IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

France’s urban passenger land transport industry is deeply rooted in the development of extensive transport networks, particularly in Paris, where public transit remains integral to the city’s daily life. State-owned entities like RATP and SNCF play a pivotal role in maintaining and optimising vast and efficient systems of metros, trams and buses to meet the demands of a steadily growing urban population in France. Continuous investments in connectivity improvements and modernisation projects support and enhance these networks, facilitating the advancement of sustainable urban mobility solutions across metropolitan regions. Over the five years through 2025, industry revenue is expected to climb at a compound annual rate of 4.1% to €10.2 billion, with an expected hike of 0.5% in 2025.France’s urban passenger land transport industry is currently witnessing significant transformations, driven by a strong focus on sustainability and technological advancements. Key initiatives, like RATP’s Bus2025, highlight efforts towards electrifying bus fleets and reducing environmental impacts, while SNCF's introduction of energy-efficient trains exemplifies advancements in rail transport. Cities, including Lyon and Marseille, are investing heavily in electric buses and modernising their transport infrastructures to future-proof their systems. Concurrently, modern ticketing systems are being enhanced to offer greater operational efficiency and user convenience. These innovations and strategic public-private partnerships foster increased ridership and service quality. The future of France's urban passenger land transport industry is poised for significant enhancement through ambitious initiatives like the Grand Paris Express project and developments in autonomous vehicle technology. Such projects aim to substantially improve connectivity across regions, accommodating millions more passengers while alleviating congestion. Over the five years through 2030, revenue is expected to rise at a compound annual rate of 1.1% to €10.8 billion. Despite challenges posed by emerging micromobility options, the potential for integration offers new growth opportunities. Embracing technological advancements, including autonomous vehicles and smart data-driven operations, will be critical for maintaining competitive advantage. These forward-thinking measures will ensure that France continues to lead in urban transportation efficiency and sustainability, effectively addressing evolving consumer demands and positioning the industry for long-term success.

Answer any industry question in minutes with our entire database at your fingertips.

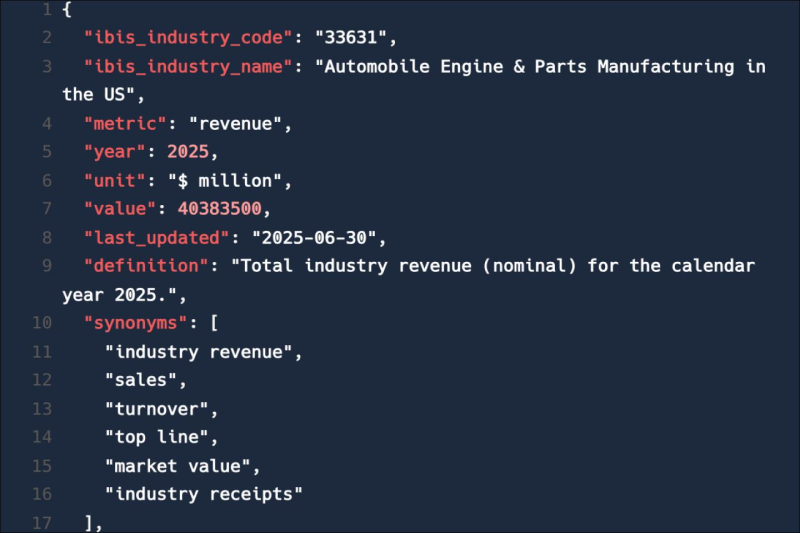

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Urban Passenger Land Transport industry in France includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released June 2025.

The Urban Passenger Land Transport industry in France operates under the industry code FR-H4921. The industry transports passengers by urban or suburban land transport systems, including bus transport, tramways, underground and metro services and overground railways. Industry operations are carried out on scheduled routes and typically follow a fixed time schedule. Taxi services and train station operations are not part of the industry. Related terms covered in the Urban Passenger Land Transport industry in France include predictive analytics, regenerative braking, demand-responsive transport (drt), micromobility, autonomous vehicles (avs) and public-private partnerships.

Products and services covered in Urban Passenger Land Transport industry in France include Contactless payments, Ordinary tickets and Season tickets .

Companies covered in the Urban Passenger Land Transport industry in France include Régie Autonome des Transports Parisiens (RATP), Société Nationale SNCF SA and Transdev Group SA.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Urban Passenger Land Transport industry in France.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed products and service segmentation and analysis of major markets for the for the Urban Passenger Land Transport industry in France.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Urban Passenger Land Transport industry in France.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Urban Passenger Land Transport industry in France. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Urban Passenger Land Transport industry in France. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Urban Passenger Land Transport industry in France. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Urban Passenger Land Transport industry in France. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Urban Passenger Land Transport industry in France.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

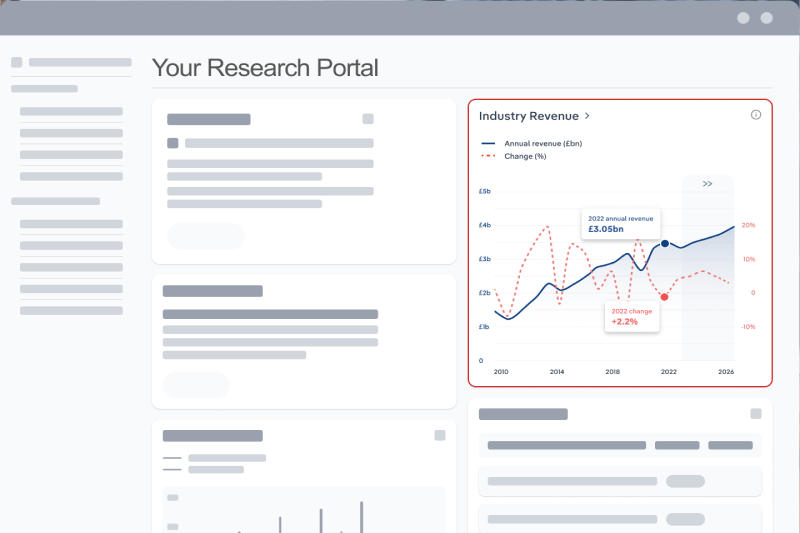

The market size of the Urban Passenger Land Transport industry in France is €10.2bn in 2026.

There are 1,453 businesses in the Urban Passenger Land Transport industry in France, which has grown at a CAGR of 1.3 % between 2020 and 2025.

The market size of the Urban Passenger Land Transport industry in France has been growing at a CAGR of 4.1 % between 2020 and 2025.

Over the next five years, the Urban Passenger Land Transport industry in France is expected to grow.

The biggest companies operating in the Urban Passenger Land Transport industry in France are Régie Autonome des Transports Parisiens (RATP), Société Nationale SNCF SA and Transdev Group SA

Contactless payments and Ordinary tickets are part of the Urban Passenger Land Transport industry in France.

The company holding the most market share in the Urban Passenger Land Transport industry in France is Régie Autonome des Transports Parisiens (RATP).

The level of competition is moderate and steady in the Urban Passenger Land Transport industry in France.