IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

The Meat Processing and Preserving industry in Europe has faced several challenges over the past five years despite receiving government support. Over the five years through 2025, revenue is forecast to inch upwards at a compound annual rate of 1.1%. Europe’s meat sector faces mounting pressure from shifting demand, tighter supply, and rising costs. Health and sustainability concerns are eroding red meat consumption, while plant-based alternatives grew fivefold between 2011 and 2023. Southern markets such as Spain and Portugal remain culturally attached to meat, but Northern Europe is shifting faster towards alternatives. Affordability has become the decisive factor. With living costs high, consumers are trading down to pork and poultry, valued for versatility and relative affordability. Even wealthier households are cutting back, squeezing processor margins and weakening demand for premium cuts.Exports now provide a buffer. In Q1 2025, the EU shipped 1.12 million tonnes of pigmeat worth €3.14 billion (+3% volume, +2.7% value), with China and the UK as top buyers, Eurostat notes. But beef is retreating: output is forecast to fall 1.3% in 2025 while imports from Brazil and Argentina rise. Adding to pressures, processors face herd contraction, labour shortages, and high energy costs, pushing many to invest in automation, renewables, and value-added lines to protect profitability. In 2025, revenue is expected to dip 0.7% to €376.3 billion while profit is expected to reach 5.1% of revenue, a drop from 5.8% in 2020 thanks to cost pressures. Looking ahead, Europe’s meat processors face a challenging landscape. Over the five years through 2030, revenue is slated to grow at a compound annual rate of 3.3% to €442.3 billion, and profit is expected to reach 7.5% of revenue. The looming shadow of eco-consciousness will stifle meat demand, with the OECD projecting EU per-capita consumption will fall by 1.6 kg by 2035. Faced with swelling competition from alternative proteins, traditional meat processors will seek innovative strategies to retain market share. Still, meat's engrained cultural value in European societies will offer some relief. Traditional meals, culinary heritage involving meat and strong demand for locally-sourced produce will serve to protect meat processors’ sales over the coming years. Supply chains face added pressure from regulation. The EU Deforestation Regulation (EUDR), effective December 2025, will require geolocation tracking for all beef and leather holdings, with non-compliance risking fines of up to 4% of turnover. Meanwhile, the new EU packaging law adds costs, requiring recyclable formats and higher recycled content. Despite the subdued outlook, opportunities remain. The CAP 2025 reform shifts subsidies towards smallholders and young farmers while tightening import standards, creating cost risks for scale players but potentially strengthening rural networks.

Answer any industry question in minutes with our entire database at your fingertips.

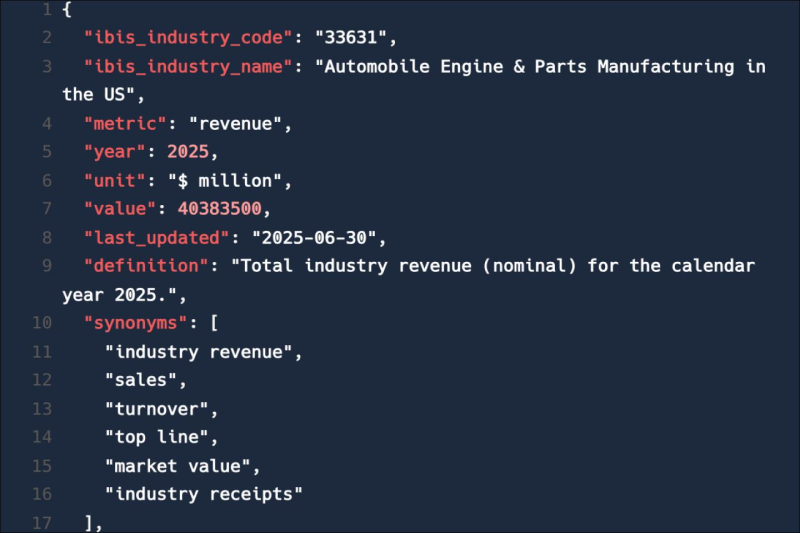

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Meat Processing industry in Netherlands includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released September 2025.

The Meat Processing industry in Netherlands operates under the industry code NL-C101. Companies in this industry process livestock to produce red meat. They operate slaughterhouses, produce fresh, chilled or frozen meat as carcasses and cuts and produce by-products like rendered lard, tallow, offal and pulled wool. Industry participants also bone, preserve and pack meat. Related terms covered in the Meat Processing industry in Netherlands include carcass, deboning, curing and rednering.

Products and services covered in Meat Processing industry in Netherlands include Beef and veal, Pork and Lamb.

Companies covered in the Meat Processing industry in Netherlands include Vion NV, Danish Crown AmbA and Pilgrim Foods Ltd.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Meat Processing industry in Netherlands.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed product and service segmentation, analysis of major markets and international trade data for the for the Meat Processing industry in Netherlands.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Meat Processing industry in Netherlands.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Meat Processing industry in Netherlands. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Meat Processing industry in Netherlands. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Meat Processing industry in Netherlands. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Meat Processing industry in Netherlands. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Meat Processing industry in Netherlands.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

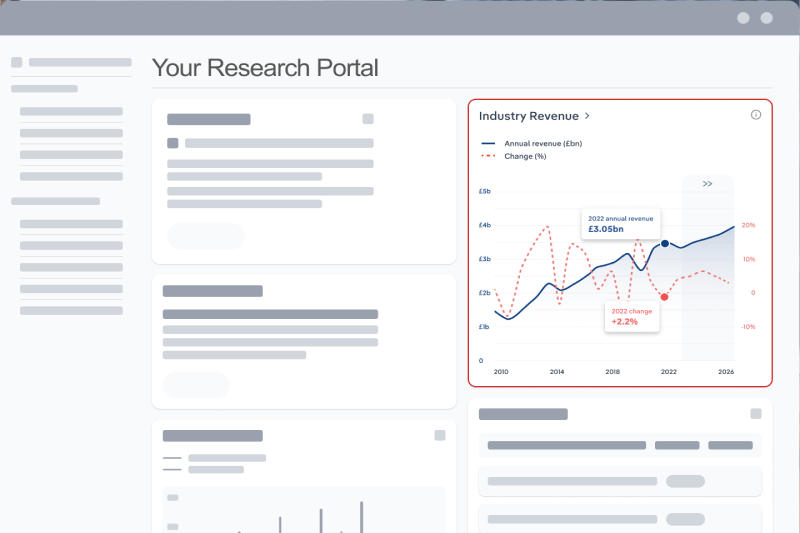

The market size of the Meat Processing industry in Netherlands is €15.7bn in 2026.

There are 817 businesses in the Meat Processing industry in Netherlands, which has grown at a CAGR of 2.9 % between 2020 and 2025.

The market size of the Meat Processing industry in Netherlands has been growing at a CAGR of 0.7 % between 2020 and 2025.

Over the next five years, the Meat Processing industry in Netherlands is expected to grow.

The biggest companies operating in the Meat Processing industry in Netherlands are Vion NV, Danish Crown AmbA and Pilgrim Foods Ltd

Beef and Veal are part of the Meat Processing industry in Netherlands.

The company holding the most market share in the Meat Processing industry in Netherlands is Vion NV.

The level of competition is moderate and steady in the Meat Processing industry in Netherlands.