Key Takeaways

- Risk-adjusted cross-selling allows lenders to diversify their portfolios into low-volatility sectors, decreasing exposure to high default rates and market volatility.

- To attain higher loan-to-value ratios and lower default rates, cross-sell choices should be guided by sector volatility, in addition to borrower-level evaluations.

- Stable margins, long-term contracts and essential demand in areas like waste management, facilities management and TIC services all contribute to strong financing and sustained development.

Cross-selling has traditionally been the preferred tool for deepening customer ties and boosting profitability. By offering additional products and services to existing borrowers, lenders can improve margins and strengthen client loyalty. However, in practice, many have pursued this strategy by targeting high-growth sectors like speculative real estate or technology start-ups, where short-term opportunities looked attractive.

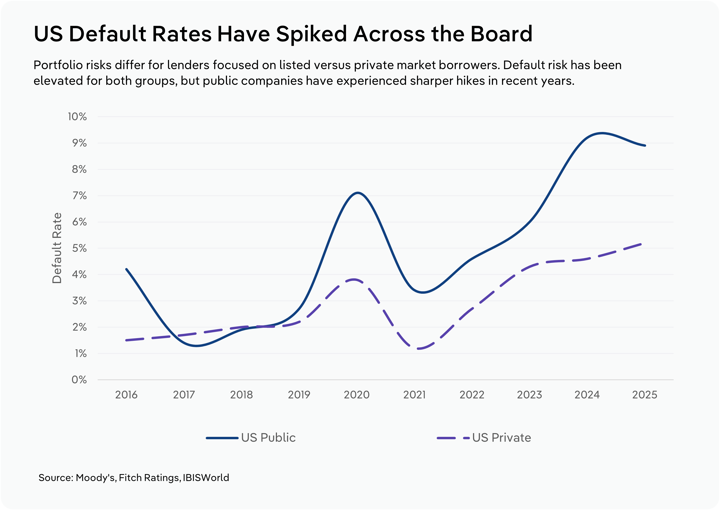

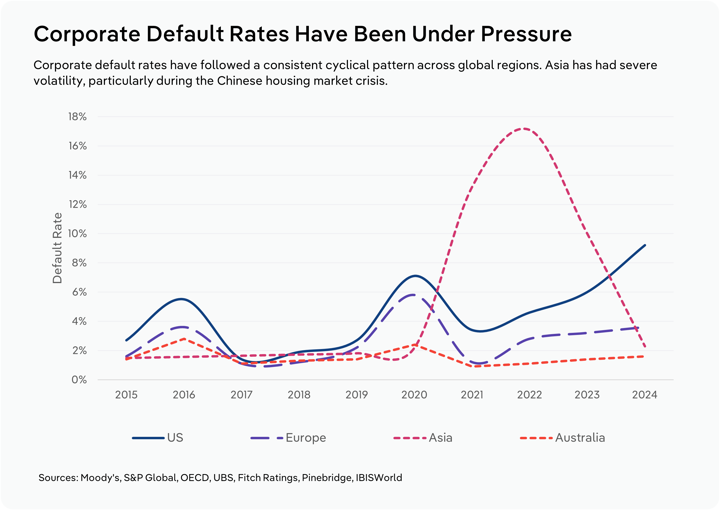

While this can generate quick gains, it comes with high risks. Volatile industries often face swings in demand, profitability and access to funding, leaving lenders vulnerable when conditions shift. When technology valuations and funding dried up in 2024 and early 2025, start-ups and tech clients that had previously acquired various overlapping loans, venture debts and credit products–frequently through cross-selling methods–faced significant cashflow issues. This resulted in a sharp hike in defaults and significant credit losses on lenders' balance sheets. Aggressive cross-sell strategies in unstable segments can lead to heightened defaults and increased regulatory scrutiny.

What’s emerging instead is a more disciplined approach: risk-adjusted cross-selling. This strategy recognizes that not all clients, or sectors, bring the same level of baseline risk. By considering not only borrower-level creditworthiness but also the inherent volatility of the sector they operate in, lenders can better balance growth and resilience.

