Key Takeaways

- Many active managers struggle to justify higher fees, as consistent evidence shows they have largely failed to outperform broad market benchmarks over recent years for investors globally.

- Exchange-traded funds (ETFs) have reshaped passive investing over recent years, giving investors an easy, low-cost way to access markets with greater flexibility and choice than ever before.

- Even though passive funds have outperformed, active strategies are finding new life through active ETFs, which blend professional management with the low costs, flexibility and accessibility investors now expect.

The battle between passive and active investing has been one for the ages, shaping portfolio decisions, fee debates and market narratives for decades. As markets evolve, this rivalry continues to redefine how investors pursue returns. To provide some context, passive investing is an investment strategy that aims to match a market's overall performance by tracking a benchmark index (like the S&P 500 or FTSE 100) through low-cost index funds or exchange-traded funds (ETFs). In contrast, the goal of active investing is to beat the market with active stock picking.

The history of active and passive investing

Traditionally, active investing was seen as the sensible approach. Picking individual stocks, timing the market and outperforming benchmarks was the core of professional investing. When their portfolios delivered healthy returns, managers worldwide would congratulate themselves, whispering to clients that such brilliance could only come from them and them alone. And then demand hefty fees as a result.

Passive investing, on the other hand, was seen as naive and boring. When John Bogle launched the first S&P 500 index fund in 1975, many investment professionals called it “Bogle’s Folly.” Why settle for average returns when skilled managers can beat the market? Passive investing was dismissed as selling out, or worse, admitting defeat in the stock-picking game, a confession that the financial hotshots of Wall Street simply couldn’t stomach.

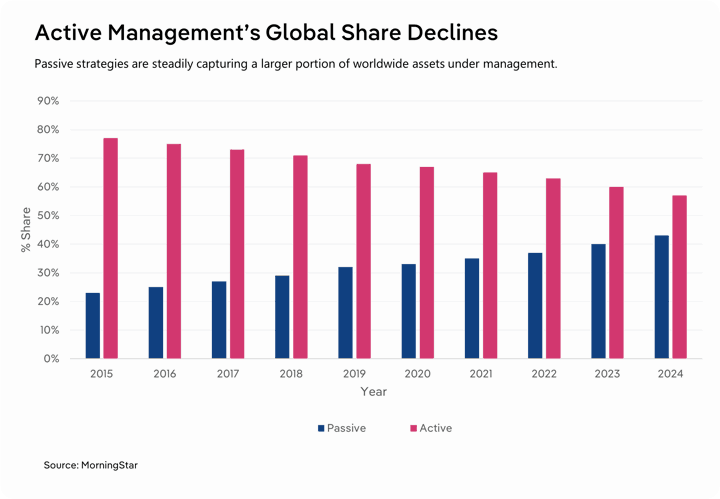

Yet, from what’s been seen over the past decade, John Bogle was ahead of the curve, so much so that people went as far as to say active management would become a thing of the past. Assets under management in the UK picked up from £2.8 trillion in 2005, when around 20% of assets were managed passively, to £9 trillion in 2023, with 33% of assets managed passively. This reflected a wider surge in popularity of passive management worldwide, to the point that markets believed the strategy would completely wipe out active investing.

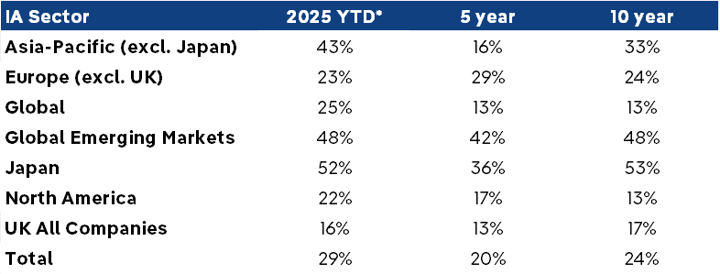

Investors valued passive investment’s low-cost base, with Vanguard offering the lowest passive fund fees, averaging 0.14% in 2025, while Swedbank topped the rankings on the active side with an average of 0.83%. This discrepancy means it’s vital for active strategies to generate healthy returns that justify the higher fees active strategies demand, something that, overall, they’ve failed to do. Only one-quarter (24%) of active funds have outperformed a passive alternative over 10 years, and just 29% outperformed over the year through November 2025.

