Key Takeaways

- IBISWorld’s Top 100 Manufacturers list covers companies from over 60 different industries, which have a combined revenue of $357.0 billion.

- Manufacturers dealt with headwinds like fluctuating commodity prices, supply chain disruptions and rising operational costs.

- Revenue changes for many top manufacturers are closely tied to price fluctuations for key inputs like milk, sugar, crude oil and gold.

- Railway transport manufacturer and maintenance provider Alstom Transport Australia recorded the strongest growth, benefiting from an acquisition of one its major rivals as well as a number of large-scale transport contracts.

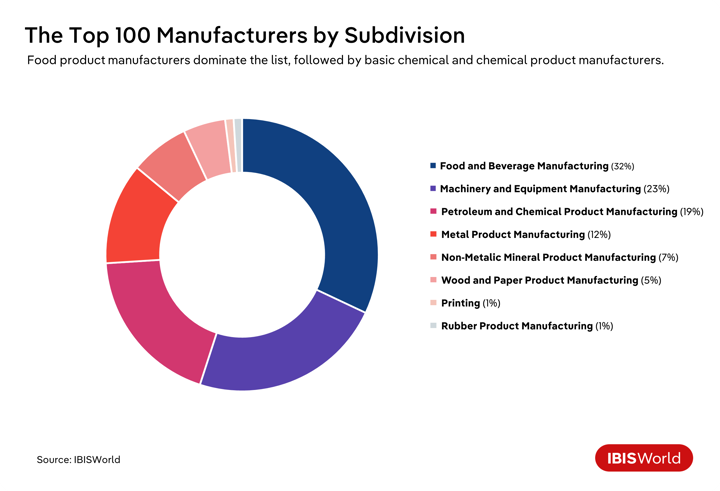

IBISWorld has unveiled its Top 100 Manufacturers List for 2024, comprising companies that together generated $357.0 billion in revenue, up from $345.2 billion the previous year. Representing 62 different industries – ranging from food and beverage, wood and metal, building and chemical products, to transport equipment – this list captures the breadth of Australia’s manufacturing sector.

The Pharmaceutical Product Manufacturing industry is the most represented by the number of companies, with six making the list, including CSL Limited, which ranks 5th overall. However, in terms of revenue, the Petroleum Refining Fuel Manufacturing industry dominates, generating $57.9 billion during the year. This list reflects the diversity and economic impact of Australia’s top manufacturers.

Rail projects propel Alstom’s success

Rail projects propel Alstom’s success

Alstom Transport Australia Holdings Pty Ltd (Alstom) recorded the strongest growth among Australian manufacturers, with its revenue surging 81.5% to $1.2 billion in the year to March 2023. This impressive performance is primarily due to Alstom's involvement in several major transport projects.

The company's participation in the Queensland New Generation Rollingstock project has significantly boosted its revenue. Contracts for Electric Multiple Unit trains and rail cars in Perth and Adelaide and VLocity Diesel Multiple Units in Melbourne also elevated its revenue. These large-scale contracts have raised demand for Alstom's manufacturing and repair services for trains, trams and light rail vehicles.

By securing contracts for these critical transport initiatives, Alstom has positioned itself as a key player in modernising Australia's transportation network. This has ensured a steady stream of revenue for the company and has solidified Alstom’s position as an industry leader.

