Key Takeaways

- Tracking Key External Drivers helps businesses anticipate market shifts early, so they can act strategically—not react under pressure.

- Layering economic data uncovers hidden growth opportunities, giving leaders a sharper, more confident approach to market expansion.

- Data-backed decisions based on cost drivers lead to smarter resource allocation, stronger positioning, and stakeholder buy-in that turns insights into action.

Consumer behavior is famously unpredictable. Simply keeping up with shifting consumer preferences is a job well done, but staying ahead can challenge even the most strategically sophisticated businesses. Having said that, consumer trends don’t operate in isolation. Broader economic forces, from supply chain disruptions to interest rate volatility, shape industry performance and business strategy.

IBISWorld’s comprehensive Business Environment Profile library highlights major forces that will impact an industry’s performance over the next 12 months and beyond. With so many variables at play, businesses cannot afford to rely on guesswork — understanding Key External Drivers can lead to better-informed decisions.

For many decision-makers tasked with the all-important role of building strategies and identifying fresh market opportunities for their organization, navigating these changes with incomplete data can lead to missed opportunities. Relying purely on intuition can also result in strategic misalignment or difficulty securing leadership buy-in. That’s why tracking the right economic indicators is crucial – without them, it’s impossible to anticipate market shifts with confidence. But what if there was a way to gain a clearer, more reliable perspective on the economic drivers shaping your industry?

As someone who has led both our Research and Revenue departments at IBISWorld, I know that using economic data is a no-brainer when it comes to strategizing and identifying new growth opportunities in the market.

This is why our Business Environment Profiles are invaluable. They provide businesses with a tool that will ground their strategies in unbiased, comprehensive data. These profiles provide insight into the external drivers and economic forces that influence industry performance and can provide the data you need to identify growth opportunities, validate your instincts and anticipate disruptions or price shocks confidently.

Join me as we explore how IBISWorld’s Key External Drivers will empower your business to not just keep up with ever-evolving markets, but also stay ahead of the curve.

Understanding the forces that shape your industry

During my career at IBISWorld, I was fortunate enough to work with our founder, Phil Ruthven. He often spoke about how no company or industry exists in isolation. Both internal forces (within the company’s control) and external forces (outside their control) influence a company’s performance and strategy. Our Business Environment Profiles give you a leg up in understanding the external—and often uncontrollable—forces impacting costs and demand within your industry and , consequently, determining your organization’s wellbeing.

Key External Drivers cover factors outside an organization’s control that materially affect industry performance. Some of the biggest factors shaping industries include fluctuating commodity prices, rising freight costs and interest rate volatility, all of which can significantly impact supply chains and business expansion.

But these are just a few examples. Many other economic drivers can influence market conditions and strategic planning, and IBISWorld tracks a wide range of external drivers. These include, but are not limited to:

- Exchange rates

- Weather conditions

- Consumer tastes and preferences

- Demographics

- Producer Price Indices (PPI)