The benefits extend beyond lower defaults. In an environment of rising interest rates and margin pressures, risk-adjusted cross-selling helps optimize the risk-return profile. Competing solely on loan pricing erodes profitability, but combining well-structured financing with complementary products in stable sectors can transform weak returns into sustainable, positive outcomes. Lenders that adopt this balanced approach aren’t just protecting their portfolios–they're also aligning with regulatory priorities that emphasize transparency, diversification and prudent risk management.

As 2025 unfolds with economic uncertainty still elevated, the most successful lenders will be those who strike the right balance, deepening relationships and driving revenue growth while anchoring that expansion in sectors that deliver resilience. By embedding sector-level volatility insights into cross-sell strategies, credit managers can unlock sustainable opportunities and safeguard long-term stability, ensuring that growth today doesn’t compromise resilience tomorrow.

Why volatility should shape cross-sell strategy

Risk-adjusted cross-selling uses sector stability, not simply customer connections, to reduce portfolio volatility and maximize long-term gains. Economic indicators are highlighting the risks of taking on clients in unpredictable, high-default sectors, placing lenders under pressure to balance expansion and resilience. Prudent, focused cross-sell tactics will not only produce higher profit but also meet changing regulatory standards for risk management and transparency.

The danger of the traditional cross-sell approach

Traditional cross-sell strategies tend to chase high-growth sectors, like speculative real estate or technology, in search of the biggest short-term returns. However, this comes at a cost: these sectors are often the most exposed to swings in revenue and profit margins and to macro shocks. When lenders expand aggressively into these areas, their overall portfolio becomes more volatile, putting capital at a greater risk and increasing the likelihood of loan losses when markets turn.

For example, in recent years, more commercial lenders have actively invested in high-growth technological start-ups, drawn by quick revenue growth and favorable interest rates. However, this comes with risks, as seen in the technology sector’s recent market correction. Technology sector borrowers that had leveraged easy access to credit through fintech lenders suffered severe cashflow problems as capital became more expensive and investor confidence waned. This concentration in a volatile area led to high credit losses and increased regulatory scrutiny, demonstrating that focusing primarily on fast-growing, high-volatility businesses without considering sector risk might jeopardize portfolio stability and long-term profitability.

The case for considering sector volatility in cross-selling

A balanced cross-sell strategy integrates both borrower-level credit assessments and an understanding of sector volatility. While evaluating an individual borrower’s financial health remains critical, recognizing the inherent stability or volatility of their industry adds a crucial layer of risk insight. In 2025, banks and lenders are increasingly cautious, preferring to partner with businesses operating in sectors characterized by solid demand and predictable cashflows, rather than to simply chase volume of deals.

Sectors like waste management and testing and inspection services have consistent income streams, stable margins and a prevalence of long-term contracts–factors that help reduce credit risk and improve lending outcomes. A focus on these sectors supports lower delinquency rates and stronger loan-to-value ratios. Major banks have also highlighted more stable performance across commercial lending portfolios with exposure to essential service industries, reinforcing the value of prioritizing resilient, low-volatility sectors in 2025.

Moreover, lenders are bolstering reserves in anticipation of potential credit deterioration, demonstrating that sustainable growth is increasingly linked to sound sector fundamentals rather than short-term volume gains. By combining borrower-specific analysis with sector-level insight, lenders position themselves to grow their portfolios more resiliently in uncertain economic times.

Signals of a low-volatility sector

Understanding which sectors truly deliver stability is essential to making risk-adjusted cross-selling work in practice. Not all “steady” industries behave the same when markets tighten, so lenders need clear benchmarks for identifying dependable borrowers. Certain signals help distinguish genuinely low-volatility sectors from those that only appear resilient in expansion periods.

