Key Takeaways

- While M&A activity has been sluggish through the first half of 2023, most global markets should see an uptick as the year comes to a close.

- Although stricter oversight from competition watchdogs has been slowing down deal completion, a number of monumental deals are still expected to close in 2023.

- Key drivers of M&A transactions include expanding supply chain models, acquiring new technological capabilities and improving ESG performance.

Global mergers and acquisitions (M&A) are off to a slow start in 2023. The likely causes include stagnant GDP growth, inflation, geopolitical conflicts, a stringent regulatory environment, high interest rates and investor uncertainty.

It's a challenging landscape, with 90% of executives claiming that M&A deals have become more complex and risky than ever before, according to KPMG. Under these conditions, not a single global "mega deal" surpassed $10 billion between October 2022 and January 2023.

So far in 2023, there has been a 46% drop in the number of M&A deals exceeding $25 million, compared to the previous quarter of 2022.

While slower M&A can impact the wider economy through lower investment levels, there are also some upsides to reduced consolidation.

In a complex M&A environment, companies are more likely to focus on organic growth opportunities, pouring resources into research and development (R&D) that improves their products and services. In this particular landscape, in 2023, the slowdown in M&A is also a sign of better due diligence and risk management.

What’s shaping M&A deals in 2023?

Amid this challenging environment, certain industries have managed to find stability and are strategizing to seize opportunities presented by shifting corporate and consumer priorities.

The complex and high-risk valuations that prolong the process of large-scale M&A deals can be attributed to the evolving strategic goals of companies. Many are now aiming to expand their supply chain operating models and/or acquire new technological capabilities, leading to intricate negotiations and evaluations.

Companies have also been thinking more seriously about sustainability when conducting M&A transactions. An uptick in ESG-oriented deals can be linked to the growing availability of capital dedicated to ESG and increased pressure from investors and regulators to disclose ESG performance and establish targets.

Where are M&A deals concentrated?

The US has long been a frontrunner in M&A deals, accounting for more than half of the total value of deals worldwide in 2021 and demonstrating a winning track record dating back to the global financial crisis.

While a number of deals announced in 2022 are still tied up into 2023, the US is expected to remain on top this year, both for domestic and cross-border deals.

Meanwhile, M&A activity involving Chinese companies has been increasing throughout the last two decades, overtaking the UK as the second-largest market in terms of M&A transaction value.