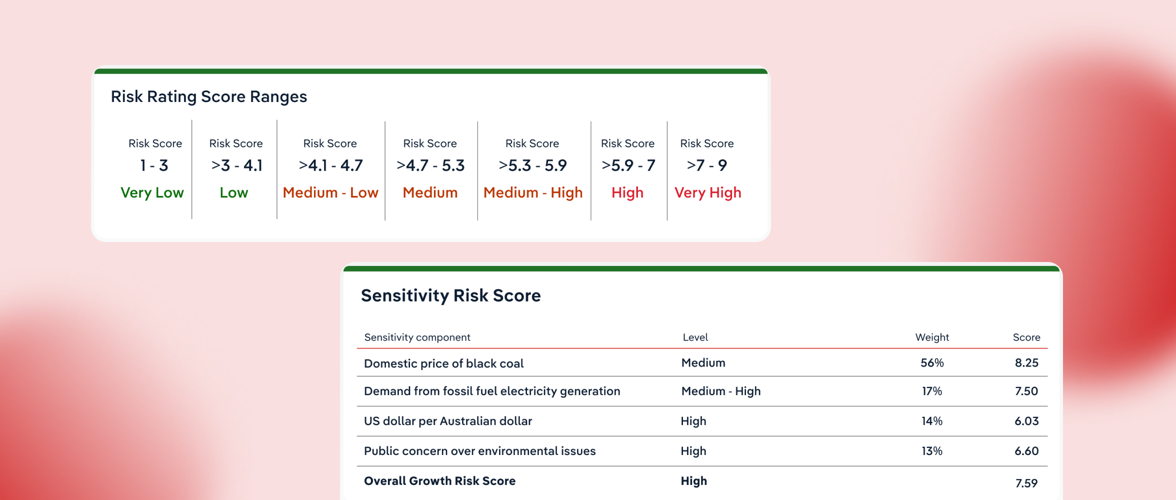

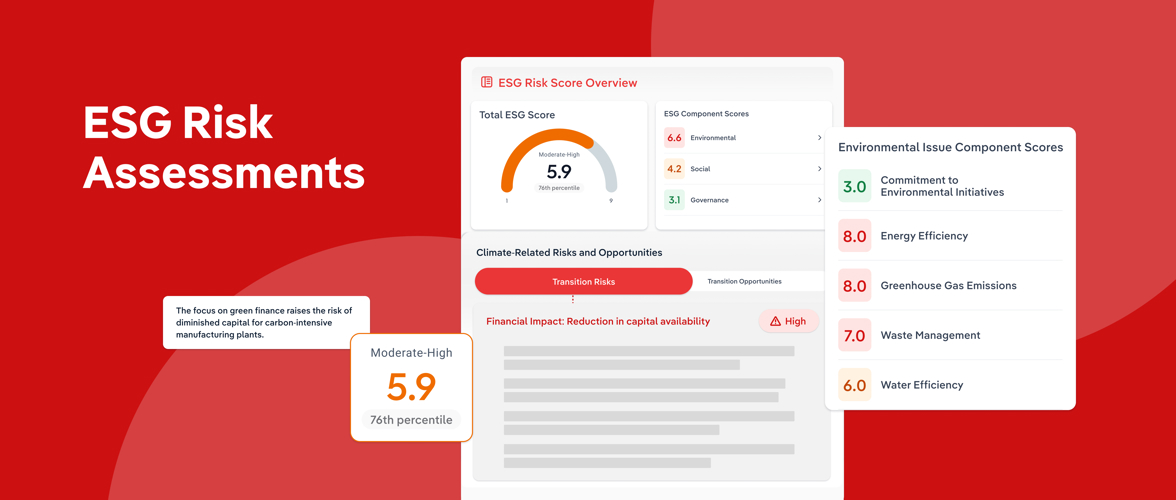

In every one of our industry reports, relevant Key External Drivers for that industry can be found in the External Environment chapter and the Industry at a Glance section. You can identify the most important external indicators for your own industry, or any other industry in your supply chain, along with if these drivers have a positive or negative impact on the industry.

From there you can navigate to our full library of drivers where you can explore other Business Environment Profiles that may be important to your project. For example:

- Fluctuating commodity prices can impact the entire supply chain, from the primary producer to the retailer and consumer. The same applies to rail, road and water freight prices where increased freight costs result in higher prices being passed down the supply chain.

- Demographic shifts, like aging populations or growth within certain age groups can influence which product lines are prioritized in a manufacturing facility, for instance. They also determine what products and in what quantities are purchased from that manufacturer by wholesalers and retailers. The insights and potential uses of such demographic information are vast.

Having access to a wide range of drivers provides a solid, data-driven foundation to support and guide your strategic direction while also helping to identify new market opportunities.