Revenue and margin stability over time

One of the most dependable indicators of sector resilience is the capacity to generate consistent revenue while maintaining constant margins over time. Industries with modest year-on-year swings are less sensitive to abrupt demand shocks or cyclical downturns, making them more financially stable. For lenders, this implies that loan servicing may be linked to reliable income sources, lowering the risk of default even when macroeconomic conditions deteriorate.

Infrastructure continues to act as a stabilizing driver, sustaining steady growth throughout periods of stagflation, rising interest rates and consumer distress. As of May 2025, infrastructure asset prices have risen 5.28%, surpassing the wider market and providing clear evidence that enduring demand can overcome turbulence elsewhere. Stable businesses like these not only provide high returns but also serve as anchor assets for portfolio resilience when other sectors struggle.

High concentration of long-term contracts or recurring revenue models

Sectors that rely on multi-year contracts or recurring revenue streams automatically give higher assurance to lenders. Companies in these sectors create recurring cashflows that can be predicted with more confidence, minimizing susceptibility to unexpected fluctuations in client demand. Waste management and testing/certification groups, for example, benefit from long-term contracts with local governments and major enterprises. These contracts often lock in predictable income streams for years at a time, and they protect suppliers from unexpected cancellations even during economic downturns. For lenders, this regularity translates into structured payback plans that match receivables, minimizing credit risk and increasing profitability. Over time, a high concentration of long-term contracts strengthens financial stability and qualifies these businesses for risk-adjusted cross-selling techniques.

Low exposure to input price shocks or geopolitical risk

Another distinguishing feature of low-volatility sectors is their low reliance on global supply chains, commodity cycles or geopolitical concerns. Businesses that provide important domestic services, like local facility management, utilities or cleaning, have more predictable operating conditions since they're based on consistent internal demand. While these sectors are not without issues, their risks are mostly operational (staff shortages, process efficiency) rather than systemic shocks induced by volatile global markets. This characteristic provides a more consistent cash flow forecast, reducing their reliance on hedging tactics or emergency cost-passing measures when global prices fluctuate. Lenders profit directly from lower risk, since these sectors’ repayment performance is less influenced by extremely variable external circumstances, which provides a level of financial certainty even when broader markets are stressed.

Low-volatility sectors primed for cross-sell growth in 2025

When sector stability and financing demand intersect, cross-sell potential rises sharply. In 2025, a handful of industries stand out for their recurring revenues, contract-driven income, and essential service profiles, offering lenders low-risk pathways to deepen client relationships.

Waste management and environmental services

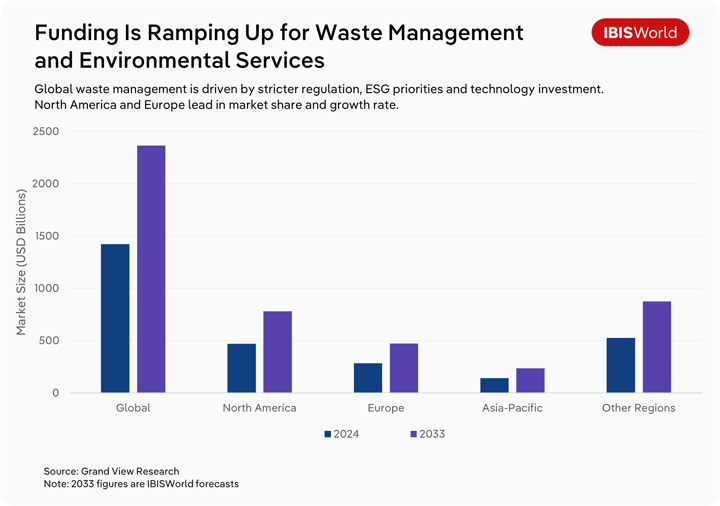

The waste management and environmental services sector has evolved as one of the most robust internationally, thanks to legal drivers, environmental obligations and the critical nature of the services it offers. Policy frameworks focusing on recycling, resource recovery and emissions reduction have increased demand in the United States and Europe.

