Key Takeaways

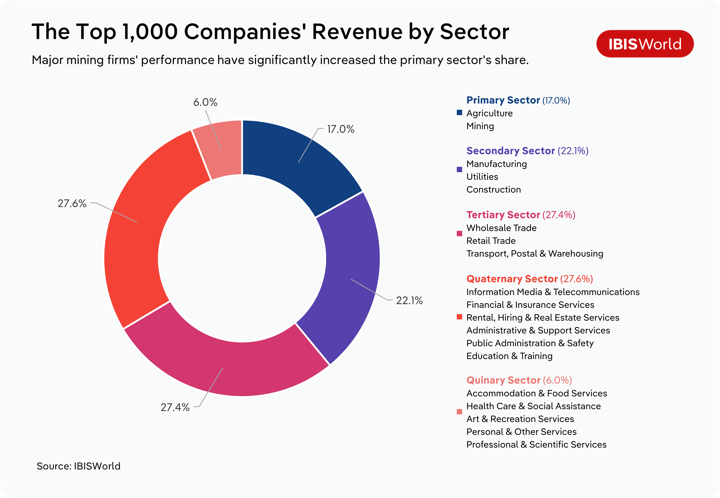

- The Top 1,000 Companies List provides in-depth insights across over 300 industries, which have collectively generated $2.9 trillion in revenue.

- National and regional commercial banks have continued managing inflationary pressures through increased technological investment and AI tools, positioning themselves for a stronger future despite the potential impacts of the RBA’s recent cash rate cuts.

- Dell Australia achieved a staggering 582.9% growth following significant changes to its business model, leading to its monumental jump up the list.

- By expanding their service offerings and meeting the needs of budget-conscious consumers, Australia’s supermarkets have grown despite the cost-of-living crisis.

- Coal miners are experiencing a downturn as commodity prices have fallen and Australia’s major export markets have shifted towards renewable energy sources.

IBISWorld’s 2025 Top 1,000 AU and NZ Companies List offers a comprehensive ranking of the highest grossing companies across 300 industries, excluding government entities and not-for-profit organisations. This special report provides an in-depth look into the trends and insights emerging from the top performers across Australia and New Zealand.

The 2023-24 financial year saw high interest rates and increasing inflation present a number of economic challenges, impacting the performance of companies across various industries.

Despite these pressures, companies on the list collectively generated $2.9 trillion in revenue, marking steady growth of 5.7% compared to the previous year’s list.

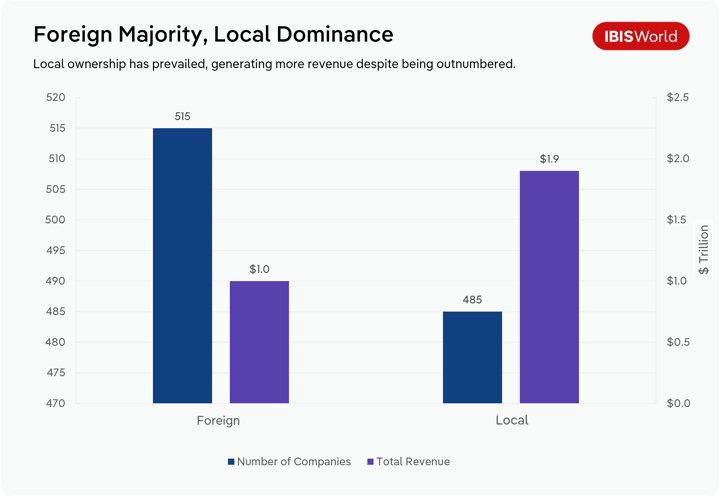

This year’s rankings reflect a shifting landscape. Rio Tinto (1st) overtook BHP Group (2nd) with an impressive $91.9 billion in revenue, while Commonwealth Bank of Australia jumped to 4th place after achieving 33.7% revenue growth. Although foreign-owned companies featured more on this year’s list, it was the Australian-owned companies that remained on top, accounting for 65.6% of the total revenue.