How Key External Drivers shape strategy

To take a straightforward example like the manufacturing sector, businesses in this field are heavily dependent on a wide array of commodities such as metals, plastics and textiles. This makes accurate commodity data and forecast prices a critical component of strategic planning. Fluctuations in prices will impact production costs, profit margins and overall competitiveness.

However, by using IBISWorld’s commodity price forecast data, manufacturers can:

- Engage in strategic procurement, optimizing their purchasing strategies to buy materials at lower prices.

- Hedge against anticipated price increases, ensuring cost management remains effective.

- Maintain pricing stability for their products to keep competitive in volatile markets.

While global commodity trends are often used to anticipate price movements and manage costs, they can also reveal where demand is growing. For example, if inputs used in textile manufacturing show rising demand in a particular region, manufacturers can explore market entry opportunities tailored to those conditions, staying agile and responsive to global shifts.

Understanding global commodity trends goes even further by helping manufacturers identify emerging markets that exhibit favorable conditions for expanding their product offerings. For instance, if the demand for certain textiles is rising in a particular region, manufacturers can tailor their strategies to explore market entry opportunities, ensuring agility and responsiveness to global economic shifts.

Overlaying economic indicators

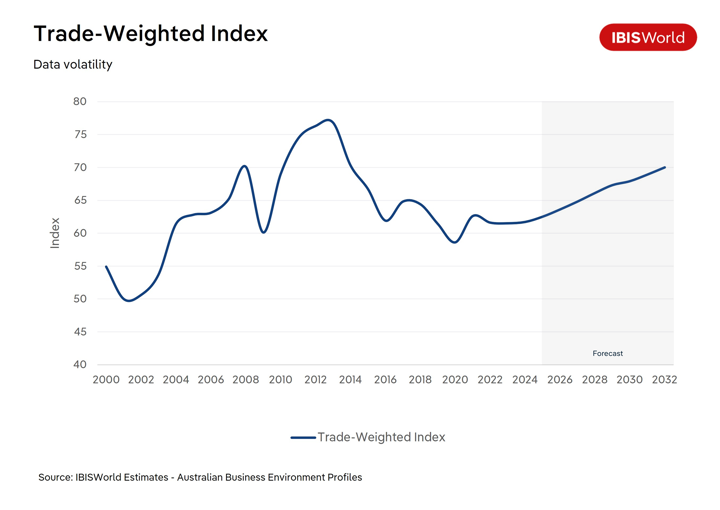

Taking this one step further, you can overlay other economic indicators such as the trade-weighted index (TWI). The TWI measures the relative value of the domestic currency against other international currencies, providing valuable insights for businesses operating in global markets.

For clothing manufacturers, for instance, monitoring the TWI allows them to:

- Assess the level of competition from foreign manufacturers.

- Adjust pricing or explore cost efficiencies if the local currency strengthens and imported goods might become more competitive.

- Identify opportunities for expanding overseas during periods of currency weakness, if exports become more attractively priced.

Anticipating consumer demand with market insights

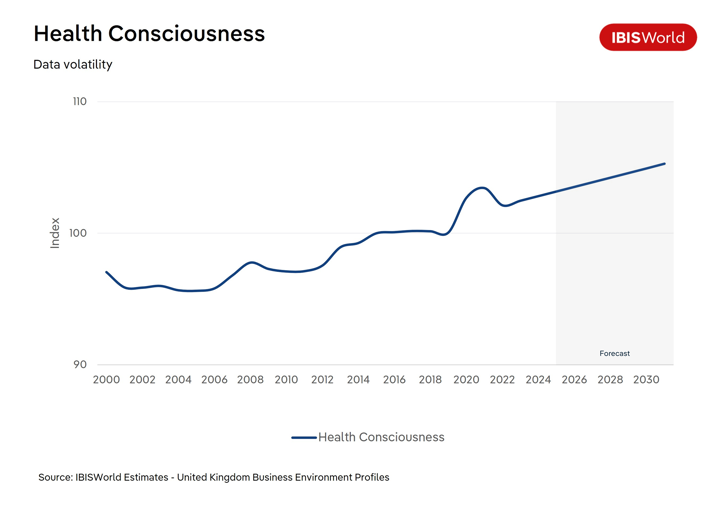

For a more consumer-focused approach, businesses can also overlay different types of consumer data such as the Health Consciousness Index to tap into market trends that can influence a product line. For clothing manufacturers, tapping into these shifts in consumer behavior can provide opportunities for innovation and product development.

