Key Takeaways:

Headline indicators for the Australian economy are strong, with above-average growth and low unemployment.

Movement restrictions related to the COVID-19 pandemic have eased both domestically and internationally. This change has fostered sharp recovery for many industries, particularly in the tourism sector.

The Russia-Ukraine conflict has exacerbated supply chain disruptions, which have sharply increased prices for key commodities. These rises have benefited commodity exporters, but have been costly for manufacturing and construction.

Inflationary pressures have reached a 21-year high, leading to consecutive interest rate rises for the first time in a decade. Rising borrowing costs have hurt industries that rely on speculative asset investments.

The 2021-22 financial year has been a turbulent period both globally and for Australia. The Delta strain of COVID-19 sent the country’s two largest cities into prolonged city-wide lockdowns, the vaccine rolled out, and lockdowns and border closures came to an end. Just as economic activity was poised to recover, the Omicron COVID-19 variant took hold worldwide. World events further disrupted recovery in economic activity as a war in Europe, supply chain disruptions, share market declines, rising inflation and growing interest rates have shifted the terrain for Australian industries. In May 2022, Australians even voted in a new Federal Government. Describing the past 12 months as significant would perhaps be an understatement.

On the surface, the Australian economy appears to be in a strong position. The CBA Group expects GDP to grow by 3.7% in 2021-22, which is well above the average annual growth rate of 2.3% over the past 10 years. Unemployment is at a historic low and currently stands at 3.5%, which is the lowest it has been since August 1974. Some economists consider the economy to be approaching ‘full employment’.

Despite these strong headline figures, uncertainty among business and consumers is widespread. Surging inflation is at the centre of this uncertainty, which has increased the cost of key inputs for many major industries and put pressure on real discretionary incomes for Australian households. The headline rate of inflation stands at its highest in 21 years, at 5.1%. The COVID-19 pandemic’s ongoing effects have disrupted the global supply chain, leading to inflationary pressures worldwide as supply struggles to keep up with demand. The Russia-Ukraine conflict has exacerbated this dynamic, further disrupting supply to an already overstretched global supply chain. These developments have inflated the prices of essential commodities, particularly food and energy.

As inflationary pressures reached Australia, the Reserve Bank followed many other countries around the world in ending a sustained period of low interest rates. For the first time in nearly a decade, the Reserve Bank raised the cash rate in consecutive monthly meetings. These decisions likely signal that the era of cheap money has ended.

Some Australian industries have flourished throughout these larger shifts, while others have struggled. Reflecting on some of the winners and losers through the 2021-22 financial year can alert us to the myriad opportunities and threats that emerge in periods of change.

Winners

Coal Mining

The Australian Coal Mining industry boomed in 2021-22, as nominal prices on the global market increased by 102.9% and demand rose substantially. These trends increased production volumes and increased the value of exported coal by over 140%. Supply chain disruptions were particularly beneficial to Australian coal miners, enabling high prices and strong demand. IBISWorld estimates that industry-wide revenue grew by over 190% in 2021-22.

The Russia-Ukraine conflict has accelerated these trends, fostering increased demand for Australian coal. Russia is a major coal exporter, especially to the European Union. However, following Russia’s invasion of Ukraine, the European Union announced it would ban Russian coal imports. As many major businesses and governments have attempted to shift away from Russia as a source for their energy supplies, demand for Australian coal has only increased. Australia is the largest coal exporter in the world, and is considered a safe and stable trading partner. This reputation has further boosted Australian exports’ attractiveness in a period of global turbulence.

These global conditions led to an extraordinary boom in revenue and profitability for the Australian Coal Mining industry. A thriving Coal Mining industry benefits a wide variety of Australian industries, especially those that are engaged in export activity. For example, rising demand for Australian coal also benefited the Rail Freight Transport industry, which specialises in transporting products to and from Australia’s sea ports. As coal mining’s profitability increases, the volume of coal mined also tends to grow, which naturally boosts demand for freight services.

On the other hand, rising coal prices are expected to hurt downstream buying industries, such as the Iron Smelting and Steel Product Manufacturing industry. Sharp rises in energy prices increase the cost of key inputs, which undermines manufacturing industries’ profitability, especially in the energy-intensive metalworking industries. Manufacturing companies should consider replanning their procurement strategy and seek to renegotiate their contracts with energy suppliers. Negotiating improved contracts may enable firms to better navigate the wide-ranging supply chain headaches many businesses have been experiencing.

