About the Loan Brokers in South Dakota Market Research Report

What’s Included in the Loan Brokers in South Dakota Market Research Report

Definition of the Loan Brokers in South Dakota?

This industry comprises brokers who arrange loans, especially mortgages, by bringing borrowers and lenders together on a commission or fee basis. Since loan brokers generate revenue through commission or on a fee basis, the increase in loan originations contributed to revenue generation and profit.

What’s included in the Loan Brokers in South Dakota?

The Loan Brokers in South Dakota includes brokering residential mortgages, brokering commercial and industrial mortgages, brokering home equity loans, brokering equipment financing arrangements and brokering vehicle loans. Related terms covered in the Loan Brokers in South Dakota industry report includes a category of mortgages that have a risk potential greater than prime, but less than subprime, a loan that has a fixed rate for a certain period of years until the rate becomes adjustable for the remainder of the loan, a loan where the borrower can qualify with no income, no job and no assets and the creation of a new mortgage that involves a range of necessary legal papers and placement of the mortgage on the lender's books.

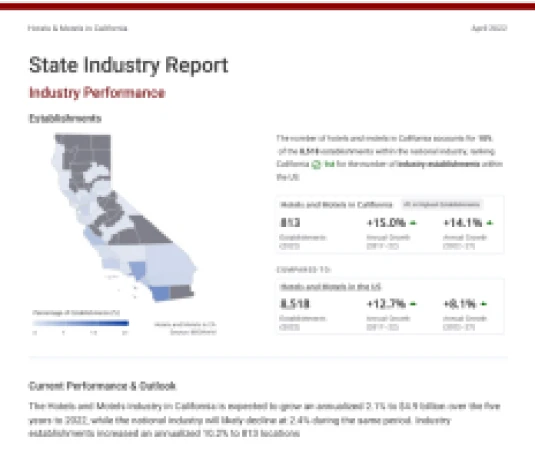

Industry Performance of the Loan Brokers industry in South Dakota

Benchmark the Loan Brokers in South Dakota industry performance with all SD county and national performance.

Loan Brokers in South Dakota

#50 in Highest Revenue 0% of state's GDPRevenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

Loan Brokers in the US

Revenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

For the full list of industry drivers, see report purchase options.

Key Drivers of the Loan Brokers industry in South Dakota

See how key industry drivers, such as population, median houshold income, new business formation, house price index, 30-year conventional mortgage rate and per capita disposable income are impacting Loan Brokers in South Dakota

South Dakota Economic Indicators

Population

Median Houshold Income

New Business Formation

View more economic information in SD State Economic profile

US Key External Drivers

House price index

30-year conventional mortgage rate

Per capita disposable income

For the full list of industry drivers, see report purchase options.

County Data of the Loan Brokers industry in South Dakota

Access proprietary data on county in the Loan Brokers in South Dakota, such as Lincoln County, Pennington County and Minnehaha County. Data includes figures on revenue, establishments, employees and wages by counties.

Key Statistics of the Loan Brokers industry in South Dakota

Download 18 years of historical data and 5 years of projected performance.