IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

Safcol is a Proprietary Company that generates the majority of its income from the General Line Grocery Wholesaling industry. In 2024 the company generated total revenue of $177,158,000 including sales and other revenue. In 2024 Safcol had 155 employees including employees from all subsidiaries under the company's control. The Chief Executive of Safcol is Mr Andrew Mitchell whose official title is Chief Executive Officer. The Chairman of Safcol is either not applicable or not available. The principal activities of Safcol Australia Pty Ltd are marketing, importing and distributing of canned seafood products. The company provides the following range of products: Tuna Salmon Mussels & Oysters Sardines

Answer any industry question in minutes with our entire database at your fingertips.

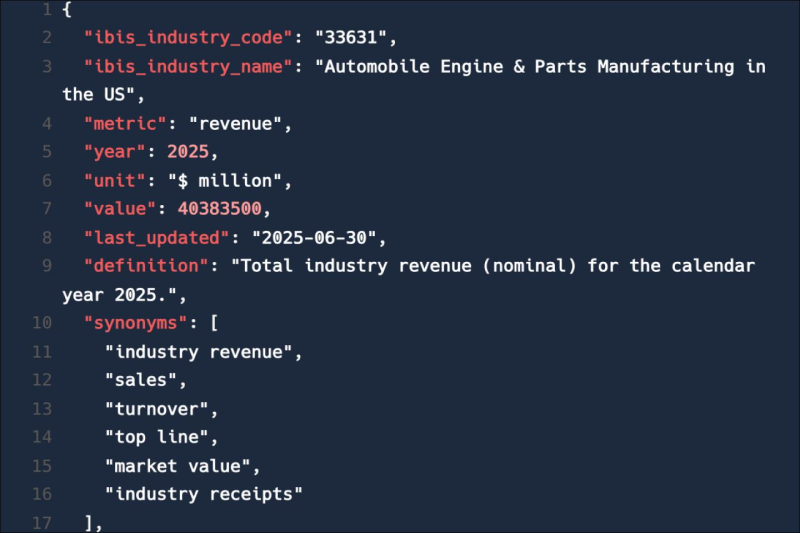

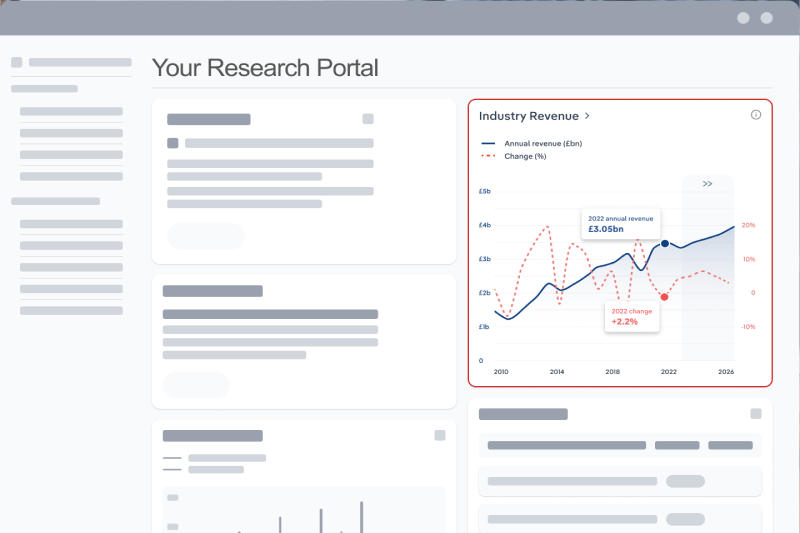

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Safcol Australia Pty Ltd includes market sizing, forecasting, data and analysis. The most recent publication will be as current as of March 2026.

Safcol Australia Pty Ltd, trading as Safcol, operates under the ABN 19 052 489 924 and was incorporated on 26 June 1991. Safcol Australia Pty Ltd primarily operates in the General Line Grocery Wholesaling industry in Australia.

The Key Personnel chapter outlines the principal leadership positions within Safcol Australia Pty Ltd, including the Chairman, Board members, Chief Executive Officer, and other key management personnel. It provides an overview of the company’s governance and executive structure, along with a breakdown of gender diversity across leadership roles, offering insight into the composition of the organisation’s senior team.

The Financials chapter presents Safcol Australia Pty Ltd’s historical financial performance, including detailed profit and loss statements outlining sales revenue, cost of sales, and profitability. It also incorporates balance sheet data, providing a breakdown of assets and liabilities, as well as additional financial metrics such as the number of shares on issue. Together, these disclosures offer a comprehensive view of the company’s financial position and performance over time.

The Growth & Ratios chapter provides historical data on key financial performance indicators, enabling an assessment of the company’s operational efficiency, profitability, and financial structure over time. Metrics covered include return on equity, return on assets, profit margins, revenue per employee, as well as gearing and leverage ratios, offering a comprehensive view of performance trends and capital management.

The Operating Segments chapter provides an overview of the revenue composition and asset allocation across the various industries in which Safcol Australia Pty Ltd operates. It offers insights into how the company’s financial performance is distributed among its core business segments, highlighting the relative contribution of each industry to total revenue.

The Competitor Benchmarking chapter includes a comparative assessment of Safcol Australia Pty Ltd’s key financial, growth, and valuation ratios against industry averages to evaluate its competitive position. It analyses valuation metrics such as price-to-earnings, price-to-book, enterprise value to EBITDA, and enterprise value to sales, alongside core financial indicators including liquidity ratios and profitability measures.

The Industries of Operation chapter outlines Safcol Australia Pty Ltd’s market share across the industries in which it operates. Each industry profile includes a comprehensive overview featuring data on total market size, the number of enterprises, industry concentration levels, and overall turnover. This analysis provides context for the company’s competitive position and scale within each relevant market.

The Shareholders chapter provides a breakdown of the ownership structure of Safcol Australia Pty Ltd, identifying key shareholders and outlining their respective ownership interests. This section offers insight into the concentration of shareholdings, the presence of institutional or strategic investors, and the overall distribution of equity within the company.

The Subsidiaries chapter provides an overview of the companies and business entities that are wholly or partially owned by Safcol Australia Pty Ltd. It outlines the ownership structure of each subsidiary, offering insight into the broader corporate group and how these entities contribute to the company’s overall activities and performance.

The History chapter presents a overview of Safcol Australia Pty Ltd’s development, highlighting key milestones and significant corporate events since its incorporation. It includes the company’s incorporation date and outlines major strategic, operational, and structural developments, providing context for its evolution and current market position.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

The principal activities of Safcol Australia Pty Ltd are marketing, importing and distributing of canned seafood products. The company provides the following range of products: Tuna Salmon Mussels & Oysters Sardines

Safcol Australia Pty Ltd, trading as Safcol, is a Private Company that generates the majority of its income from the General Line Grocery Wholesaling industry in Australia.

Murray Cod Australia Limited company is based at 189 Philip Highway, Elizabeth south, South Australia, Australia.

The Chief Executive Officer of Safcol Australia Pty Ltd is Not Available and the Chief Executive Officer is Andrew Mitchell.

In 2025, Safcol Australia Pty Ltd generated total revenue of approximately $177.2 million.