The 2025 Top 1,000 List provides valuable insights into the key drivers behind growth and decline across industries, including technological investment, shifting consumer demand and the global transition towards renewable energy. Understanding these trends will be critical for companies aiming to enhance their competitive positioning in the year ahead.

Banking’s growth continues amid market volatility

The National and Regional Commercial Banks industry has remained resilient despite a challenging economic environment marked by rising interest rates and heightened uncertainty. Major institutions have capitalised on higher lending margins and resilient consumer demand, allowing the industry to maintain upwards momentum.

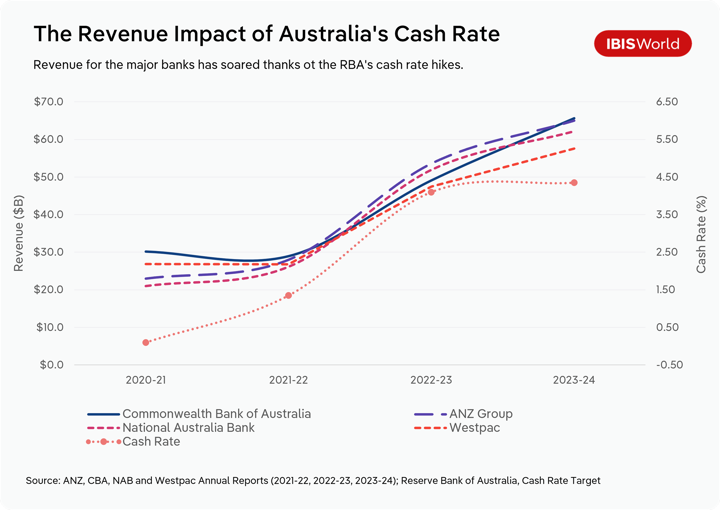

Higher interest rates are driving record banking revenue

Australia’s banking sector has continued its surge on the back of high interest rates. With the Reserve Bank of Australia (RBA) increasing the official cash rate in late 2023, the country’s Big Four banks – Commonwealth Bank of Australia (CBA), ANZ Group Holdings Limited (ANZ), National Australia Bank Limited (NAB) and Westpac Banking Corporation (Westpac) – collectively generated $250.4 billion in revenue, reflecting a 23.9% increase from the previous year. This strong performance meant they had no trouble retaining their places within the list’s Top 10 companies, with CBA and Westpac even climbing.

The smaller banks have also demonstrated their outstanding performances, boasting double-digit growth, with two banks notably making their debut – MyState (889th) and IMB Limited (974th). IMB Bank’s tremendous 42.3% growth largely stems from it achieving $1.47 billion in loan approvals, up 8% from the previous year.

Among the top performers of the National and Regional Commercial Banks industry, CBA has seen immense growth of 33.7%, jumping up three spots with a total revenue of $65.7 billion. This was largely due to climbing interest rates charged on loans. The average interest rate on the bank’s interest-bearing assets rose 32.5% during the year, according to data in its 2023-24 annual report.

Despite swelling gross interest revenue during the year, Australia’s major banks all saw a drop or negligible growth in net interest margins and revenue. This was largely due to competitive mortgage pricing and mounting interest expenses, as interest rates charged to the banks also surged.

As competition has heated up, Australia’s financial institutions have ramped up digitisation and AI integration in their product offerings, aiming to add value for their customers while effectively reducing operational costs. The major banks have allocated substantial resources to technology, reporting a total spend of $8.9 billion collectively. These investments have allowed banks to streamline their processes, enhance their digital banking service offerings, improve fraud detection and strengthen regulatory compliance services. With some operational costs lowered and profitability declines partially mitigated, this investment has paid off.

Rate cuts are set to ease borrowing constraints

As inflationary pressures have eased, the RBA made the decision to lower the cash rate to 4.10% in February 2025. Provided that interest rates fall further in 2025, Australia’s banks may see a short-term dip in their performance before lower interest rates boost demand for mortgages and loans and stimulate economic activity in the long term. With the banks continuing to invest in emerging technologies and AI tools, their operational costs are likely to shrink in the year ahead.

