IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

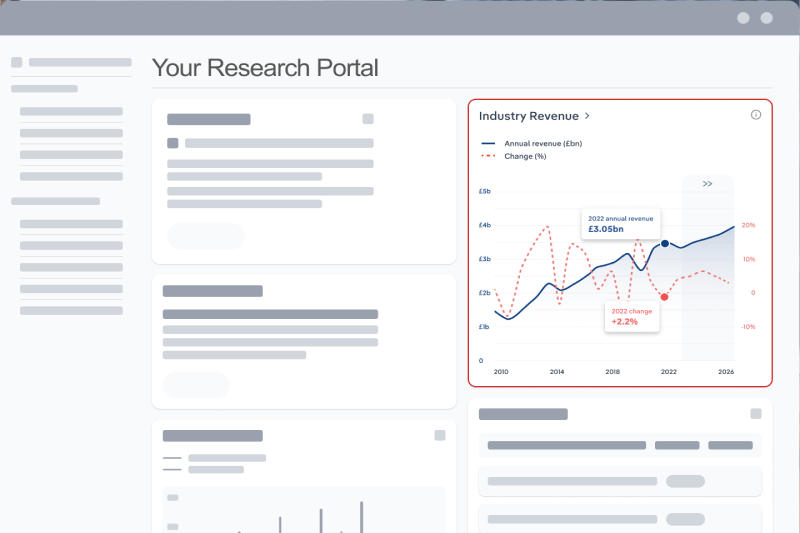

Over the five years through 2025, industry revenue is expected to drop at a compound annual rate of 5.8%. Specialist food retailers in the UK have endured a turbulent period marked by soaring costs, fragile consumer confidence, and intensifying competition. Supermarkets and discounters intensified pressure, expanding private label ranges into premium and organic lines. In response, specialists leaned on differentiation through provenance, artisanal quality, sustainability, and closer community ties, with many embracing digital tools, home delivery, and loyalty initiatives. Evolving consumer habits also spurred adoption of grocery-plus models, blending retail and food service to deliver ready-to-eat, health-focused, and locally sourced meals—an increasingly important lever of resilience and growth.Operating expenses rose sharply due to surging ingredient, feed, energy, and labour costs, squeezing margins even as food inflation eased from an EU peak of 19.3% in 2023 to 3.1% by mid-2025. Stubborn input costs and stagnant household budgets kept value top of mind for consumers, with over a third of UK shoppers still cutting back on groceries. Labour costs climbed with minimum wage hikes and tight labour markets, challenging a sector reliant on personal service and skilled staff. Independents often turned to flexible or family labour, while larger chains absorbed premium wage pressures. Energy shocks in 2022 pushed many small shops to the brink, with government relief proving vital. In 2025, revenue is expected to dip by 4.7% to €99.5 billion, while profit is anticipated to absorb 8.7% of revenue. Over the five years through 2030, revenue is expected to dip at a compound annual growth rate of 1.5% reaching €92.2 billion, while profit is anticipated to remain under pressure from intense competition reaching 7.2% of revenue. Specialist food retailers face a complex future shaped by labour pressures, intensifying competition, and shifting consumer values. Persistent labour shortages and rising wages will remain a defining challenge, with larger chains turning to automation to offset costs, while smaller shops balance authenticity with cautious digital adoption, wary of undermining their artisanal identity. Competitive pressure will sharpen as supermarkets expand premium private labels and capture more foot traffic through scale and strategic locations. To stand out, specialist retailers must lean into differentiation, offering experiences such as tastings, workshops and masterclasses, alongside stronger storytelling and digital engagement. Consumer behaviour will reinforce opportunities for specialists. Health, sustainability and premiumisation are driving demand for fresh, ethically sourced and high-quality food. Younger shoppers, in particular, expect traceability and are willing to pay premiums for welfare-friendly, clean-label products.

Answer any industry question in minutes with our entire database at your fingertips.

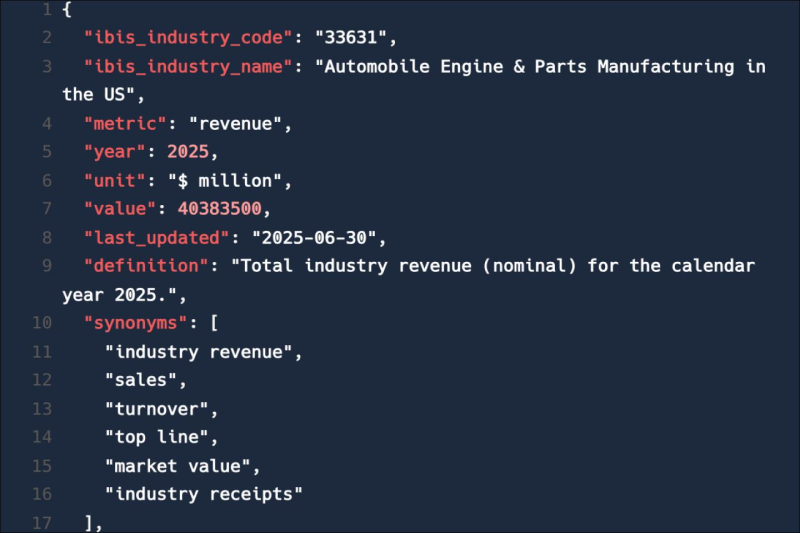

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Food Retailing industry in Cyprus includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released September 2025.

The Food Retailing industry in Cyprus operates under the industry code CY-G4721. This industry consists of food retailers, which may sell fruit, vegetable, meat, fish and bakery products. This industry excludes the retail sale of food by mass retailers such as supermarkets and department stores. Related terms covered in the Food Retailing industry in Cyprus include crustaceans, cultivated meat , organic food and confectionery.

Products and services covered in Food Retailing industry in Cyprus include Meat, Fruit and veg and Bakery products.

Companies covered in the Food Retailing industry in Cyprus include Boulangeries Paul SAS.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Food Retailing industry in Cyprus.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed products and service segmentation and analysis of major markets for the for the Food Retailing industry in Cyprus.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Food Retailing industry in Cyprus.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Food Retailing industry in Cyprus. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Food Retailing industry in Cyprus. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Food Retailing industry in Cyprus. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Food Retailing industry in Cyprus. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Food Retailing industry in Cyprus.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

The market size of the Food Retailing industry in Cyprus is €453.8m in 2026.

There are 632 businesses in the Food Retailing industry in Cyprus, which has declined at a CAGR of 0.8 % between 2020 and 2025.

The market size of the Food Retailing industry in Cyprus has been declining at a CAGR of 1.6 % between 2020 and 2025.

Over the next five years, the Food Retailing industry in Cyprus is expected to grow.

The biggest company operating in the Food Retailing industry in Cyprus is Boulangeries Paul SAS

Meat and Fruit and vegetables are part of the Food Retailing industry in Cyprus.

The company holding the most market share in the Food Retailing industry in Cyprus is Boulangeries Paul SAS.

The level of competition is high and increasing in the Food Retailing industry in Cyprus.