once they’re in the table,” he says. “Getting them there is the hard part.”

By lunchtime, the codes are fully standardized and ready for the next step.

Day 2, 10 AM: Turning codes into actual tariff rates

The next morning, Gabriel shifts from preparing the codes to seeing how they behave in the tool’s backend logic.

For each code, the system retrieves the base MFN (Most Favored Nation) duty. Some rates are straightforward percentages. Others combine formats. For example, a dollar amount per unit plus a percent. The formulas split these structures, update the percentage portion, and recombine them.

Next, the system checks whether the product is exempt from unilateral duties by referencing a list in another tab. The list of exempt commodities regularly changes, and a new update to the exempt list in Revision 25 must be incorporated before the tool can accurately perform this step. If the product is not exempt from unilateral duties, the tool pulls in any applicable country-specific rates. For example, a standard additional duty on products from China.

Then comes one of the trickiest elements: stacking duties.

The US may impose a tariff on a commodity from all countries as well as an additional tariff on that commodity from one specific country. If this is the case, the logic needs to apply both without double counting. To handle this, Gabriel opens a separate redistribution tool he built to manage overlapping rates.

“It’s just logic management,” he says. “You make sure the hierarchy is respected.”

He runs spot checks across the updated timber codes—10% here, 25% there—and verifies that reductions for partners like the UK or European Union also added in Revision 25 are applied correctly.

By mid-afternoon, the new rates are flowing cleanly through the system.

Day 2, 1 PM: Updating the industry exposure layers

With the product-level updates complete, Gabriel moves to the industry-level layers: the sections of the tool that allow users to gauge the significance of tariff changes for types of businesses.

“Tariffs change quickly,” he says. “Industry structure changes slowly, but it still needs to be current.”

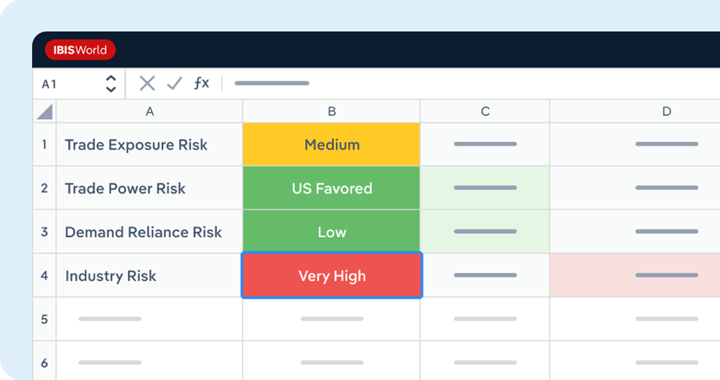

He opens the Industry Exposure and Industry Analysis tabs, where indicators like pricing power, globalization, revenue volatility, import reliance, and trade exposure help contextualize tariff impacts.

These inputs draw on IBISWorld’s broader report ecosystem. Updating them ensures the tool reflects the latest forecasts, risk ratings, and industry fundamentals.

“It’s important that the tariff side and the industry side speak the same language,” he says. “If one is current and the other isn’t, the picture gets distorted.”

He reviews pricing power metrics for all industries, then checks trade dependence, which represents spending on inputs sourced abroad. High dependence signals vulnerability. Low dependence implies smoother absorption of cost pressures.

Once all the core data is updated, he checks that the new wood product tariffs are correctly displayed when the user selects the industry 32111 Sawmills and Wood Preservation. A few cells require manual review. A few charts get refreshed. Small tasks that matter for accuracy.

“It’s always the last five percent that takes the longest,” he says. “But it’s the part our clients feel the most.”

Day 2, 4 PM: Getting the update ready for release

By late afternoon, the update is nearly complete. What remains is transforming the working version into the clean, fast file clients receive.

Gabriel opens a fresh copy of the workbook. The working version is too formula-heavy to distribute. The frontend loads quickly, but the backend contains thousands of rows and logic chains that would slow the file dramatically if left untouched.

“The goal here,” he says, “is to keep everything accurate and make everything fast.”

He begins converting backend formulas to static values where possible. Some formulas stay dynamic; others can be flattened. He moves methodically across the sheets.

Next, he runs a macro that hides backend tabs. The calculations remain embedded, but the complexity stays behind the scenes.

He tests a few industries to confirm responsiveness: timber, cabinets, upholstered furniture, and a few affected UK and EU categories. Everything loads instantly.

Once satisfied, he packages the updated file and sends it to our IT and Client Services teams, who handle distribution and client support.

Final Word

Watching Gabriel update the Tariff Tool makes the invisible visible. Every revision requires pulling together information from different agencies, interpreting dense annexes, and shaping all of it into structured, accurate data.

What stands out most is how much depends on understanding the logic behind the rules. The HTS is not built for ease. It shifts constantly. And every update demands analytical discipline and practical judgment that no automated workflow can replicate.

At the end of the day, I asked Gabriel whether he learned this process from documentation or training.

He shook his head. “No. I figured it out piece by piece. You learn the system by working through it.”

His answer made it clear why the Tariff Tool is used by so many of our clients: it’s built on the kind of thoughtful expertise that can only come from doing the work line by line.