The fluctuating fortunes of Australia’s top fuel and metal manufacturers

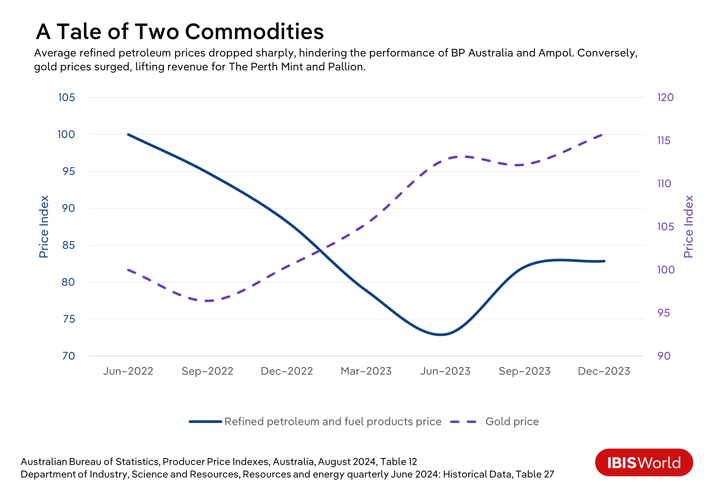

The start of the Russia-Ukraine war in 2022 caused a surge in crude oil prices. Despite remaining volatile throughout 2023, crude oil prices fell from the high recorded in 2022. These lower prices weighed on the performance of petroleum refiners Ampol Limited and BP Australia Investments Pty Ltd. Revenue for Ampol, the largest manufacturer in the country, only fell slightly due to a drop in refined petroleum prices and a decline in demand from its convenience channel.

Refined petroleum prices in Australia fell 11.3% over the 2023 calendar year, according to data from the ABS. At the same time, Ampol’s sales volumes in Australia rose 11.0%. It was a different story for BP Australia, as both volume and price declines caused the company’s revenue to fall 18.9% in the year to December 2023.

Although falling petroleum prices weakened revenue for these manufacturers, gold performed well. The price for the precious metal, which is generally seen as a safe haven asset, escalated amid growing investor uncertainty. The combined impact of persistent, high global inflation, a weakening US dollar and rising geopolitical tensions in Europe and Asia contributed to a significant boost in demand for gold. In addition, central banks in various countries increased their gold reserves, further driving up prices. These trends supported revenue rises for Gold Corporation (trading as The Perth Mint) and Pallion Group Pty Limited, the second and tenth largest manufacturers on the list, respectively.

Rising food prices drive revenue growth

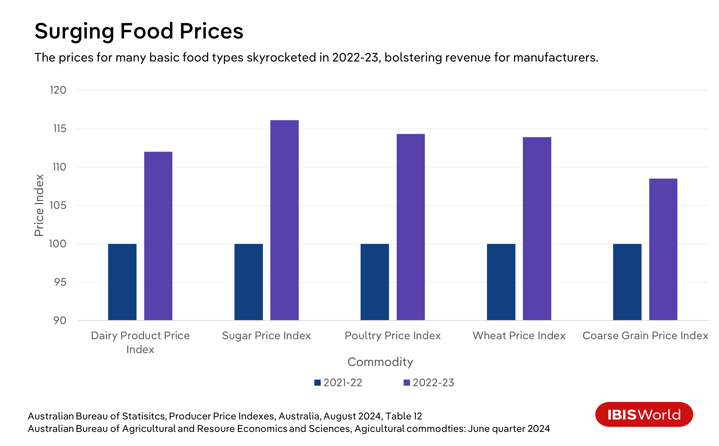

Food and beverage manufacturers account for just over 20.0% of revenue on the list. Revenue from these companies collectively grew 9.0% in 2022-23, almost triple the combined revenue growth of all companies on the list of 3.3%. Sharp increases in major food commodity prices can largely explain this contrast.

A spike in milk prices

A near three-decade low in raw milk supply drove a 31.3% surge in farmgate milk prices, which reached a record high of 74.8 cents per litre in 2022-23. Falling raw milk production weakened dairy product volumes, but processors passed the higher farmgate prices on to customers. That’s why the three dairy product manufacturers in the Top 100 – Bega Cheese Limited (23rd), A.C.N. 166 119 133 Pty Ltd (trading as Saputo Dairy Australia) (28th) and Lactalis Australia Pty Ltd (37th) – saw revenue increases of 12.7%, 8.1% and 12.8% respectively.

Rising costs for poultry farmers

Poultry meat is the number one consumed meat in Australia. The three largest poultry processors in the country all feature on the list of Top 100 manufacturers in Australia: Inghams Group Limited sits at number 27, Baiada Poultry Pty Limited at number 45 and Turosi Pty Ltd at number 76.

Australian poultry production only edged up 1.1% in 2022-23. However, sharply rising costs for farmers – especially for feed, utilities and employment – saw poultry processors ramp up the prices they charged wholesalers and retailers. Despite the strong price rises, per capita poultry meat consumption remained relatively stable, boosting processors’ revenue. Revenue for Inghams rose 12.4%, while Baiada Poultry’s climbed 4.2% and Turosi’s lifted 10.7%.

