Key Takeaways

- Professional services are lifting output without expanding headcount through AI and smarter workflows.

- Tech productivity is rising even as hiring slows, with AI enabling leaner, faster teams.

- Mining faces workforce bottlenecks, but long-term demand and sustainability advantages support strategic investment.

Across markets, decision-makers are contending with shrinking talent pools, ageing populations and rising wage pressure. For some sectors, these constraints have stalled delivery and squeezed margins. As workforce gaps persist across sectors and regions, decision-makers face new challenges in scaling operations and delivering returns. Even in high-demand industries, execution risk is rising as talent shortages stretch project timelines, inflate costs and limit capacity.

But others are adapting… and growing.

Continue reading to explore three sectors still finding momentum amid tight labor conditions:

- Professional services, where AI and workflow redesign are driving efficiency.

- Information and technology, where demand is rising even as headcounts hold steady.

- Mining, where automation and long-term demand are supporting scalable output.

Each offers a different blueprint for achieving more with less. For leaders looking to direct investment, realign priorities or futureproof their strategy, these sectors offer not just resilience, but opportunity.

Professional services: Lifting output through smarter workflows

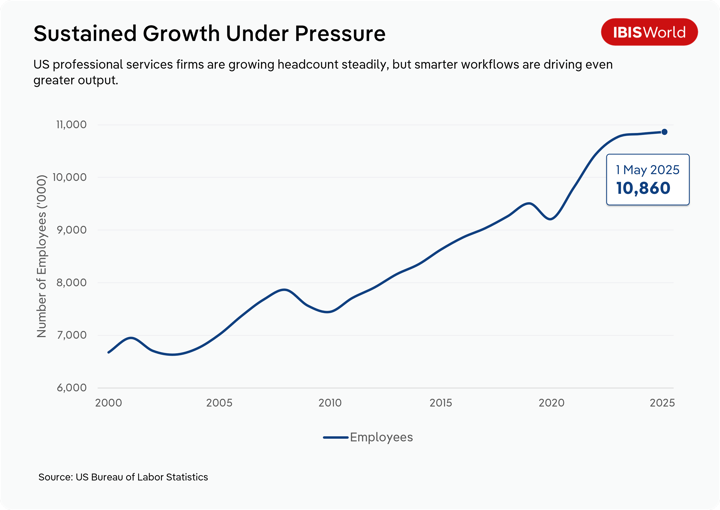

Professional service firms aren’t aggressively scaling headcount, but they are scaling output more efficiently. Across multiple markets, this sector is adapting to workforce pressure through smarter work design, modest automation and targeted upskilling. Rather than overhauling roles or cutting jobs, firms are improving how work gets done. The result is cost-efficient delivery in a sector where quality and expertise remain non-negotiable.

The US

Professional service firms are using AI to streamline internal tasks, not slash headcount. From legal services to consulting and research, the sector has integrated AI into functions like internal support, admin and information retrieval. At companies like Palo Alto Networks, AI now handles a large share of internal queries, freeing up staff to take on more strategic work. Instead of disrupting jobs, AI is relocating capacity, helping firms control costs and improve responsiveness.

Still, broader economic conditions remain the key driver of job growth or contraction. This suggests professional services firms are absorbing new tools without relying on workforce expansion.

Australia

Professional, scientific and technical services are forecast to be one of the top contributors to employment growth over the next decade. The challenge, however, is that they’re growing from a position of existing labor strain. As the economy continues shifting toward knowledge and service sectors, this industry’s ability to scale will depend on how well it can optimize roles and workflows, not just hire more people. Structural shortages and a tight talent pipeline mean firms will need to rethink how work gets done.

The UK

Productivity in professional services is being lifted by an increasingly qualified workforce. Degree holders are more likely to find work in high-skill sectors like consulting, law and finance – particularly in talent-dense regions like London and the South East. But that centralization is also deepening labor divides. Outside major cities, persistent skills gaps and lower access to training and limiting how far professional services firms can scale.

