About the Masonry in North Carolina Market Research Report

What’s Included in the Masonry in North Carolina Market Research Report

Definition of the Masonry in North Carolina?

Operators in the Masonry industry provide services such as stone setting, bricklaying, brick-to-glass block laying and exterior marble, granite and slate work. Industry activities also include additions, alterations, maintenance, repairs and new construction. This industry excludes businesses that pour, build and finish concrete foundations and structural elements (see IBISWorld report 23811).

What’s included in the Masonry in North Carolina?

The Masonry in North Carolina includes constructing walls and other structures by laying bricks, blocks or stones, repairing existing masonry work, constructing foundations made of bricks, blocks or stones, laying bricks or glass blocks, laying marble, granite or slate on the exterior of buildings and structures, setting stone, laying paving bricks, blocks or tiles, constructing and repairing partitions, arches, sewers and chimneys, constructing and repairing work on kilns and furnaces and laying refractory bricks. Related terms covered in the Masonry in North Carolina industry report includes repair of brickwork by \"tucking\" mortar into damaged mortar joint using the point of a trowel, bricks or blocks typically manufactured from ceramic materials that can withstand extremely high temperatures, and are used in lining furnaces, kilns, and fireplaces, an interlocking, precast piece of concrete or brick commonly used in exterior hardscaping applications, in masonry, joints are the spaces between bricks, concrete blocks or glass blocks that are filled with mortar or grout and a covering or coating on a structure or material.

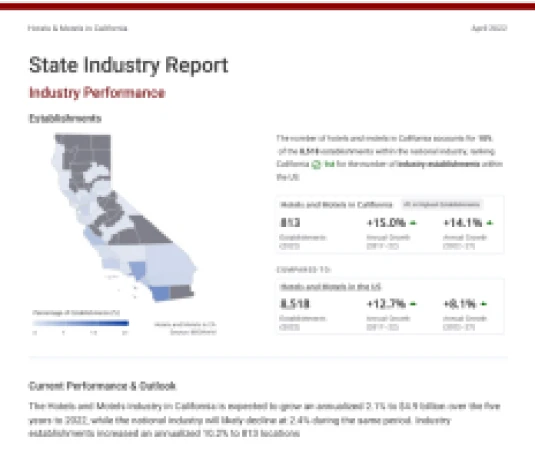

Industry Performance of the Masonry industry in North Carolina

Benchmark the Masonry in North Carolina industry performance with all NC county and national performance.

Masonry in North Carolina

#7 in Highest Revenue 3.8% of state's GDPRevenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

Masonry in the US

Revenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

For the full list of industry drivers, see report purchase options.

Key Drivers of the Masonry industry in North Carolina

See how key industry drivers, such as unemployment rate, median houshold income, per capita disposable income, value of residential construction, value of private nonresidential construction and housing starts are impacting Masonry in North Carolina

North Carolina Economic Indicators

Unemployment Rate

Median Houshold Income

Per Capita Disposable Income

View more economic information in NC State Economic profile

US Key External Drivers

Value of residential construction

Value of private nonresidential construction

Housing starts

For the full list of industry drivers, see report purchase options.

County Data of the Masonry industry in North Carolina

Access proprietary data on county in the Masonry in North Carolina, such as Wake County, Mecklenburg County and Union County. Data includes figures on revenue, establishments, employees and wages by counties.

Key Statistics of the Masonry industry in North Carolina

Download 18 years of historical data and 5 years of projected performance.