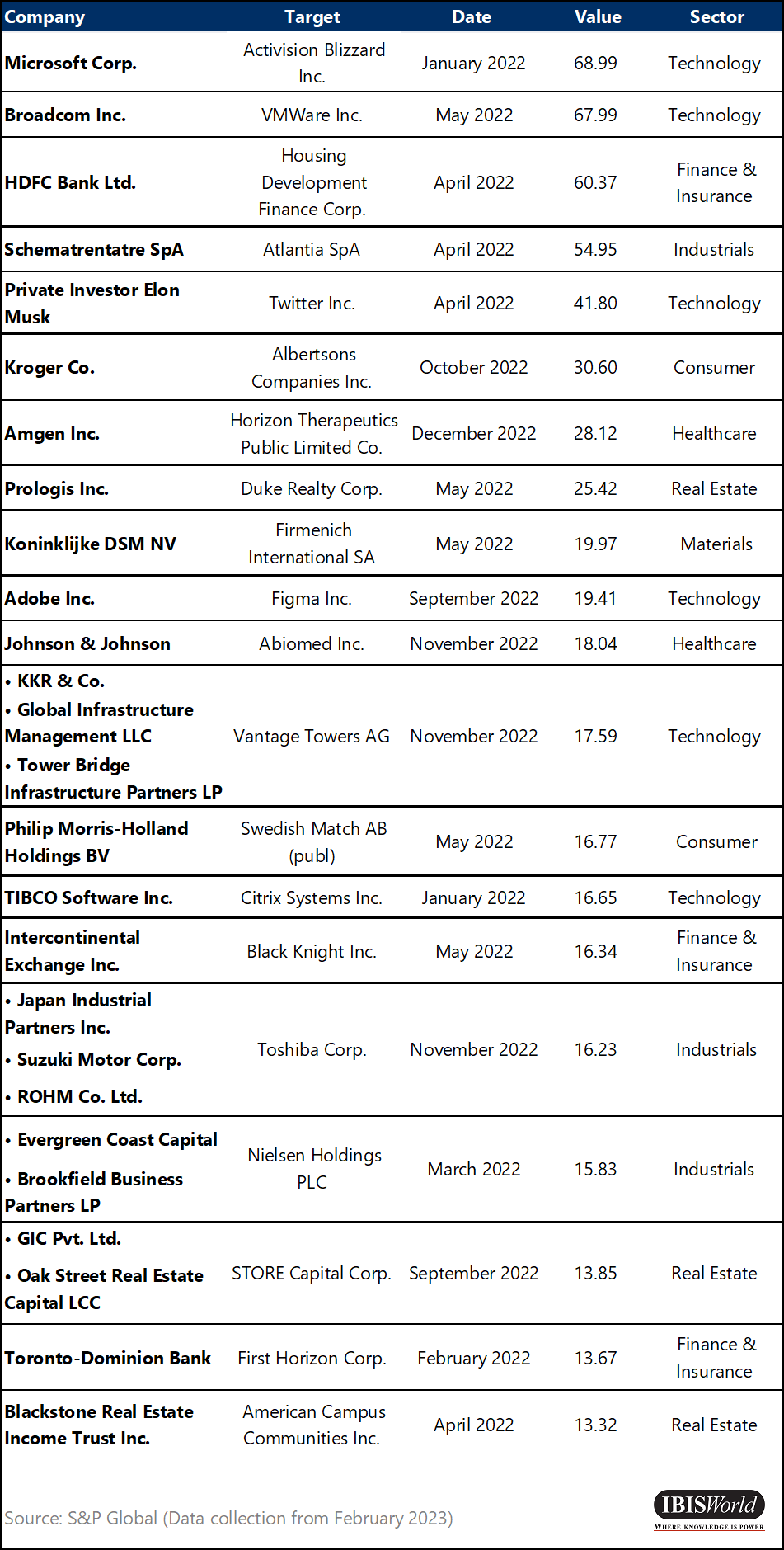

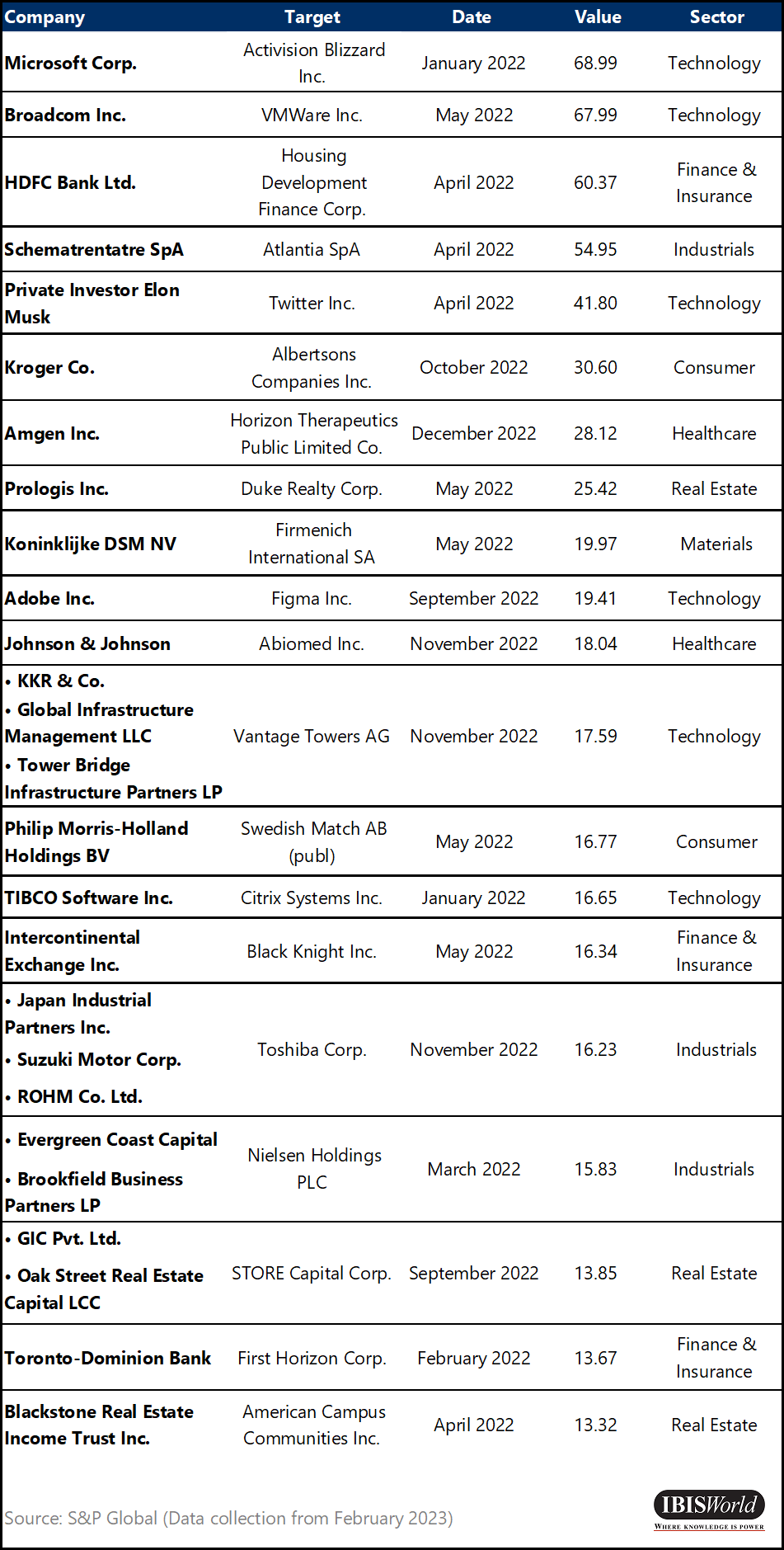

Largest deals since January 2022

As of January 2022, 19 global mega deals, exceeding $10 billion, remained in limbo following the termination of five comparable deals in 2022. Some of these pending transactions, including Microsoft’s proposed $68.99 billion acquisition of Activision Blizzard Inc., are encountering regulatory scrutiny.

The Biden administration has tightened regulations surrounding antitrust reviews, aligning with similar regulatory measures adopted in other parts of the world. While regulators are not extensively impeding and blocking deals, there have been widespread delays in granting approvals and enabling deals to progress smoothly.

On top of this, a number of banks have withdrawn from the leveraged loan market, making financing deals more difficult for small, midsize and large companies. Loan losses in the infamous Twitter Inc. deal and Citrix Systems deal, which was struck just before the US Federal Reserve began aggressively hiking interest rates, have scarred banks.

The Broadcom-VMWare transaction

Silicon Valley is no stranger to tech acquisitions and neither is Broadcom Inc.

Broadcom is a global technology leader in semiconductor and infrastructure software solutions. Their product portfolio includes data center networking and storage, enterprise, mainframe and cyber security software focused on automation, monitoring and security, smartphone components, telecoms and factory automation.

Broadcom currently leads the US Security Software Publishing industry, capturing at least 10% of market revenue. As technology becomes more complex and cyber threats grow, this industry is set to expand at a CAGR of 10% over the next five years, reaching over $100 billion.

Broadcom’s presence in the wider Software Publishing industry is slated to grow with its acquisition of VMWare, as they maintain that the deal will skew their portfolio toward software solutions, specifically. Post-deal, software revenue is expected to account for approximately 49% of total Broadcom revenue.

Its global presence across the technology sector has stirred up some objections since the VMWare deal was first announced. Similarly, Broadcom actually lost a deal back in 2018 when the Trump Administration sounded alarms about its move to acquire Qualcomm.

The UK’s Competition and Market Authority (CMA) and the European Commission (competition watchdog for the EU) were the latest to press back on the VMWare deal. The deal could pose threats to competition and availability of fibre channel host bus adapters (FC HBAs) and storage adapters in global markets. Despite these concerns, approval of this transaction appears to be just around the corner and will amount to one of the largest tech deals in history.