Oil and Gas Extraction

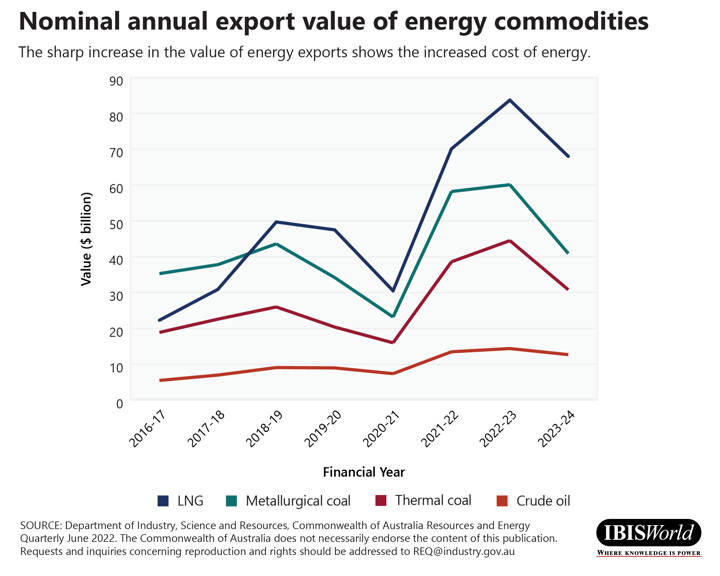

The Oil and Gas Extraction industry has also enjoyed significant increases in prices and demand, arising from various global supply chain disruptions. Once again, these disruptions have mostly benefited exporters through both rising prices and high demand for Australian oil and gas.

Profitability and revenue are high in the industry, as the value of LNG exports exploded in 2021-22. According to the Department of Industry, Science, Energy and Resources, the nominal value of LNG exports increased by over 130% in the same year. The value of exported crude oil has also risen sharply.

Much like the coal mining industry, these booms have benefited several industries throughout the supply chain, particularly those that enable increased export volumes. For example, the Pipeline Transport industry in Australia relies heavily on the Oil and Gas Extraction industry’s performance, enabling increases in haulage volume and greater investment in capacity expansion.

The boom in oil and gas extraction has also fostered rising investment in petroleum exploration in Australia, particularly for natural gas. These increases can have long-term benefits for the Australian economy, securing the country’s future as a major energy producer. Other flow-on industries that can capitalise on these trends include the Oil and Gas Field Services, Transport Equipment and Large Vehicle Rental or the Mining Support Services industries. These industries rely on demand from large energy firms, such as Chevron Australia and Woodside Petroleum.

Grain Growing

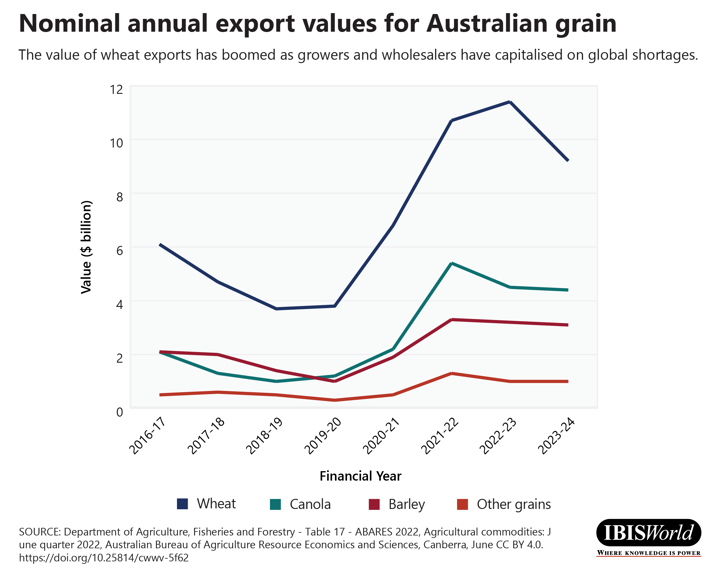

Exporters of wheat, barley, canola and other cereal grains have also garnered significant revenue and profitability increases from the changing global economic climate. The Russia-Ukraine conflict has once again benefited operators that specialise in exports. Both Russia and Ukraine are major grain exporters, especially to countries in the Global South. Similar to energy commodities, grain prices and demand have risen sharply, benefiting Australian grain growers.