Coal and oil: Market turmoil

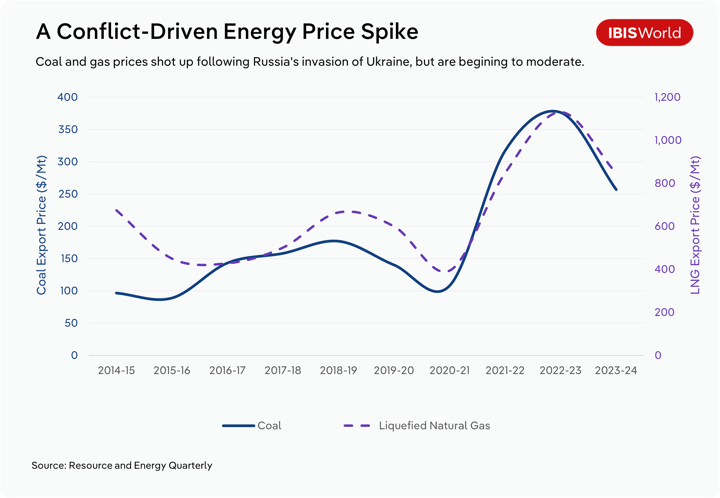

The Coal Mining industry has experienced volatility in recent years, with coal prices more than doubling over the two years through 2022-23 as the Russia-Ukraine conflict reduced global supplies. However, during 2023-24, prices dropped by more than 30%. Consequently, this year’s Top 1,000 Companies List highlights a massive 19.5% drop in collective revenue among coal mining businesses. Most prominently, Whitehaven Coal (133rd) took a hit of 36.4%, reporting a revenue drop of more than $2.0 billion since the previous year. While plunging coal prices are primarily to blame, there are other significant influences driving prices lower and threatening the industry’s long-term financial health.

The transition to net zero is disrupting coal exports

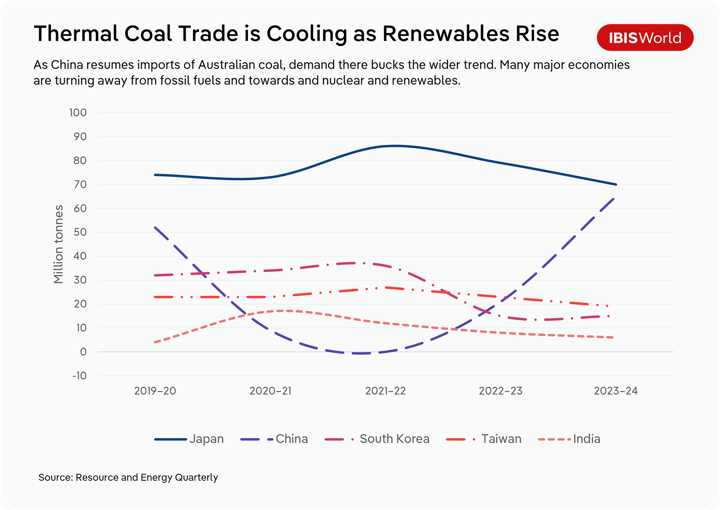

Australia’s major global trading partners have tried to cut their carbon emissions, resulting in a steep decline in demand for coal. Japan, South Korea and Taiwan are three of Australia’s largest thermal coal export markets, accounting for over 50% by volume and 60% by value. However, as these nations generate a greater share of their energy through renewables and nuclear power, export volumes have fallen 11.4% with revenue plunging 55.5% during 2023-24.