Defenders of the deal say it will bring much-needed competition to a hyperscale cloud market now dominated by Amazon Web Service (AWS), Microsoft Azure and Google Cloud.

The Kroger-Albertsons transaction

The Kroger Co., headquartered in Cincinnati, OH, accounts for nearly 20% of all revenue in the US Online Grocery industry. Its top competitor, Walmart Inc., holds a market share of more than 40% in this $36.3 billion dollar industry.

While Kroger faces competition from superstores like Walmart, among its peers that operate solely in the supermarket industry, Kroger takes the top position in the US market.

Though still to be finalized, in early October 2022, Kroger announced they would be purchasing another US-based competitor, Albertsons, in one of the largest grocery deals ever. Overall, the combined entity is expected to have pre-forma results of $209 billion across almost 5,000 stores.

The supermarket industry has been consolidating for years, with Amazon’s 2017 acquisition of Whole Foods representing a major milestone. The industry has also been marked by several cross-border acquisitions. For example, European company Ahold-Delhaize acquired FreshDirect in 2020 and had a second US-based acquisition on the table that flopped when King Kullen and Ahold-Delhaize came to a mutual agreement to terminate the deal.

Consolidation among supermarkets is under close watch around the world, with food prices hitting record highs. In Australia’s largest grocery stores, Woolworth’s and Coles, food prices increased at an average of 9.2% over the three months to December 2022. Since then, Woolworth’s proposed acquisition of independent operator SUPA IGA has been opposed by the Australian Competition and Consumer Commission (ACCC) due to the impact it could have on lessening competition.

Global discount stores like Costco and Aldi play an important role in providing competitive options for cash strapped shoppers, even as grocery giants continue snatching up smaller competitors.

Amgen - Horizon Therapeutics transaction

Amgen Inc., headquartered in Thousand Oaks, CA, currently has a sizable foothold in the Global Biotechnology industry and is looking to expand that foothold by acquiring Horizon Therapeutics plc, which also operates globally.

Amgen stands to gain an estimated $2 billion in revenue from Horizon’s products. Over the long term, synergies realized through the acquisition could bump up the price of Amgen’s shares significantly, as much as 20% by 2029. With lucrative pharmaceutical products in Horizon’s portfolio, Amgen’s buyout could send shockwaves through the biopharma industry, in particular.

When Amgen revealed its intention to buy Horizon in 2022, they reported an expected completion date in the first half of 2023. Now, after being challenged by the Federal Trade Commission (FTC), the companies are targeting mid-December.

In its argument against the buyout, the FTC cited Amgen’s history of establishing bundling schemes with payers and pharmacy benefit managers (PBMs) that offer cross-market rebates on bundles of products in exchange for favorable formulary positions.

The FTC has found that Amgen’s product portfolio is so broad that it would be able to secure a favorable formulary position at every major PBM once Horizon is absorbed.

This approach, of zeroing in on past behaviors and drug pricing, is new for the FTC.

Since March 2021, the FTC has been working with international competition enforcement agencies to strengthen its antitrust reviews of pharmaceutical deals.

When faced with stringent antitrust reviews, biopharma companies often cite innovation as a key outcome. To drive innovation, Amgen has already partnered with other companies to share resources and profit. In 2022 alone, Amgen entered into partnerships with Plexium, Arrakis Therapeutics and Generate Biomedicines.

But recent findings show that scale does not always equal innovation, giving regulators something to stand on when challenging pharma deals. Over the past few years, big pharma’s contributions of new compounds have slowly declined, according to healthcare economics experts. Now, about 70% of novel drugs are being developed by smaller companies that lack economies of scale.

Final Word

What's ahead in the M&A space? Well, for most global markets, M&A activity is expected to perk up as 2023 forges on. With generative AI having made a huge splash this year, technology acquisitions are heating up.

Renewable energy is another space where M&A is projected to take off as companies grapple with ESG performance.

The US will continue to be a leader in M&A deals, with US companies increasingly pursuing cross-border transactions. Although the pandemic highlighted a need to nearshore production after presenting serious disruptions to global supply chains, analysts at Morgan Stanley expect international deals to return to growth this year. Risk management will undoubtedly play a stronger role in cross-border strategies, and developed nations will likely take priority.