In the United States, the Infrastructure initiatives and Jobs Act set aside US$275 million from 2022 to 2025 for recycling programs and circular economy initiatives. Similarly, the EU's Circular Economy Action Plan is pushing large-scale budget allocations for plastics recovery and improved sorting infrastructure, which is expected to boost long-term demand. Importantly, revenue streams are rooted in multi-year contracts with municipalities and corporations. Biffa's UK municipal contracts, for example, last 7 to 10 years, ensuring income stability across economic cycles. Technology adoption has also increased efficiency; AI-driven sorting and ‘smart bin’ deployments are spreading throughout the United States and Europe, keeping operational costs predictable.

This background supports huge worldwide funding demand. The World Bank expects that worldwide trash volumes will skyrocket 73% to 3.88 billion tonnes per year by 2050, while PwC predicts that Australia requires AU$3.5 billion to AU$4.2 billion in investment in waste processing facilities. Family-owned SMEs continue to account for more than 60% of operators in advanced economies, but huge infrastructure funds and integrated utilities are also seeking acquisitions and regional expansions, broadening the funding mix.

Borrower needs and cross-sell opportunities

- Infrastructure loans for new recycling, waste-to-energy and materials recovery facilities

- Equipment financing for collection fleets and AI-enabled sorting plants

- Green/sustainability-linked credit tied to recycling tonnage or emission reduction KPIs

- Working capital facilities for SMEs ramping up contracts or seasonal waste fluctuations

- Advisory and consulting services linked to compliance and sustainability reporting, increasing attractiveness to investors

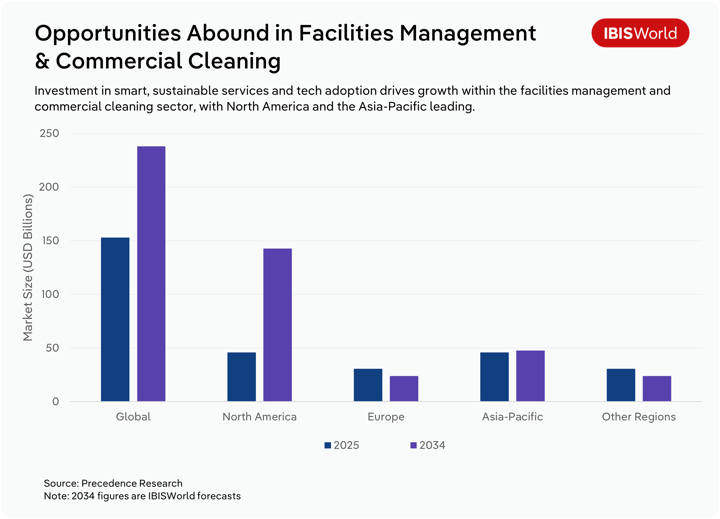

Facilities management & commercial cleaning

Facilities management (FM) has been notably countercyclical, with demand remaining steady globally despite macroeconomic turbulence. Contracted cleaning and maintenance aren’t optional, as buildings must maintain hygiene, safety and energy standards regardless of GDP growth. Since the pandemic, facilities management has benefited from a boost in safety-conscious demand. Contract bundling, which refers to integrated solutions encompassing cleaning, security, HVAC and sustainability metrics, has also increased profit, with most commercial FM contracts lasting three to five years and ensuring consistent income.

Global facilities management providers like ISS, Compass Group and ABM Industries are investing extensively in automation, IoT-enabled monitoring and 'green cleaning' solutions, which need capital expenditures and continuing finance. Small-to-medium enterprises (SMEs) continue to dominate most of the vendor landscape, notably in Europe and the United States, and frequently require funding to compete for bigger packaged contracts. For lenders, this sector offers low volatility, recurrent cashflows and asset-backed lending options, making it ideal for structured cross-sell products.