For instance, if data indicates a rising trend in health consciousness, clothing manufacturers might consider investing in sustainable, organic materials or developing new lines of active and athleisure wear to meet this demand.

The power of data layering

This is really just the start of using and layering data to formulate a cohesive and data-driven strategy. By combining drivers such as commodity prices, economic indicators and consumer trends – along with other key factors unique to each industry – you can optimize costs, position your business competitively in global and domestic markets, and be flexible in the face of shifts in consumer demands.

No single metric tells the full story of an industry. For a strategy to be fully effective, businesses need to layer multiple economic indicators – tracking how shifts in one area (such as interest rates) influence another (like consumer spending). This helps you to avoid blind spots, make proactive moves and strengthen your forecasts.

Turning insights into strategic action

So far, we’ve looked at a pretty simple way of leveraging Key External Drivers for manufacturers. But these drivers go beyond just the manufacturing industry. Let’s explore how businesses across different industries can leverage our comprehensive Business Environment Profiles to uncover opportunities, plan smarter expansions and drive strategic decision-making.

Spotting untapped opportunities

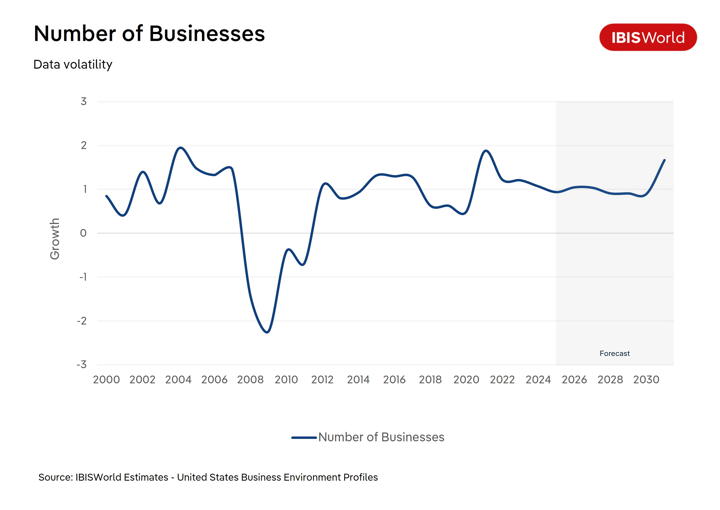

Using external driver data from our Business Environment Profiles, you can leverage demographic and economic data to uncover sectors or regions ripe for growth. For example, accountants tracking the Number of Businesses in a region can identify underserved markets with significant potential. SaaS companies might focus on areas with rising Capital Expenditure on Software to tailor their offerings precisely or understand if they need to expand their Sales team.

Industries like education and consumer services, such as universities, student housing, and even tattoo studios, can benefit from targeting regions with a growing population of 18 to 25-year-olds, aligning their services with youthful, emerging markets.

Planning smarter expansions

IBISWorld provides expansive geographic coverage across North America, Europe, Australia, and New Zealand, giving businesses the ability to assess comprehensive regional external drivers. By examining geographic breakdowns, companies can effectively identify underdeveloped markets where competition is less intense.

Say you’re a cheese producer tracking consumption trends, and you notice a trend in increasing cheese, butter and yoghurt consumption in certain regions, coupled with a high Domestic Price of Milk. This could indicate strong export potential, empowering the business to strategically plan expansions and gain a foothold in markets primed for growth.

