About the Family Planning & Abortion Clinics in South Carolina Market Research Report

What’s Included in the Family Planning & Abortion Clinics in South Carolina Market Research Report

Definition of the Family Planning & Abortion Clinics in South Carolina?

This industry includes freestanding centers with medical staff primarily engaged in assisting pregnant women and families in making various decisions regarding family planning. Services are provided on an outpatient basis and include contraception, genetic and prenatal counseling, voluntary sterilization and pregnancy termination.

What’s included in the Family Planning & Abortion Clinics in South Carolina?

The Family Planning & Abortion Clinics in South Carolina includes contraception services, fertility and sterilization services, emergency contraception kits, other reproductive health services and pregnancy termination services. Related terms covered in the Family Planning & Abortion Clinics in South Carolina industry report includes includes all fertility treatments in which both eggs and sperm are handled, the reproductive age span of women, which is assumed for statistical purposes to range from 15 to 45 years old in the united states, the number of live births per 1,000 women of reproductive age in a given year and a given place, a process by which egg cells are fertilized by sperm outside the woman's womb in a test tube in a laboratory setting, refers to the incidence of disease with a population and the adverse effects caused by a treatment, a federal grant program dedicated solely to providing individuals with comprehensive family planning and fqhcs are community-oriented healthcare organizations that offer comprehensive primary care and support services regardless of a patient's financial capability, insurance coverage, or immigration status. fqhcs receive federal funds under section 330 of the public health service act and are eligible for enhanced reimbursement from medicare and medicaid.

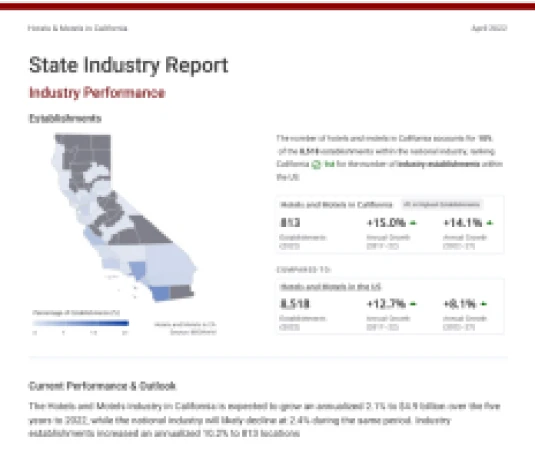

Industry Performance of the Family Planning & Abortion Clinics industry in South Carolina

Benchmark the Family Planning & Abortion Clinics in South Carolina industry performance with all SC county and national performance.

Family Planning & Abortion Clinics in South Carolina

#29 in Highest Revenue 0.6% of state's GDPRevenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

Family Planning & Abortion Clinics in the US

Revenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

For the full list of industry drivers, see report purchase options.

Key Drivers of the Family Planning & Abortion Clinics industry in South Carolina

See how key industry drivers, such as population, net migration, per capita disposable income, federal funding for medicare and medicaid, number of people with private health insurance and per capita disposable income are impacting Family Planning & Abortion Clinics in South Carolina

South Carolina Economic Indicators

Population

Net Migration

Per Capita Disposable Income

View more economic information in SC State Economic profile

US Key External Drivers

Federal funding for Medicare and Medicaid

Number of people with private health insurance

Per capita disposable income

For the full list of industry drivers, see report purchase options.

County Data of the Family Planning & Abortion Clinics industry in South Carolina

Access proprietary data on county in the Family Planning & Abortion Clinics in South Carolina, such as Greenville County, Richland County and Charleston County. Data includes figures on revenue, establishments, employees and wages by counties.

Key Statistics of the Family Planning & Abortion Clinics industry in South Carolina

Download 18 years of historical data and 5 years of projected performance.