IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

The Geophysical Service industry in Canada's dependence on commodity prices has produced volatility as resource exploration has waxed and waned. Contracting new geophysical surveys depends heavily on the oil, natural gas and mining sectors, which are sensitive to commodity price fluctuations. In 2020, the pandemic caused a sharp drop in global energy prices, reducing demand for geophysical services. The industry rebounded from 2021 through 2023 as oil prices rose, but revenue has dipped since as industrial production has once more declined. Although industry revenue is forecast to decline 5.9% to $916.7 in 2025, geophysical services revenue is higher today than five years prior. Despite the instability of downstream markets, industry revenue is projected to increase at a CAGR of 2.5% from 2020 to 2025. Exploration capital has shifted toward lithium, nickel, copper and uranium because of the need for transition metals in batteries, electric vehicles and renewable energy technologies, driving survey design and method choices. According to Natural Resources Canada, companies intend to allocate $4.2 billion toward transition metal exploration in 2025. Quebec has dominated lithium and nickel corridors using magnetic and hyperspectral datasets, while Saskatchewan’s Athabasca Basin has emphasized resistivity and gravity methods. Geophysical service providers are bundling acquisition, interpretation and cloud delivery as a result, scaling airborne coverage to accelerate drill-ready project timelines.Global energy and mineral prices are expected to contract moderately in the coming years, which will limit spending on new resource exploration. Industry revenue is thus forecast to decline at a CAGR of 2.2% to $821.1 million through 2030. However, geophysical services providers look beyond oil cycles, pivoting toward public works like new-energy data for wind and carbon storage, where geospatial and subsurface inputs tie to long-dated programs. Companies will also respond by shifting toward services that generate stable revenue in lean cycles like multi-client data access, AI-assisted reprocessing and integrated offerings.

Answer any industry question in minutes with our entire database at your fingertips.

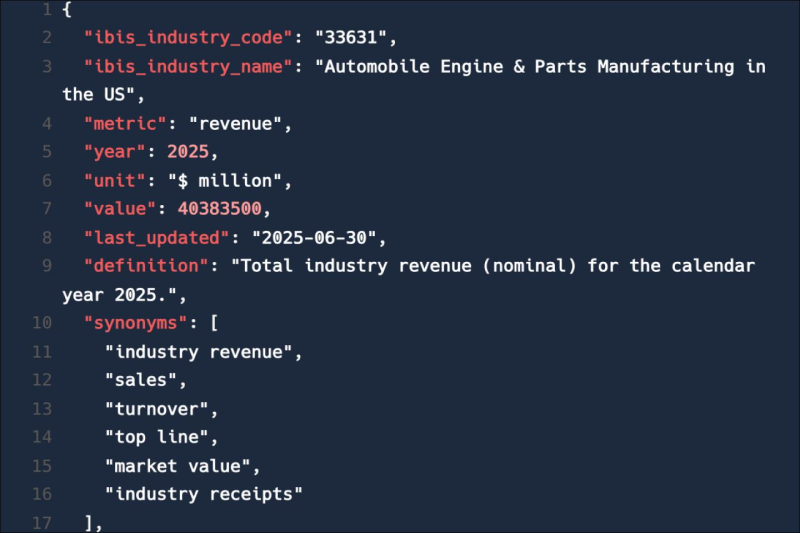

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Geophysical Services industry in Canada includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released September 2025.

The Geophysical Services industry in Canada operates under the NAICS industry code 54136CA. Operators in the Canadian Geophysical Services industry gather, interpret and map geophysical data. They often specialize in locating and measuring the extent of subsurface resources, such as oil, gas and minerals, but may also conduct surveys for engineering purposes. Operators use a variety of surveying techniques depending on the purpose of the survey, including magnetic surveys, gravity surveys, seismic surveys or electrical and electromagnetic surveys. Related terms covered in the Geophysical Services industry in Canada include geophysical survey, seismic survey and survey crew.

Products and services covered in Geophysical Services industry in Canada include Geophysical data sales, Geophysical data collection and Integrated geophysical services.

Companies covered in the Geophysical Services industry in Canada include Stantec, Schlumberger and Viridien.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Geophysical Services industry in Canada.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed products and service segmentation and analysis of major markets for the for the Geophysical Services industry in Canada.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Geophysical Services industry in Canada.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Geophysical Services industry in Canada. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Geophysical Services industry in Canada. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Geophysical Services industry in Canada. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Geophysical Services industry in Canada. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Geophysical Services industry in Canada.

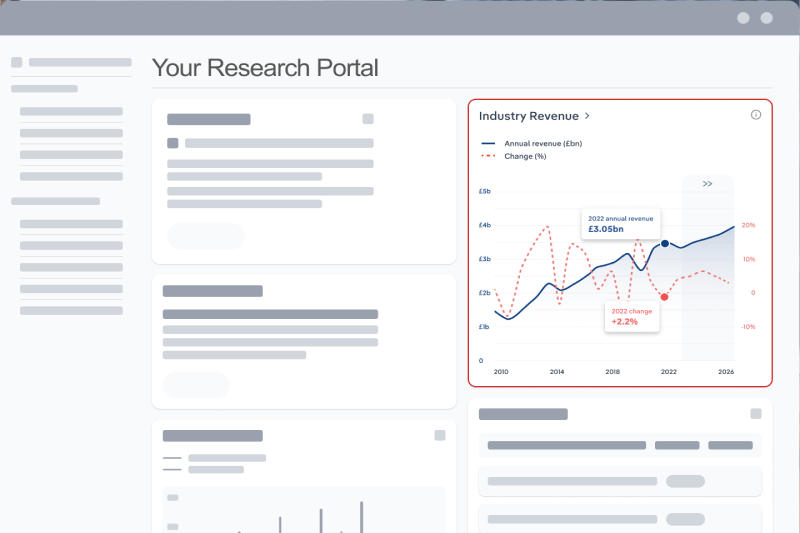

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

The market size of the Geophysical Services industry in Canada is $916.7m in 2026.

There are 1,095 businesses in the Geophysical Services industry in Canada, which has declined at a CAGR of 2.0 % between 2020 and 2025.

The Geophysical Services industry in Canada is unlikely to be materially impacted by import tariffs with imports accounting for a low share of industry revenue.

The Geophysical Services industry in Canada is unlikely to be materially impacted by export tariffs with exports accounting for a low share of industry revenue.

The market size of the Geophysical Services industry in Canada has been growing at a CAGR of 2.5 % between 2020 and 2025.

Over the next five years, the Geophysical Services industry in Canada is expected to decline.

The biggest companies operating in the Geophysical Services industry in Canada are Stantec, Schlumberger and Viridien

Geophysical surveying and mapping of subsurface terrain or formations and Identifying subsurface fault lines and mineral deposits are part of the Geophysical Services industry in Canada.

The company holding the most market share in the Geophysical Services industry in Canada is Stantec.

The level of competition is high and increasing in the Geophysical Services industry in Canada.