A climb in global sugar prices

Sugar also experienced significant price increases. Weak production in India and Thailand, which together account for one-quarter of global sugar output, led world sugar prices to skyrocket 27.0% in the 2023 calendar year. Two sugar manufacturers, Wilmar Sugar Australia Limited and Queensland Sugar Limited, come in at number 32 and 60 on the list, respectively, both having benefited from the global price increases. Wilmar Sugar’s revenue grew 18.1%, even though its raw sugar production remained stable at around 2.1 million tonnes. Queensland Sugar’s revenue jumped 34.7% over the 2022-23 financial year. The company’s rising raw sugar sales volumes, which leapt 21.4% from 1.4 million tonnes to 1.7 million tonnes, as well as increased prices in the second half of its reporting period, supported its revenue growth.

Tight global grain supplies

The Grain Mill and Cereal Product Manufacturing industry is represented by six companies on the list this year, which all recorded double-digit percentage revenue growth. Similarly to sugar manufacturers, rising global prices and increased production aided these manufacturers' revenue. Australian wheat and coarse grain harvests reached record or near-record levels in 2022-23, and while this would typically place downwards pressure on prices, tight global supplies due to the Russia-Ukraine war hiked prices during the year. Manufacturers passed these higher costs on to their customers, thereby lifting revenue. For example, flour and grain mill manufacturer Cajosa Pty Ltd (trading as Manildra Group) (38th), which derives around half its revenue from international markets like the United States and Japan, saw its revenue rise 21.7%. PFG TopCo1 Pty Ltd (trading as Allied Pinnacle) (84th), a major pre-mixed bakery product manufacturer, had revenue growth of 14.3%.

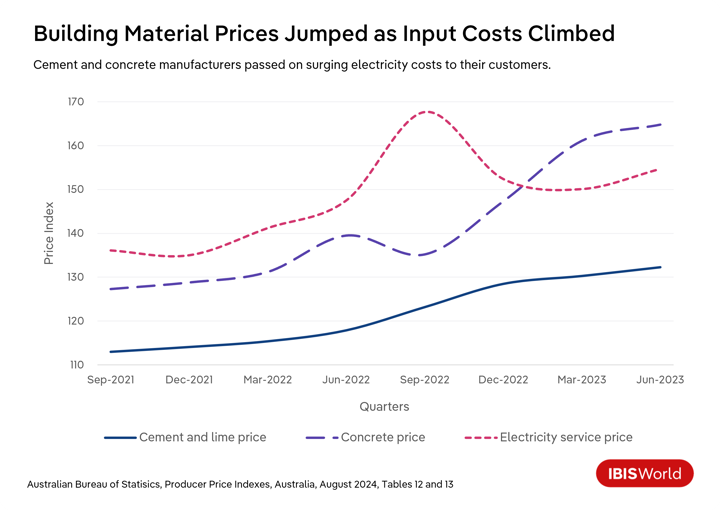

Building material prices skyrocket amid surging energy prices

Rising energy prices have hiked costs for manufacturers, including manufacturers of building construction products like concrete and cement. In addition to rising energy expenses, these manufacturers faced higher costs from labour shortages, which they passed on to their customers.

Cement and lime prices rose 11.7% in 2022-23, while concrete prices rose 15.5%, and rising demand throughout the year also had a two-fold effect on revenue. Strong demand from non-residential building construction – largely from government infrastructure projects like the West Gate Tunnel Project in Victoria, WestConnex in New South Wales and the Tonkin Gap project in Western Australia – outpaced declining demand from the residential construction market. Furthermore, increasing demand from these projects put pressure on supply throughout the year, lifting prices.

Building material manufacturers feature significantly on the list. These include concrete, aggregate and cement manufacturers like James Hardie Industries Public Limited Company (16th), Boral Limited (21st), Hanson Australia (Holdings) Proprietary Limited (36th), Holcim Participants (Australia) Pty Ltd (41st) and ADBRI Limited (47th). These companies’ combined revenue rose 10.5%, to $15.7 billion. Holcim Participants (Australia) and Boral recorded the strongest revenue rises of these companies, up 18.8% and 17.8%, respectively. Boral reported revenue growth across all its product segments, including 20.0% growth in concrete, where the company reported 6.0% volume growth and 12.0% growth in prices. Holcim Australia’s acquisition of ready-mix concrete manufacturer Vic Mix Pty Ltd in September 2023 bolstered its revenue.