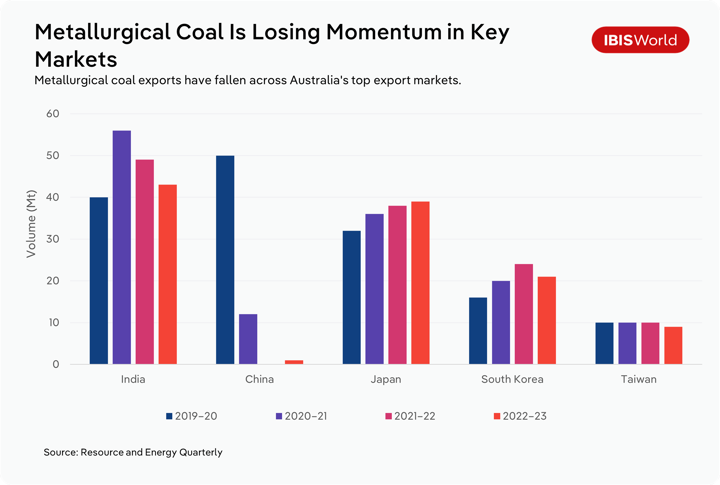

Falling coal prices, coupled with weakened demand from key markets like Japan and South Korea, are projected to drag on coal mining revenue for years to come. Plans to shut down major coal-fired power plants, like Victoria’s Yallourn Power Station in mid-2028, highlight diminishing demand domestically. Nonetheless, coal production is forecast to rise in the coming years as demand persists among key developing economies like India and Vietnam that’re still reliant on coal as an inexpensive and reliable steel-making input.

Australia’s thermal coal exports to China surged 208% in 2023-24 with metallurgical coal exports showing a lesser jump, benefiting from the end of a total ban on Australian coal that had been in place since October 2020. However, Australia’s coal mining sector is unlikely to see a full recovery in terms of growth given that China’s revitalised demand doesn’t outweigh the loss of demand from other export markets that’re venturing ever further into renewable power generation.

Falling commodity prices have substantially hit oil markets

Companies in the list operating across the oil and gas supply chain also endured significant declines during the year, with the majority experiencing double-digit revenue declines. Shell’s QGC Upstream Investments Pty Ltd (413th) took the biggest hit, with its revenue dropping 36.1% in the 2023 calendar year.

Substantial volatility within the market has ultimately stemmed from oil and gas price corrections in 2023 and 2024. Prices ballooned to an eight-year high in 2022 amid the Russia-Ukraine war, as this event significantly disrupted global supply chains. Lower output volumes and decreased commodity prices impacted Oil and Gas Extraction industry companies’ performances, with Woodside Energy Group Limited (19th) and Santos Limited (59th) both losing revenue over the year.

Santos finished decommissioning its Campbell platform in September 2024, contributing to its production volumes falling 5% to 91.7 million barrels of oil equivalent (mmboe). Although Woodside (19th) achieved record production volumes of 193.9 mmboe, a 13.5% fall in liquefied natural gas prices ultimately outweighed this growth and led to its revenue downturn.

Governments have responded to concerns for the oil and gas markets' future

In light of concerns, the federal and state governments have set out measures to address supply chain issues in the oil and gas sector. These include temporary price caps on gas, an increase in Western Australia’s domestic gas reserve and frameworks like the Boosting Australia’s Diesel Storage Program. If these measures prove effective at reducing the domestic impacts of global disruptions, like the Russia-Ukraine conflict, they present a fantastic opportunity to relieve cost pressures.

Dell’s bold pivot has rewritten the rankings

Dell Australia Pty Limited (226th) is a foreign-owned private company that provides technology, hardware and software products as well as storage management services. Making its debut on the Top 1,000 list this year, Dell has emerged as one of the fastest growing companies after achieving a 582.9% revenue growth in the year to January 2024.

However, Dell Australia’s growth wasn’t connected to the wider Computer and Computer Peripheral Wholesaling industry’s performance, as the industry experienced a 1.5% revenue decline overall as inflationary pressures weakened demand for computer products.

Dell Australia’s staggering growth stemmed from major changes in its business model in February 2023. The company restructured its operations, transitioning from a commissionaire arrangement to a limited risk distributor arrangement with Dell Global B.V. (Singapore Branch) and EMC Information Systems International Unlimited Company.

Under these new arrangements, both related parties supply hardware, software and services to Dell Australia for distribution, and Dell Australia takes ownership of it, rather than just acting as an intermediary company that’s only charged a commission. As a result, the company now records revenue as the principal in the sales of goods and services it distributes. With $2.0 billion in hardware and software sales reported in 2024, Dell Australia’s new business model has already positioned it in the top quarter of this year’s list.

With growing demand for IT services, hardware and cloud computing, Dell Australia is well-placed to sustain its newfound position as a major computer hardware and software wholesaler. Its performance reinforces the strategic benefits of adapting supply and distribution arrangements.