Why this sector delivers scalable efficiency gains

Efficiency gains are compounding, not peaking

Process improvements, automation and AI aren’t future ambitions, they’re already reducing cost-to-serve in key workflows. From internal support to client onboarding, firms are freeing up senior staff to focus on higher-value work. These gains are not tied to headcount growth, making them sustainable even in a tight labor market.

Labor costs are stabilizing relative to revenue potential

Professional services firms have more flexibility to absorb wage pressure than sectors with fixed pricing or regulated revenue. Their pricing power, project-based billing and low capital intensity help protect margins, especially as firms refocus resources on scalable, high-return work.

Demand for high-skill services is still rising

From advisory and legal to research and consulting, demand for specialized knowledge remains strong across markets. Skilled talent may be limited, but client need isn’t slowing, and firms that optimize their workflows can take on more without expanding headcount.

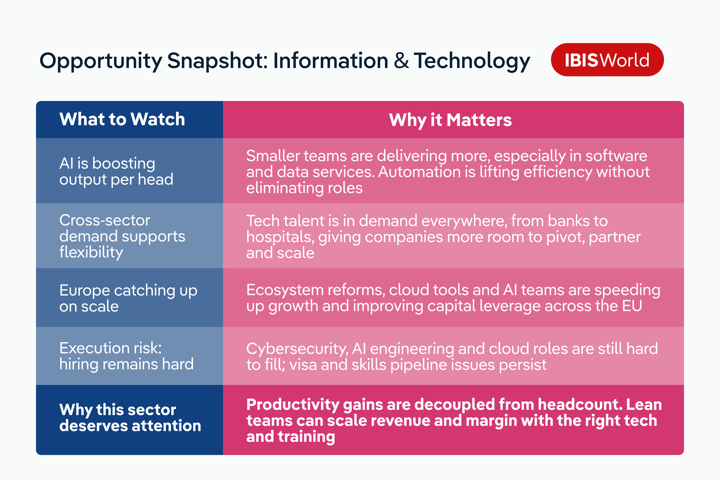

Information and Technology: Scaling with leaner, faster teams

Despite recent layoffs in some sub-sectors and intense hiring competition, the information and technology sector continues to offer a compelling long-term growth story. AI adoption is helping professionals scale their impact, digital skills remain in high demand across industries and productivity gains are outpacing headcount growth in key technical functions.

The US

Employment in the information sector has declined since the second half of 2022, but not all losses are due to automation. Over-hiring during the pandemic, rising interest rates and new tax rules (notably the 2022 IRS Section 174 amendment requiring amortization of software R&D costs) have led to workforce reductions, particularly in Software Publishing and Web Search Portals.

AI tools like Claude are already reshaping how developers work. Although computer and mathematical occupations make up just 3.4% of the US workforce, they account for 37.2% of Claude interactions. Within Claude Code, 79% of prompts involve full automation while 21% support human-AI collaboration. However, engineers remain essential. AI-generated code can lack business context or introduce security flaws, requiring human oversight and validation.

Despite these changes, the Bureau of Labor Statistics still expects strong job growth in tech. Roles like software developers and database architects are likely to benefit as AI tools make digital products cheaper to build and easier to scale.

The UK

The UK’s tech workforce accounts for 5.4% of total employment, but demand still outpaces supply. Roles in AI engineering, cybersecurity, cloud infrastructure and data science are among the hardest to fill, and 18% of adults don’t meet the digital skill requirements employers expect.

Brexit has narrowed the recruitment pipeline from Europe, while the high cost of skilled worker visas discourages some employers from sponsoring international hires. These shortages are already slowing digital transformation in the public sector and healthcare, where IT capability gaps are a key barrier to modernization.

The tech sector also skews young and male, with only 29% of professionals identifying as women. While diversity is improving at entry-level and in non-technical roles, senior tech positions remain less representative. Still, the younger workforce provides a strong foundation for future capability.

