About the Semiconductor Machinery Manufacturing in Massachusetts Market Research Report

What’s Included in the Semiconductor Machinery Manufacturing in Massachusetts Market Research Report

Definition of the Semiconductor Machinery Manufacturing in Massachusetts?

This industry manufactures equipment used to make semiconductors, more commonly known as chips or integrated circuits. Products manufactured include wafer-processing equipment, semiconductor assembly and packaging equipment and other semiconductor-making machinery.

What’s included in the Semiconductor Machinery Manufacturing in Massachusetts?

The Semiconductor Machinery Manufacturing in Massachusetts includes manufacturing etching equipment, manufacturing microlithography, manufacturing semiconductor assembly and packaging machinery, manufacturing chemical vapor deposition (cvd) equipment, manufacturing surface mount machinery for making printed circuit boards, manufacturing thin-layer deposition equipment, manufacturing wafer-processing equipment, manufacturing photolithography equipment and manufacturing microelectromechanical systems (mems) manufacturing equipment. Related terms covered in the Semiconductor Machinery Manufacturing in Massachusetts industry report includes a fabrication plant where semiconductors are manufactured, part of a semiconductor, often in the form of a silicon crystal, measures the number of orders the industry currently has compared with the number of orders the industry can process, technology used to generate energy by converting sunlight directly into electricity (solar power), a measurement equal to one billionth of a meter, commonly used when referring to wafer size and commonly used in electronic products and often known as integrated circuits and chips, these silicon elements conduct electricity.

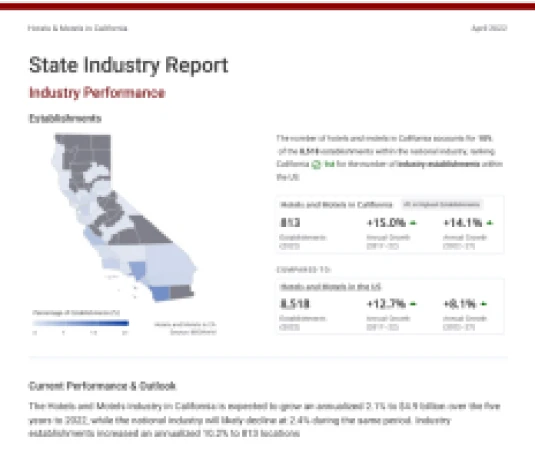

Industry Performance of the Semiconductor Machinery Manufacturing industry in Massachusetts

Benchmark the Semiconductor Machinery Manufacturing in Massachusetts industry performance with all MA county and national performance.

Semiconductor Machinery Manufacturing in Massachusetts

#3 in Highest Revenue 19.3% of state's GDPRevenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

Semiconductor Machinery Manufacturing in the US

Revenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

For the full list of industry drivers, see report purchase options.

Key Drivers of the Semiconductor Machinery Manufacturing industry in Massachusetts

See how key industry drivers, such as population, new business formation, median houshold income, producer price index: semiconductor and electronic components, private investment in computers and software and trade-weighted index are impacting Semiconductor Machinery Manufacturing in Massachusetts

Massachusetts Economic Indicators

Population

New Business Formation

Median Houshold Income

View more economic information in MA State Economic profile

US Key External Drivers

Producer Price Index: Semiconductor and electronic components

Private investment in computers and software

Trade-weighted index

For the full list of industry drivers, see report purchase options.

County Data of the Semiconductor Machinery Manufacturing industry in Massachusetts

Access proprietary data on county in the Semiconductor Machinery Manufacturing in Massachusetts, such as Middlesex County, Essex County and Worcester County. Data includes figures on revenue, establishments, employees and wages by counties.

Key Statistics of the Semiconductor Machinery Manufacturing industry in Massachusetts

Download 18 years of historical data and 5 years of projected performance.