Supermarkets have benefited amid a cost-of-living crisis

Australia has found itself within a cost-of-living crisis in recent years, with the Consumer Price Index (CPI) increasing 4.2% during 2024, well above the RBA’s target range of 2.0% to 3.0%. The Supermarkets and Grocery Stores industry has come out of this well, as consumers have cut back on discretionary spending in order to afford the essential household goods they sell.

The top Australian supermarkets, Woolworths Group (3rd) and Coles Group (9th), have experienced 5.7% and 7.6% growth, respectively, amid inflationary pressures that saw consumers allocating more of their spending to necessities like groceries. Campaigns like “Great Value, Hands Down” and “Dine In” have assisted the supermarket giants in stimulating demand from budget-conscious customers through providing affordable ready-made meals and an expanded product range. Increased volume turnover has contributed to Coles and Woolworths both seeing profit margins edge up over the year.

While cost-of-living pressures are set to ease and further cash rate cuts are forecast for 2025, increased consumer spending is projected to drive supermarkets and grocery stores’ continual success in the year ahead. However, recent ACCC recommendations would allow for greater competition in the industry if implemented.

The ACCC has recommended that supermarkets be required to publish prices on their websites and provide online comparison tools, making the grocery shopping experience more consumer friendly. Nevertheless, as most households spend nearly one-quarter of their net income on groceries according to the 2024 ACCC Supermarkets Inquiry consumer survey, the supermarket giants will continue to enjoy sustained long-term demand.

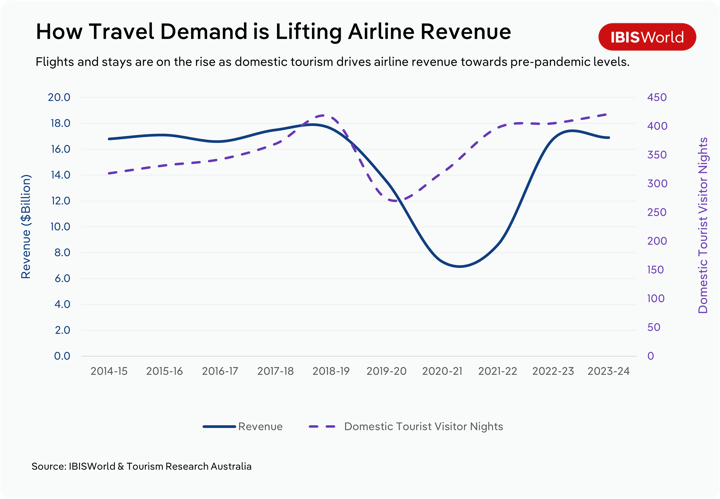

The aviation sector is strengthening despite airline collapses

Domestic and international travel continued its post-pandemic rebound with airlines and travel agencies capitalising on stronger demand. 2023-24 saw major domestic airlines like Qantas (22nd), Air New Zealand (83rd) and Virgin Australia (92nd) all perform well, with moderate growth moving them all further up in the top 100 places.

Rex Airlines and Bonza Airlines fell victim to an increasingly competitive market and numerous operational errors that resulted in flight delays and cancellations. Despite these domestic airlines’ collapses, the duopoly of Qantas and Virgin Australia continued to outperform the Domestic Airlines industry, demonstrating robust revenue growth of 10.6% and 12.7%, respectively.

Virgin Australia recorded a 1.9% increase to 19.2 million passengers while Qantas carried 51.8 million passengers during 2023-24, a 13.3% jump from 2022-23. Launching new international routes, like Qantas’s new Sydney-New York and Perth-London routes, has driven growth in carriers’ available seat kilometres to boost their passenger capacities and revenue-generating capabilities.

Airport operators around Australia and New Zealand also took flight, with all airports on the list boasting double-digit growth during the year. Auckland International Airport (611th) took the cake this year, achieving outstanding 40.0% growth thanks to a 17% jump in passenger numbers to 18.5 million during 2023-24. This comes with a 48% seat capacity increase for flights to and from North American destinations that has boosted overall tourism in New Zealand.