Local growing conditions have matched these favourable demand conditions, with several years of bumper crops boosting overall production. Average yields were the highest on record in 2021-22, which supported the summer crop, and the total summer crop set new national records. The winter crop for 2021-22 also set production records, making it the most valuable winter crop on record. Other major grain exporters, particularly the United States and Canada, have experienced poor growing conditions, which have only served to increase international demand for Australian grain.

These two developments have significantly increased revenue and profitability, with record high prices and a rising volume of grain exports. However, rising fertiliser and energy prices have limited many of these gains, as input costs also rose sharply through 2021-22. In this case, the Russia-Ukraine conflict has hurt the industry, as Russia is a major producer of fertilisers and fertiliser inputs. However, rising export volumes benefit a variety of industries throughout the supply chain, such as Agricultural Machinery Manufacturing and Livestock and Other Agricultural Supplies Wholesaling. Industries that enable higher export volumes, such as the Cereal Grain Wholesaling industry, have also capitalised on the opportunities that this dynamic presents.

As in the case of energy, the rising price of wheat also bodes poorly for many industries as the cost of food increases overall. Firms involved in food manufacturing, food retailing and hospitality are likely to experience increasing input costs, which may undermine profitability. For example, the Cereal, Pasta and Baking Mix Manufacturing and Pizza Restaurants and Takeaway Services industries experienced rising purchase costs in 2021-22, which constrained profitability in both industries. It is worthwhile for businesses to review procurement strategies to have the best chance of managing these volatile costs. Engaging with consultancy firms may enable businesses to get ahead of these trends and implement strategic plans for long-term buying relationships.

Tourism

Throughout 2021-22, public health restrictions imposed to halt the COVID-19 pandemic’s spread gradually eased. This development is most advantageous to the wide variety of industries that benefit from international and domestic tourism.

These industries all experienced substantial recoveries following the vaccine’s rollout, which led to state and international borders reopening, and the ban on cruise ships entering Australian waters lifting. As restrictions on movement eased, pent-up demand for travel and many households’ increased savings during the COVID-19 pandemic accelerated many of these industries’ recovery.

A rebound in tourist activity was a blessing for the industries involved directly in the tourism sector. These industries include the Airline (international and domestic), Hotels and Resorts and Travel Agency and Tour Arrangement Services industries, among many others. These industries rely almost entirely on tourism, which made the COVID-19 pandemic particularly ruinous for many of them.

Most importantly, recovery continued through the Omicron COVID-19 variant’s emergence. This event failed to significantly dampen consumers’ desire to travel, despite its potential effect on traveller sentiment. The desire to travel is still strong, despite all the instability in the global economy. This factor is a valuable insight for investors, especially those in the tourism sector.

It is going to take some time to rebuild the sector to its pre-pandemic state. The rising cost of energy is likely to limit this recovery, as flights become more expensive due to the rising cost of fuel. Inflationary pressures’ effect on discretionary income is also likely to constrain this recovery. Firms and investors engaged in the tourism sector should consider the trends that were emerging before the COVID-19 outbreak. As pent-up demand to travel subsides once again, firms should consider whether these trends are sustainable in the changing economic climate.

Losers

Construction

Firms in the construction sector faced wide-ranging problems during the 2021-22 financial year. Rising input costs, a tight labour market, supply chain hold-ups and increasing interest rates all contributed to a major downturn in the sector, which has led to many operators going out of business or facing severe financial crises.

Declines have occurred across the construction sector and throughout its extensive supply chain. Falling demand from the construction sector also has implications for many manufacturers that supply construction projects, and for property and real estate services that rely on the sector. Firms that this crisis has affected should consider investing more heavily in sales and marketing to explore new domestic and global markets.

Supply chain hold-ups have also alerted many businesses to the need to develop a more sustainable supply chain, with more inputs sourced domestically. These trends can help businesses reduce their carbon footprint and may enable greater surety of supply going forward, especially as supply delays often undermine construction projects.

Superannuation Funds

Uncertainty surrounding rising interest rates and many central banks’ response has led to sharemarket declines worldwide. The Australian sharemarket also followed global trends; in 2021-22, the Australian All Ordinaries index lost 11.1% and the S&P/ASX 200 fell by 10.2%, while returns on Australian shares fell by 7.4%. These decreases marked only the third time in the past decade that Australian shares have recorded a financial loss.

