Competitive intelligence, also known as corporate intelligence, refers to the ability to collect, analyse and utilise information and data collected on competitors, customers, competitive environment and other market factors that can contribute to a business’s competitive advantage. This information can be used in order to develop efficient, effective and strategic business practices to widen a company’s competitive advantage.

Competitive intelligence is important to businesses as it allows them to better understand the competitive landscape in which they operate and be more aware of the potential opportunities and threats that may arise at a sector, industry or market level. Conducting competitive intelligence should not be seen as a bonus, it should be seen as an essential tool to aid the formation of business strategies.

How does competitive intelligence work?

Competitive intelligence works by collecting and analysing ethically sourced, actionable data and information and using this data to construct a detailed image of the marketplace in order to pre-emptively prepare and respond to challenges before they arise.

Competitive intelligence is essentially a deep dive exercise whereby businesses uncover information about all of the fine points regarding the industry in which they operate, the industry’s and competitors’ customers and products and the business plans and strategies of competitors, among other things.

In order to efficiently conduct a competitive intelligence analysis, a business must set objectives for what they want to learn from the exercise. A clear objective will enable researchers to focus on specific data sources that best satisfy the needs of the task. A clearer task or objective will also allow the research team to devise a more detailed and effective plan.

Once a key goal or objective has been decided upon, information and data collection strategies must be determined. Data collection strategies help the research team stay within the scope of the project.

Now the data can be compiled and analysed. Data should be collected at an industry and company level. This allows researchers to compare their own business with their competitors in relation to the overall industry and can give a more detailed picture of how both fit into the marketplace.

Without an understanding of the industry’s context, it may be more difficult to identify strengths, weaknesses, opportunities and threats. The collection and analysis of data is often the most time-consuming aspect of a competitor analysis, but IBISWorld’s Industry Reports are here to help.

Our reports contain detailed information at an industry level, including information on the direction of the industry, products and markets, operating conditions, the industry’s competitive landscape, the major companies operating within the industry and additional information such as financial ratios and ESG risk scores.

Once the analysis is complete, themes and insights from the data are relayed to key stakeholders. Depending on who the information is being given to, the method of delivery may differ. For instance, a sales team may benefit more from battle cards, whereas management may prefer a more detailed report. It is important to collaborate with the teams beforehand to determine the most effective way to communicate the findings of the analysis.

These findings will allow a business to gain a competitive advantage, synthesise and implement more efficient and informed business strategies in order to better differentiate themselves and closer align to customer needs and expectations.

Potential factors to analyse

1. Products

A product is an item offered for sale and can be in a physical, virtual or cyber form. Conducting a competitive product analysis can be done by using a competitor’s website, sales brochure and even going over annual reports. This can allow you to gain an insight into their pricing strategy and allow you to understand how well they are performing in comparison to your own business.

When analysing a competitor’s product, key points to look out for are:

- The key features of the product

- The perks associated or included with the product

- The technology the product uses

- How the product is priced and how this compares to other products within the marketplace

It can also be useful to unearth which products and services are most popular within your target industry – this may uncover a potential gap in the market.

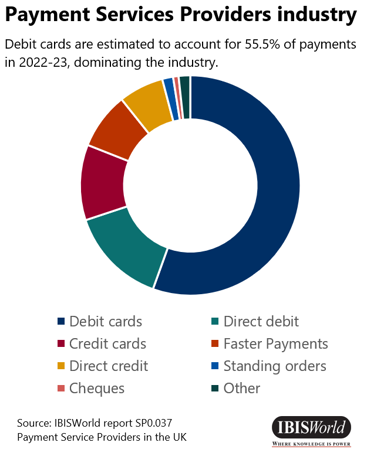

For example, the Payment Service Providers industry’s most popular product is debit cards, with most payments accounted for by discretionary consumer payments.

This information, combined with the low level of market share concentration within the industry, indicates that there may be potential opportunities for new entrants and the target market is likely to be consumers.

2.Customers

A customer is a person who will purchase goods or services from a business. Understanding the target market within your industry and of your competitors can be used to form strategic plans and make decisions on a number of aspects, including product development, marketing and pricing. However, knowing who your customers are is only part of the story.

One metric that customers can offer is Share of Voice. This is the volume of mentions competitors get on the internet and social media platforms, which can be compared with your own and other companies. It is also important to use this tool to gather insight into the sentiment of these mentions, as it is unlikely that all mentions will be positive. This can give you insight into your competitors and their products.

It’s also important to understand the locations of customers within the industry, as this may highlight where high levels of market saturation exist and give insight into where untapped markets may exist or where the most demand for your product may be.