Europe

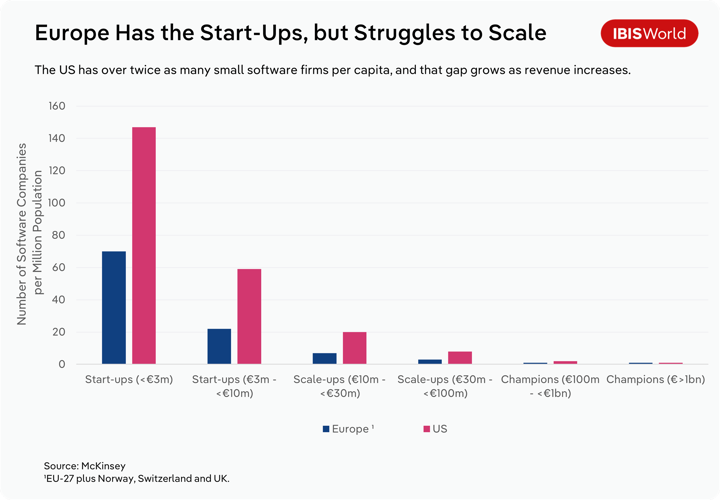

Europe’s tech sector as well, is gaining momentum, with thousands of early-stage firms emerging across the region. But far fewer scale to higher revenue tiers compared to the US.

Across the EU, the ICT sector contributed over €791 billion in 2022, which equates to 5.5% of the region’s gross value added. The number of European software firms generating €100 million or more in annual revenue has increased fivefold in the last ten years, with innovation clusters emerging across major cities.

However, scaling remains a hurdle. European software start-ups that reach €100 million in revenue take around five years longer on average than US counterparts, and the pipeline narrows significantly beyond the €10 million mark. Fragmented markets, slower capital flow at later stages and a more conservative corporate culture are key constraints.

That said, ecosystem reforms and AI advances are starting to reduce these barriers. Recent tax and data sovereignty changes, cloud adoption and the rise of small, AI-enabled teams are creating new efficiencies and helping start-ups expand faster across borders.

Why this sector is poised or high-margin, cross-sector growth

It delivers output gains without linear headcount growth

AI tools are already reshaping how software engineers work, automating repetitive tasks and increasing delivery speed. This allows companies to do more with leaner teams, especially in high-margin areas like software publishing and data services.

Digital skills are transferable across industries

From healthcare to finance to government, almost every sector now competes for tech talent. This cross-sector demand gives tech businesses room to expand into new client bases, product lines or verticals, even when hiring is constrained.

Smaller AI-enabled teams are unlocking scale across borders

Cloud adoption, tax reforms and AI tools are making it easier for lean teams to scale faster, especially in Europe. This shift reduces barriers to cross-border expansion and improves operating leverage, even in fragmented markets.