Winning stakeholder buy-in

Strategic planning is one thing, but getting buy-in from internal and external decision makers is another. Having a gut feeling about a business or client’s direction isn’t enough. Stakeholders need compelling, data-backed reasoning.

Leveraging the clear charts, tables and data in both our Industry Reports and Business Environment Profiles helps transform complex facts into clear, convincing visuals. With this data visualization, you can lay out your plans confidently and clearly, effectively communicating your well-supported recommendations to get that sign-off.

Strategic growth in a changing market

A few years ago, I worked with a prospective client who was the founder of a small-scale clothing manufacturer and online retailer. The company experienced explosive revenue growth during COVID and had rapidly gone from operating out of makeshift manufacturing and warehouse facilities to full-scale commercial manufacturing spaces.

As the COVID boom slowed, the founder recognized the need to revisit their strategy to ensure the growth of the company continued. They faced challenges like rising interest rates, erratic energy prices and supply-chain issues, all while adapting to their new market position from start-up to an established brand.

Throughout several meetings, we took them through our library of Business Environment Profiles, focusing on indicators such as the Cash Rate, Electricity Service Prices and several freight pricing reports. By examining historical trends alongside IBISWorld’s analyst-backed forecasts, the founder could clearly visualize the potential impact on the company’s production costs. This prompted them to focus their strategic review on their supply chain to improve efficiency and protect against further energy price and interest rate rises.

I caught up with the founder a few months ago, and we chatted about how the review had gone and whether, two years in, they had effectively implemented it and achieved some successes. They had successfully implemented several key strategies based on our data, including:

- Refinancing loans at fixed interest rates to protect against future rate hikes.

- Investing in solar electricity generation, reducing reliance on external suppliers and achieving significant utility cost savings.

- Negotiating favorable shipping contracts, insulating the business from road freight price spikes.

Initially, some of these decisions were greeted with skepticism from external investors and other members of the company's leadership team, particularly as most loans and contracts were renegotiated at higher initial prices. However, it didn’t take long for additional price increases to demonstrate the value of these strategies through tangible savings.

Beyond cost savings, the data also guided their long-term market positioning. By layering external driver insights on freight costs, interest rates and consumer trends, they identified new export opportunities in regions with a rising demand for sustainable clothing. This shift helped them future-proof their businesses rather than just reacting to short-term cost pressures.

These strategic adjustments led to overall cost savings and improved operational efficiency, both in the long and short-term. The founder ended up securing organization wide buy-in by presenting data backed strategies that showcased their willingness to be proactive when it comes to facing challenges in their external environment. As a result, the client positioned themselves competitively, even in a tough market, and ensured a solid foundation for continuous growth.

Final Word

IBISWorld’s library of Business Environment Profiles will give you thousands of drivers that cover four continents, as well as globally focused drivers. Coupling that with our Industry Reports gives you a very powerful view of both the external and internal operating environments of a company and the industry it operates in.

With IBISWorld’s Business Environment Profiles, you can:

- Quickly identify high-potential opportunities, such as new markets or product development opportunities.

- Identify and mitigate risks to your operations and profitability with proactive, forwarding-looking planning.

- Allocate resources more effectively by leveraging precise economic data.

We help businesses identify and validate opportunities, and adapt to immediate and long-term shifts in the market. Whether it's responding to demand surges or preparing for disruptive trends, these tools ensure businesses remain agile, strategic and future-focused.

As the economic landscape continues to evolve, businesses need to make faster, smarter decisions to remain competitive. Successful companies don’t usually stumble into success. Growth is built on strategic planning, data-backed insights and confidence to drive and stick to the strategy.

With IBISWorld’s collection of Business Environment Profiles, you're armed with the clarity and confidence to make those big moves and grab an opportunity when it comes up. You’ve read this far, well done! Explore all Key External Drivers covered in our Business Environment Profiles now to see how data can drive your next strategic move.