About the Open-End Investment Funds in Tennessee Market Research Report

What’s Included in the Open-End Investment Funds in Tennessee Market Research Report

Definition of the Open-End Investment Funds in Tennessee?

This industry comprises legal entities (funds) that earn fees by pooling and investing money, giving the investors rights to a proportional share of the fund performance. Ownership shares of these funds are sold to the public in initial public offerings, with additional shares offered continuously. Investors redeem the shares at prices that the fund’s net asset value or market value determines. This report focuses on mutual funds and exchange-traded funds.

What’s included in the Open-End Investment Funds in Tennessee?

The Open-End Investment Funds in Tennessee includes sponsoring and offering equity funds, sponsoring and offering bond funds, sponsoring and offering money market funds, sponsoring and offering exchange-traded funds and sponsoring and offering hybrid funds. Related terms covered in the Open-End Investment Funds in Tennessee industry report includes also known as a \"lifestyle fund,\" assets are managed to a more conservative risk tolerance as the target date (usually retirement) approaches, an investment vehicle that is traded on a stock exchange much like a stock, the degree to which an asset or security can be easily bought or sold quickly in the market without impacting the asset's price. liquidity is characterized by a high level of trading activity and an investing tool used by individuals to earn funds for retirement savings. there are several types of iras, including traditional iras and roth iras.

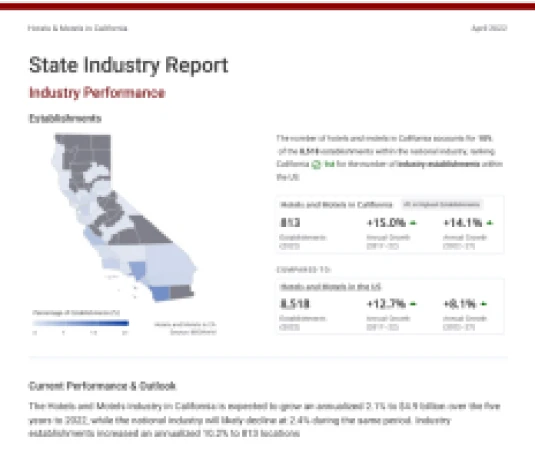

Industry Performance of the Open-End Investment Funds industry in Tennessee

Benchmark the Open-End Investment Funds in Tennessee industry performance with all TN county and national performance.

Open-End Investment Funds in Tennessee

#28 in Highest Revenue 0.2% of state's GDPRevenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

Open-End Investment Funds in the US

Revenue (2025)

Annual Growth (2020-25)

Annual Growth (2025-30)

For the full list of industry drivers, see report purchase options.

Key Drivers of the Open-End Investment Funds industry in Tennessee

See how key industry drivers, such as unemployment rate, house price index, per capita disposable income, yield on 10-year treasury note, s&p 500 and personal savings rate are impacting Open-End Investment Funds in Tennessee

Tennessee Economic Indicators

Unemployment Rate

House Price Index

Per Capita Disposable Income

View more economic information in TN State Economic profile

US Key External Drivers

Yield on 10-year Treasury note

S&P 500

Personal savings rate

For the full list of industry drivers, see report purchase options.

County Data of the Open-End Investment Funds industry in Tennessee

Access proprietary data on county in the Open-End Investment Funds in Tennessee, such as Hamilton County and Davidson County. Data includes figures on revenue, establishments, employees and wages by counties.

Key Statistics of the Open-End Investment Funds industry in Tennessee

Download 18 years of historical data and 5 years of projected performance.