Active Managers Outperforming a Passive Alternative

Why active managers are falling behind

In short. The Magnificent Seven. Alphabet, Amazon, Meta Platforms, Apple, Nvidia, Microsoft and Tesla. These technology stocks have been the main driver of stock returns, benefitting from the buzz around generative AI. Nvidia alone accounted for 20% of the rise in the S&P 500 in 2024. The average S&P 500 index fund had 28% of the portfolio’s market cap invested in the seven largest tech giants. However, very few active managers will have such significant exposure to so few companies, meaning the remaining positions in the portfolio would have to do the hard yards. An unrealistic task.

The introduction of ETFs also revolutionised passive investing by offering cheaper, more accessible and liquid ways to track markets, fuelling massive growth in passive strategies. ETFs are investment funds that hold a basket of assets like stocks, bonds or commodities and trade on a stock exchange like individual stocks. They typically track a market index, like the FTSE 100, but can also focus on specific sectors or themes, contributing to the shift towards passive investing.

The bulk of demand for ETFs is being driven by younger investors, with over two in five (41%) ETF investors aged 18 to 34. In the same survey, 46% of respondents cited low fees and cost-effectiveness as the main reason for investing in ETFs, an area in which active funds struggle to compete. Even Warren Buffett, someone who has made his fortune through active management, has been a strong advocate of passive, low-cost index funds for most individual investors, as these often outperform active managers.

An active approach to passive investments

Over the coming years, passive investment strategies will continue to gather momentum, drawing in capital from investors seeking diversification and low fees. However, the complete eradication of active strategies predicted by many financial gurus only a few years ago is unlikely to materialise. The battle of active versus passive seems a thing of the past. In its place, an active approach to passive investing. For one, recent years have seen a surge in passive funds that move beyond broad-market indices, instead targeting specific themes, styles, regions, or other niches. One notable area experiencing significant demand is AI-focused ETFs, as investors are benefitting from gains spreading beyond traditional leaders like Microsoft and Nvidia. While these funds are passive in construction, assembling them into a portfolio demands active judgment.

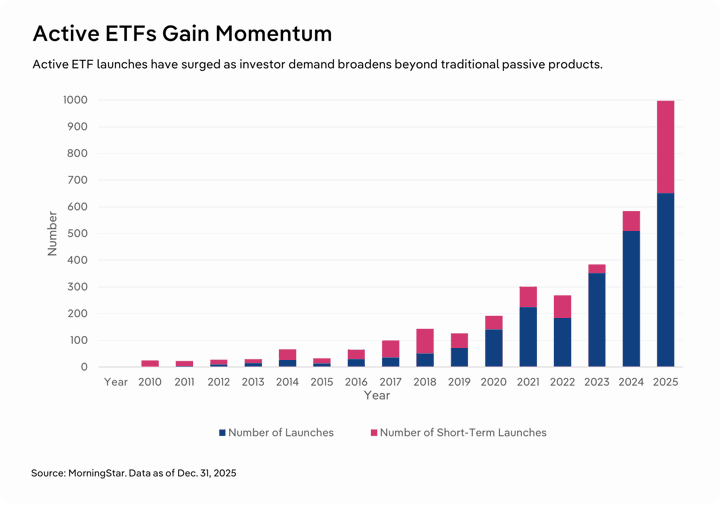

The ETF market has also reflected a resurgence in active management. If you asked someone a few years ago if they were using ETFs in their portfolio, you’d be fairly confident that they were using passive, index-tracking strategies. Now, investors are using ETFs as a wrapper that can hold both passive and active strategies.

Although passive ETFs still dominate, it won’t be long till active strategies really gain a foothold in the industry. As of yet, the US leads the charge in active ETFs, but momentum is building in Europe. 94% of European wealth managers reported plans to ramp up their use of active ETFs in 2025. Additionally, data from justETF shows there are 174 actively managed ETFs currently available on the London Stock Exchange. London-listed ETFs of all types, active and passive, number around 2,300, so about 8% of London’s ETFs are actively managed.

Final Word

In the end, the story is not one of replacement but of recalibration. After years of zero-sum rhetoric, the industry is shifting towards a coalition model. In its own way, the investment world shows that a measured approach, combining active insight with passive consistency, can create outcomes that lead to practical, sustainable results.