These results have harmed superannuation investment income, which fell over the 2021-22 financial year. In particular, the Self-Managed Superannuation and Retail Superannuation Funds industries experienced substantial declines. These trends signal the greater effects of rising interest rates, as the era of cheap money comes to a close. These conditions have particularly damaged highly speculative investments, which sharp falls in technology shares and cryptocurrencies in 2022 have further demonstrated. Declining retail investment in the sharemarket also signals inflation’s effects on discretionary spending.

Businesses and investors that rely on high discretionary spending should heed the warning signs that these trends portend, at least in the short term. These trends may suggest that the economy is entering a period of structurally higher interest rates in the long term.

Liquor Retailing

Revenue in the Liquor Retailing industry fell in 2021-22, following the highs firms experienced during the COVID-19 pandemic. Prolonged lockdowns greatly benefited the industry, as government stimulus enabled higher discretionary spending, and lockdowns prevented consumers from substitute activities such as drinking alcohol at hospitality venues. Consumers were also more likely to buy more expensive alcohol during lockdowns, which boosted industry profitability.

As restrictions on other forms of discretionary spending have eased, government stimulus has wound back and inflationary pressures on consumers have increased. Furthermore, consumer spending on alcohol from retail outlets has fallen. These trends demonstrate that some consumption patterns that developed during the COVID-19 pandemic are not going to endure, particularly as movement restrictions ease and pressures on discretionary spending increase.

These trends affect many upstream industries, especially the Wine Production, Spirit Manufacturing, Beer Manufacturing and Liquor Wholesaling industries. As demand declines, businesses should adjust their forecasts to account for a changing consumer economy. Increased social awareness of alcohol consumption’s potential effects have also affected the industry, which has prompted many alcohol manufacturers to increasingly invest in low- or no-alcohol products.

Grape Growing

Declines in the Grape Growing industry demonstrate that not all agricultural producers have benefited from the shifting economic climate in 2021-22. Declining revenue for grape growers in Australia demonstrates the effect that global supply shortages have on input costs, particularly for fertilisers and energy. These cost increases have undermined many agricultural producers’ productivity.

In addition, demand for Australian grape growers has decreased, primarily due to fallout from ongoing trade hostilities between Australia and China. In the latter stages of the 2020-21 financial year, the Chinese Government imposed tariffs of between 116% and 218% on bottled wine imports from Australia. Wine manufacturers are a key downstream market for Australian grape growers, which has contributed to further declines in their revenue and profitability.

These trends demonstrate the importance of maintaining trade relations with key export markets, and the wider damage that trade wars can have on connected industries. Exporters should consider diversifying their customer bases to avoid the shocks that can arise from bilateral trade disputes.

Conclusion

In a mixed year for the Australian economy, Australian industries’ performance varied. The strongest performing industries were those that capitalised on shifting trends in the global economy, particularly in industries with large export markets. However, global supply shortages, especially for key commodities such as food and energy, are an ongoing challenge for businesses, governments and consumers. Rising prices followed by rising interest rates have decisively shifted the economic climate. It is crucial that firms adjust to these changing trends, especially those that are likely to endure in the long term.

IBISWorld reports used to develop this release:

Australian industry reports

- Coal Mining in Australia

- Rail Freight Transport in Australia

- Iron Smelting and Steel Manufacturing in Australia

- Oil and Gas Extraction in Australia

- Pipeline Transport in Australia

- Oil and Gas Field Services in Australia

- Transport Equipment and Large Vehicle Rental in Australia

- Mining Support Services in Australia

- Agricultural Machinery Manufacturing in Australia

- Livestock and Other Agricultural Supplies Wholesaling in Australia

- Cereal Grain Wholesaling in Australia

- Cereal, Pasta and Baking Mix Manufacturing in Australia

- Pizza Restaurants and Takeaway in Australia

- Tourism in Australia

- International Airlines in Australia

- Domestic Airlines in Australia

- Hotels and Resorts in Australia

- Travel Agency and Tour Arrangement Services in Australia

- Construction in Australia

- Metal Roof and Guttering Manufacturing in Australia

- Real Estate Services in Australia

- Self-Managed Superannuation Funds in Australia

- Retail Superannuation Funds in Australia

- Liquor Retailing in Australia

- Wine Production in Australia

- Spirit Manufacturing in Australia

- Beer Manufacturing in Australia

- Liquor Wholesaling in Australia

- Grape Growing in Australia

Business Environment Profiles – Australia

AU & NZ Enterprise Profile Reports