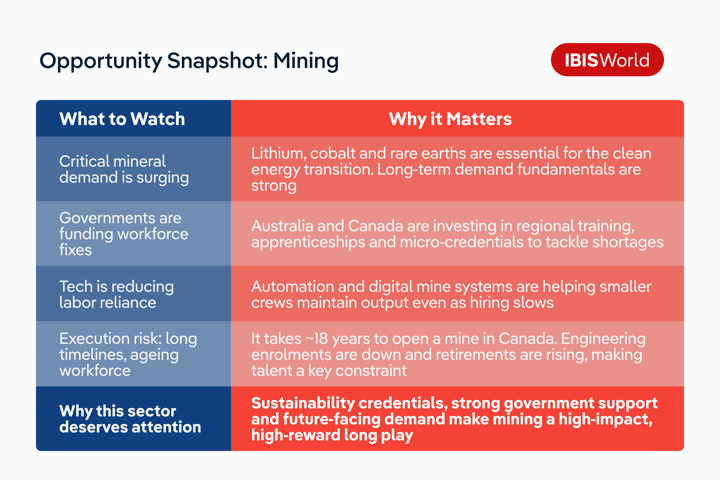

Mining: Building long-term value amid workforce gaps

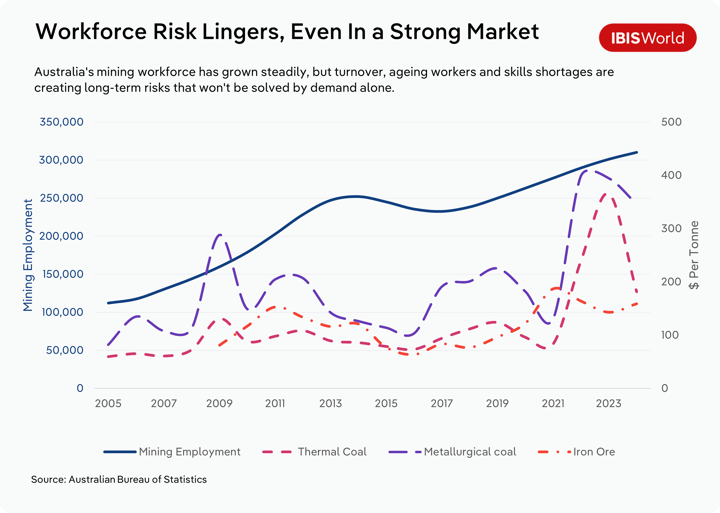

Mining remains a cornerstone of long-term growth in resource-rich economies, especially as the global shift toward cleaner energy increases demand for critical minerals. But from Australia to Canada, labor shortages and long project timelines are making it harder to scale operations fast enough to meet this demand.

Australia

Labor shortages are affecting both skilled and entry-level roles, especially in remote regions and technical functions like automation and environmental management. The overall vacancy rate reached 5% in 2024, contributing to rising costs and wage pressure.

High turnover from fly-in, fly-out (FIFO) arrangements and lifestyle trade-offs are reducing workforce continuity, particularly among younger workers. At the same time, a drop in mining engineering enrolments and growing environmental concerns are narrowing the talent pipeline just as many in the current workforce near retirement.

Despite these headwinds, momentum is building. The Critical Minerals Workforce Development Initiative is expanding access to micro-credentials, apprenticeships and regional job opportunities—targeting 90,000 mining roles by 2040. With lithium and cobalt vital to achieving net-zero, the sector’s relevance is likely to grow, not fade.

Canada

Canada is also positioning itself as a critical minerals leader, but labor constraints and investment gaps are slowing progress. The country’s mining sector already employs around 200,000 people directly and 100,000 indirectly, with operations spanning over 100 countries and a combined market capitalization of C$520 billion. But the talent pipeline isn’t keeping pace.

Two-thirds of young Canadians say they wouldn’t consider a mining career, contributing to a shortfall of 10,000 workers at a time when demand is surging. Meeting domestic demand alone could require the value of critical mineral production to double by 2040 (from $8 billion to $16 billion) but current investment levels fall short.

Canada is also planning 15 new mines and 19 processing facilities to meet the needs of its growing EV battery manufacturing sector, but delivery could stall amid labor gaps and permitting timelines that average 18 years. Insufficient workforce development risks pushing timelines even further.

At the same time, more than a third of active priority mineral projects are located near protected areas or Indigenous lands, reinforcing the importance of respectful engagement, environmental stewardship and inclusive development.

Canada does have an edge in sustainability. Its mines are around 68% less emissions-intensive than the global average, which is an increasingly valuable advantage as investors weigh climate risks. But converting potential into performance will require faster progress on workforce planning, capital mobilization and regulatory efficiency.

Why this sector underpins long-term clean energy

It's essential to global energy goals

Demand for lithium, cobalt and other critical minerals is rising fast as economies move toward net-zero. Countries like Australia and Canada are key suppliers, and scaling mining operations is crucial to meeting energy transition targets. Despite current labor shortages, long-term demand fundamentals remain strong.

Governments are building talent pipelines to support growth

In both Australia and Canada, workforce development is emerging as a strategic priority. Targeted investments in apprenticeships, micro-credentials and job pathways are beginning to address gaps in technical functions like automation and environmental management, offering scalable solutions for a more resilience mining workforce.

Technology and sustainability advantages can drive competitive edge

Digital mine systems, autonomous equipment and emissions-efficient operations are lifting productivity and appeal to climate-conscious investors. As mentioned, Canada's mines are less emissions-intensive than the global average, while growing tech adoption in both countries is helping leaner teams lift output.

Final Word

For decision-makers navigating workforce shortages, growth is still possible, but it looks different. These sectors show that scaling is increasingly about strategy, not size. Whether through AI, workflow design or sustainability-led innovation, the future belongs to organizations that can align capability with demand.