With the major airlines and airports performing well, it comes as no surprise that providers in the Travel Agency and Tour Arrangement Services industry have also experienced significant growth. Intrepid (838th) and WEB Travel Group (908th) have made their debut on this year’s list, after generating 112.8% and 31.4% growth in revenue, respectively.

Intrepid reported record revenue numbers as bookings spiked 68% from 2022 to 2023. This surge in demand for travel and tourism followed on from eased movement restrictions and increased consumer spending power in the post-pandemic environment.

Outlook: Continued growth is forecast despite economic pressures

The addition to new domestic and international routes presents a valuable opportunity for major airlines. Virgin Australia has partnered with Qatar Airways to expand its international routes between Australia and Doha from June 2025, with Qatar Airways operating the flights on the carrier’s behalf. Qantas’s plans to establish new international routes and expand seating availability on routes to various US cities and Pacific destinations will similarly provide consumers with an expanded flight network.

With this in mind, travel agencies could potentially see bumper booking numbers, supporting continued revenue growth over the next five years. IBISWorld projects revenue for the Travel Agency and Tour Arrangement Services industry to expand at an annualised 3.4% to $15.2 billion over this period. Travel from domestic and international tourists, as well as business customers are all set to expand.

The 2024-25 Federal Budget provided opportunities for the aviation sector, with an additional $40.0 million in funding announced to extend the Regional Airports Program and support regional flight connectivity. These infrastructure developments will provide a boost to firms reliant on domestic travel.

Final Word

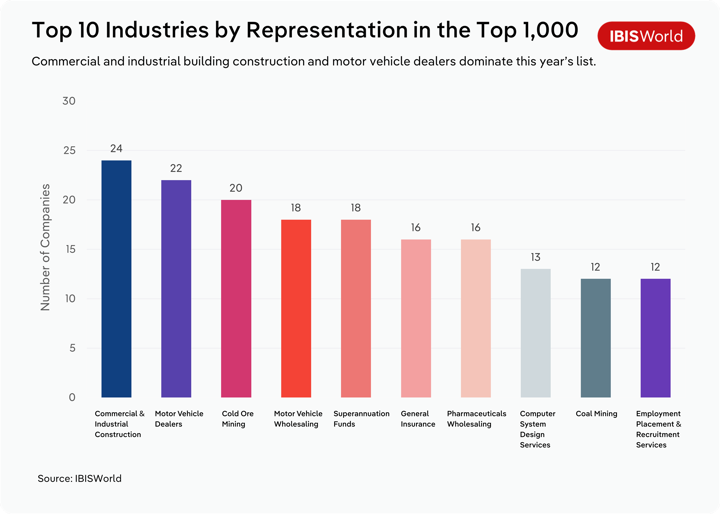

IBISWorld’s 2025 Top 1,000 list has seen overall growth in revenue from the previous year. The Commercial and Industrial Building Construction industry once again stood out with 26 companies represented in the Top 1,000. Among these, Mirvac Group (174th) shone the most, achieving 59.6% revenue growth from the previous year. While the majority of these companies demonstrated growth, many still slipped down the rankings.

Continual outstanding performances from general insurance firms, domestic airlines and banks have led the way in climbing the list, overtaking commercial and industrial builders. Motor vehicle dealers, motor vehicle wholesalers and gold ore miners also paved the way this year by once again displaying quite a turn out among the Top 1,000 companies.

With the RBA’s decision to cut the cash rate in February 2025 and the potential for further rate cuts during the year, the banks’ gross interest revenue may be limited. However, net margins are likely to improve as a result. Airlines and travel agencies are likely to see a further rise in bookings on the back of increased flight route connectivity and improved consumer spending power as interest rates come down.

Geopolitical conflicts in Europe and the Middle East will continue to influence oil and gas prices and disrupt various supply chains. In response to these issues, government measures aim to improve fuel security and limit the impacts of these global supply disruptions on Australian consumers’ hip pockets. While this is good news for consumers, this restricts oil and gas suppliers' revenue-earning capacity. As a result, they'll find it increasingly difficult to obtain capital from overseas to start new projects, in turn discouraging foreign customers from signing long-term supply deals.