Borrower needs and cross-sell opportunities

- Operational leases for equipment (cleaning machinery, IoT, HVAC), spreading costs over contract life cycles

- Working capital facilities for staffing at contract ramp-up stages and smoothing seasonal variations

- Green loans tied to carbon reduction or energy performance contracts

- Invoice and receivables financing to bridge long payment cycles on bundled contracts

- Industry-specific insurance and risk advisory packages bundled with lending

Testing, inspection & certification (TIC) services

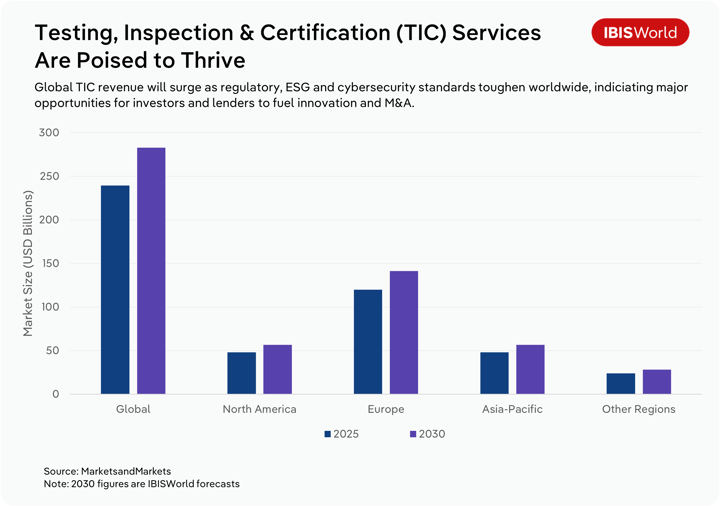

The TIC services sector has one of the most stable demand profiles since regulatory, safety and compliance testing is necessary in all major economies, independent of market cycles. The worldwide TIC market is expected to increase from US$232 billion in 2024 to US$282 billion in 2030, at a 3.4 CAGR, indicating both regulatory growth and new areas of complexity. Recent ESG disclosure laws, cybersecurity assessments and food safety requirements in the United States and the European Union (EU) are opening new business opportunities for TIC providers. For example, the EU's Corporate Sustainability Reporting Directive (CSRD) is boosting demand for ESG certification services in 2025. Similarly, in the United States, OSHA and FDA rules continue to drive consistent testing standards in manufacturing, medicines and energy.

Revenue from TIC services is supported by recurrent contracts, inspections and certifications that occur on a rolling basis, frequently multiple times each year, resulting in consistent income even during downturns. Digitalisation and AI-enabled inspection methods are increasing throughput and cost efficiency, necessitating a new wave of capital investment from both major multinationals (e.g. SGS, Bureau Veritas, Intertek) and mid-market laboratories seeking to modernize technology stacks. From a lending viewpoint, this produces persistent demand for asset finance, technology loans and consulting services, all from a sector where default risk is significantly low owing to regulatory requirements.

Borrower needs and cross-sell opportunities

- Structured term loans for AI and digital testing platforms

- Leasing/financing of lab equipment and mobile testing facilities

- Working capital lines for onboarding new regulatory contracts

- Advisory/consulting packages on compliance and reporting, integrated with credit facilities

- Client education initiatives that deepen relationships while helping borrowers anticipate regulatory change

Final Word

Credit and relationship managers wanting resilient portfolio growth in 2025 shouldn’t rely exclusively on current sector stability. Instead, they should implement constant monitoring, adaptive credit rules and data-driven decision-making. The fundamentals of waste management, facilities management and testing/certification show why lending to low-volatility sectors with stable margins, recurring contract revenue and critical demand decreases portfolio volatility and promotes reduced default rates.

Importantly, low-volatility sectors aren’t low-growth; they have historically demonstrated good, consistent long-term performances and, as of 2025, have even outperformed more volatile, high-beta sectors during times of market stress. This resilience demonstrates how investing in low-volatility sectors may provide dynamic growth while also insulating portfolios from significant fluctuations in value and risk.