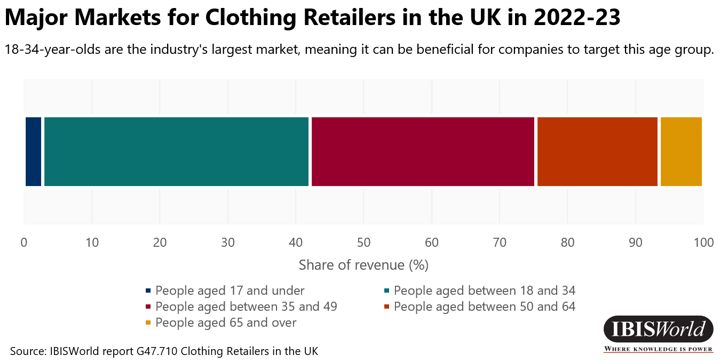

For instance, the Clothing Retailing industry’s largest market is currently consumers aged between 18 and 34, with women’s clothing being the most popular product type.

In conjunction with the low level of market share concentration within the industry, it could be inferred that a company wishing to expand their market share could increase their marketing presence within this age group to expand sales of women’s clothing.

3.Competitors

Competitors are other businesses that offer similar goods and services to the customers within your industry. Competitors can be differentiated into direct and indirect competitors. Direct competitors offer products that could be regarded as alike to your own and usually operate in a similar geographic region to you. Indirect competitors provide different products to your own, but could satisfy the same customers need.

When analysing competitors, important factors to uncover are:

- Their market share (which may be included in the Major Companies chapter of IBISWorld’s Industry Research Reports)

- The products and services they offer

- The strategies and tactics they use

- Their financial results

- How they price their products

- The technology they

- Who their target market is

Furthermore, a SWOT analysis can be used within a competitive intelligence analysis to evaluate each component of a competitor’s business to identify any strengths, weaknesses, opportunities and threats. IBISWorld reports include a key threat and opportunity for each industry, as well as industry-level financial ratios, which can be used to assess how a competitor compares with the market as a whole and how they may be at risk given market conditions.

4. Industry

An industry refers to the primary activities a business or group of businesses. It is important to understand and analyse the specific industry or market in which you are operating, as the threats and opportunities present differ between industries.

IBISWorld reports give an insight into the context of an industry. For example, the Products & Markets section give insight on:

- What products and services are offered by the industry

- Which products and services are the most popular

- What markets are targeted by the industry

- Which markets are the most popular

- Where businesses with the industry are located

- The importance of international trade within the industry

- Which factors influence demand for the industry’s products or services

Why is industry context important?

IBISWorld’s Industry Research Reports are designed to give readers actionable data and analysis to assist in conducting a competitive intelligence, as many metrics required are readily available. For example, our reports include a range of financial ratios which can be used to track the performance and give an insight into potential opportunities or threats that the industry faces. These can also be used to make comparative judgements on competitors to identify whether a business is performing above or below the overall industry.

IBISWorld reports include liquidity ratios, coverage ratios, leverage ratios, and operating ratios, as well as information detailing industry assets, liabilities and equity.

These financial ratios can be used to conduct a profitability analysis, which can be used within a competitive intelligence. It is best to compare the industry-level ratios with an individual company’s ratios to assess whether a business is under- or overperforming compared to the industry average. The reports also contain analysis of ESG at an industry level and can help give an insight to how and where businesses in a particular industry may be able to strengthen their ESG policies.

The first chapter of IBISWorld reports, Industry Performance, details how the industry has performed over the past five years and how it is expected to fare over the next five years. This is done by using data from high-quality and reliable sources to give an insight into how wider market conditions have affected the industry, to what extent and how they or other factors may continue to have a bearing on the direction of the industry in the future.

The Products & Markets chapter of IBISWorld reports details the products or services the industry offers and their popularity, the industry’s key markets and their contribution to overall revenue, what factors influence demand for the industry, how much international trade the industry partakes in and its key trading partners and where businesses within the industry are located. This allows readers to quickly dissect key product and customer information, which can be used to compare a business’ products and target market to that of the overall industry, as well as to give an insight into what areas of the business may be saturated or where opportunities may be present.

The Competitive Landscape chapter give an overview of the wider industry conditions, including the level of market share concentration, the level of competition, potential barriers to entry, globalisation and the cost structure of the industry. The cost structure includes analysis of the industry’s average operating margin, wages, purchases and depreciation costs. This information can be used as a benchmark to assess the potential risks or opportunities for a business to enter a new market or how protected existing operators may be from new entrants.

The Major Companies chapter can aid in competitor analysis as the industry-relevant operations of large competitors is discussed. Forecasts on their market share are also given in connection with an analysis of the players performance over the past five years. This can help researchers to identify weaknesses or strengths in competitors.

For more information on any of the UK’s 500+ industries, log on to www.ibisworld.com, or follow IBISWorld on LinkedIn and IBISWorldUK on Twitter.