About the Credit Bureaus & Rating Agencies in Pennsylvania Market Research Report

What’s Included in the Credit Bureaus & Rating Agencies in Pennsylvania Market Research Report

Definition of the Credit Bureaus & Rating Agencies in Pennsylvania?

This industry comprises companies that provide information, outlooks and ratings on the creditworthiness of particular companies, individuals, securities or financial institutions. The industry can be divided into two primary groups: credit bureaus and credit rating agencies (CRAs). Credit bureaus offer services related to consumer credit information, while CRAs generally focus on businesses, governments, securities and financial markets.

What’s included in the Credit Bureaus & Rating Agencies in Pennsylvania?

The Credit Bureaus & Rating Agencies in Pennsylvania includes providing individual credit reports and rating services, offering commercial credit reports and rating services, providing debt collection and risk management services, offering convention and trade show organization services and providing investigation services. Related terms covered in the Credit Bureaus & Rating Agencies in Pennsylvania industry report includes a form of direct marketing that uses databases of customers or potential customers to generate personalized communications, an act allowing consumers to obtain a free yearly credit report from each of the three consumer credit reporting companies (equifax, experian and transunion), a company engaged in the assessment and rating of the quality and risks of debt securities, companies or organizations, a company that collects information from various sources and provides consumer credit information on individuals, a type of debt security that is backed by a pool of bonds, loans and other assets. payments, risks and values are derived from the underlying asset, an investment instrument backed by mortgage loans. payments, risks and values are derived from the underlying asset, an agency that issues credit ratings that the us securities and exchange commission permits other financial firms to use for various purposes and a bond that is considered suitable for the preservation of invested capital, or one that is rated within the top four categories by moody's or standard & poor's.

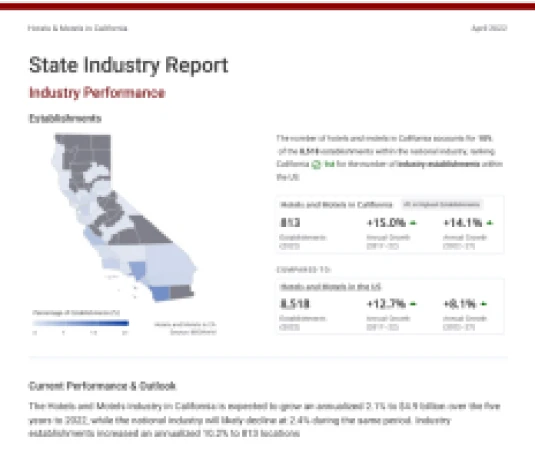

Industry Performance of the Credit Bureaus & Rating Agencies industry in Pennsylvania

Benchmark the Credit Bureaus & Rating Agencies in Pennsylvania industry performance with all PA county and national performance.

Credit Bureaus & Rating Agencies in Pennsylvania

#7 in Highest Revenue 4.5% of state's GDPRevenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

Credit Bureaus & Rating Agencies in the US

Revenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

For the full list of industry drivers, see report purchase options.

Key Drivers of the Credit Bureaus & Rating Agencies industry in Pennsylvania

See how key industry drivers, such as population, unemployment rate, new business formation, number of businesses, aggregate household debt and s&p 500 are impacting Credit Bureaus & Rating Agencies in Pennsylvania

Pennsylvania Economic Indicators

Population

Unemployment Rate

New Business Formation

View more economic information in PA State Economic profile

US Key External Drivers

Number of businesses

Aggregate household debt

S&P 500

For the full list of industry drivers, see report purchase options.

County Data of the Credit Bureaus & Rating Agencies industry in Pennsylvania

Access proprietary data on county in the Credit Bureaus & Rating Agencies in Pennsylvania, such as Allegheny County, Delaware County and Chester County. Data includes figures on revenue, establishments, employees and wages by counties.

Key Statistics of the Credit Bureaus & Rating Agencies industry in Pennsylvania

Download 18 years of historical data and 5 years of projected performance.