Geopolitical tensions boost revenue from lucrative defence contracts

Rising geopolitical tensions in the Asia-Pacific region, as well as the ongoing war in Ukraine, have supported revenue growth for defence manufacturers in Australia. These tensions have fuelled demand for military equipment, technologies and services, enabling local manufacturers to secure substantial financial gains. The emphasis on strengthening defence capabilities has also spurred international collaborations, like AUKUS, further enhancing revenue streams for Australia’s Defence industry. Consequently, the Australian Government has ramped up defence spending, leading to lucrative contracts for Australian defence firms.

Companies like BAE Systems Australia Holdings Limited (48th) and ASC Pty Limited (89th), which are major shipbuilders in Australia, benefit from long-term, often multibillion-dollar projects. Heightened tensions in the South China Sea in recent years have increased the need for naval fleet upgrades, which helped support rising revenue for these companies in 2022-23.

Rising zinc demand drives growth in renewable energy manufacturing

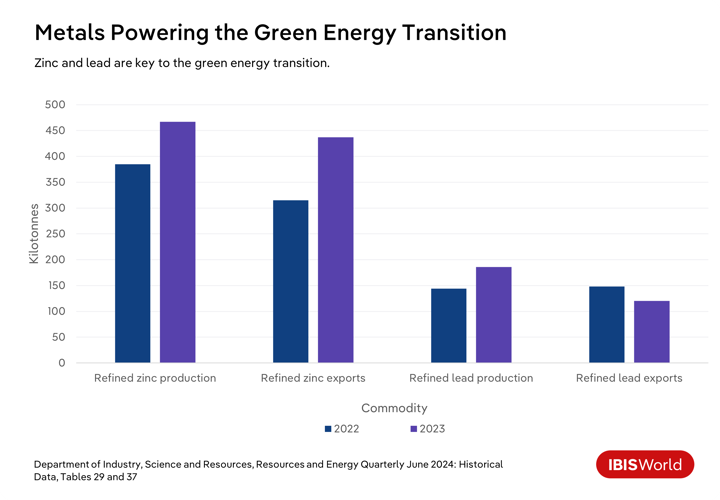

Leveraging the capabilities of Australia’s manufacturing and mining sectors will be essential in the transition to net zero greenhouse gas emissions by 2050. Australia is a leading producer of copper, zinc and lead, and these metals are crucial to the renewable energy transition.

The Copper, Silver, Lead and Zinc Smelting and Refining industry was worth $4.5 billion in 2022-23, and two companies – Sun Metals Holdings Limited (69th) and Nyrstar Australia Pty Ltd (87th) – have made it on IBISWorld’s list of the Top 100 Manufacturers. These companies run Australia’s only two zinc refining plants, and zinc is essential for protecting solar panels and wind turbines from corrosion and for reducing carbon emissions in battery production.

Sun Metals’ revenue grew 6.9% over the year to December 2023, to reach $1.0 billion*. Nyrstar Australia experienced similar growth of 5.1% over the 12 months through September 2023. Although zinc prices declined over both of these companies’ reporting periods, strong demand for zinc – especially in overseas markets like the United States, China and other countries in the Asia-Pacific region – bolstered revenue growth. Nyrstar Australia also refines lead, a key input in battery manufacturing.

Final Word

Australia’s Top 100 manufacturers span a diverse range of industries. Rising input prices, which were passed on to customers, drove significant revenue shifts. For instance, elevated milk and sugar prices fuelled strong gains for processors like Bega Group and Queensland Sugar, while gold producers like Pallion and concrete giants like Boral also saw revenue boosted from price hikes. On the flip side, falling refined petroleum prices led to a steep revenue drop for BP Australia.

However, price fluctuations aren’t the only factor at play. The biggest mover, Alstom Transport Australia Holdings, surged thanks to its acquisition of rival Bombardier Transportation Australia Pty Ltd and ongoing state government contracts. Additionally, manufacturers like Sun Metals and Nyrstar Australia have thrived amid the green energy transition, as their zinc products have been in high demand for solar panels, wind turbines and batteries.