Key Takeaways

- The Bank of England (BoE)'s rate cut bodes well for financial markets and investor confidence, but underlying global uncertainties dampen its effect.

- Consumers and businesses remain cautious and are likely to delay major investments amid lingering economic uncertainty.

- Lower rates offer more affordable credit for businesses, while consumers also benefit from lower borrowing costs, fuelling increased spending on goods and services.

- The BoE has confirmed that the interest rate cut is a cautious step rather than the beginning of a pre-determined series of cuts, limiting its immediate impact on the economy.

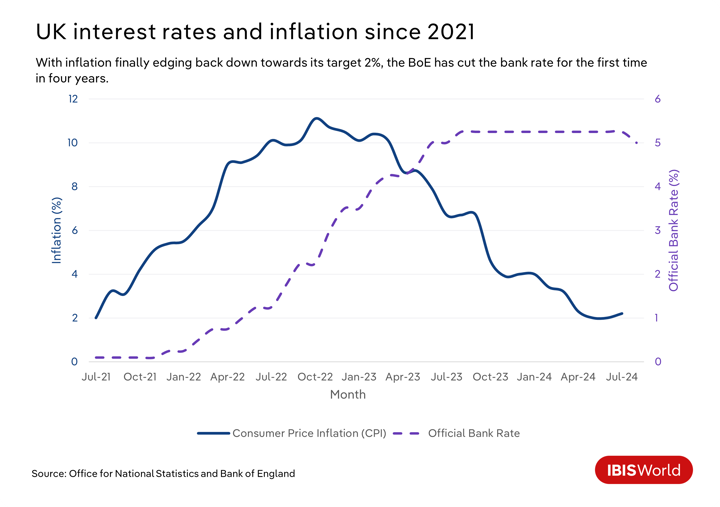

On 1 August 2024, the Bank of England (BoE) lowered interest rates for the first time in more than four years. In a closely contested decision, the Monetary Policy Committee (MPC) voted by a margin of five to four to reduce the bank’s key rate from 5.25% to 5%. This came after inflation returned to its target level of 2% in May 2024 and remained steady in June, as reported by the Office of National Statistics (ONS). This marks a significant recovery after years of rampant inflation, which peaked at 11.1% in October 2022. Although inflation reached its target in May 2024, the MPC’s rate cut decision came with hesitation as uncertainty lingers. Underlying service inflation and wage growth are expected to exert upward pressure on prices. In fact, ONS data reveals that inflation rose to 2.2% in July, driven by price pressures on household services. Nevertheless, the MPC maintains that this marginal cut can ease inflationary pressures while also stimulating economic growth in the long run.

Although inflation reached its target in May 2024, the MPC’s rate cut decision came with hesitation as uncertainty lingers. Underlying service inflation and wage growth are expected to exert upward pressure on prices. In fact, ONS data reveals that inflation rose to 2.2% in July, driven by price pressures on household services. Nevertheless, the MPC maintains that this marginal cut can ease inflationary pressures while also stimulating economic growth in the long run.

From the outset, the new Labour government has pledged to grow the economy, addressing years of sluggish growth and the recession that struck the UK at the end of 2023. The recent rate cut brings optimism but equally continued uncertainty, so it’s no surprise the entire country is closely watching what happens next. To what extent will the rate cut affect the economy? And how will the government navigate this change amid promised growth?

Market reactions

The long-awaited quarter-point rate cut sent an immediate ripple through financial markets, although the overall response was somewhat muted amid uncertainty over future cuts. The BoE’s reserved approach, with no clear indication given in the first half of 2024 of when it would begin to relax its base rate, kept businesses and consumers cautious. In May 2024, the International Monetary Fund (IMF) recommended that the BoE cut rates to 3.5% by the end of 2025 to stimulate growth after years of anaemic economic performance, leading people to expect cuts sooner rather than later. Despite this, rates held steady until August, underscoring the BoE’s cautious stance on reducing rates too quickly.

Since the 2016 Brexit vote, UK stock markets have underperformed, exacerbated by the economic downturn from the COVID-19 pandemic and the Russia-Ukraine conflict. However, the rate cut has sparked renewed buoyancy in markets. If rates are cut further, lower borrowing costs are set to stimulate corporate growth, boost investment in equities and enhance consumer spending, driving company earnings and stock prices higher in the future.

Shortly after the rate pivot, the FTSE 100 initially climbed but later tumbled due to growing global concerns over a US recession. UK banks also experienced a dip in the stock market resulting from tightened net interest income from clipped rates. While interest rate cuts are expected to bolster investor confidence, investors will remain cautious, keeping a close eye on global market volatility and prevailing uncertainties.

The foreign exchange market also reacted swiftly. The British pound fell against both the dollar and the euro. Lower interest rates diminish returns for foreign investors, reducing demand for the pound and causing it to depreciate against other currencies. A weaker pound then boosts demand for British exports, as they become more price-competitive, supporting economic growth. However, as speculation mounts that a rate cut in September is unlikely, the pound rebounded at the end of August and reached its highest level against the dollar since March 2022.

Regarding UK government bond yields, they also dropped, leading to a reduction in the government’s borrowing costs, as it can issue new debt at more favourable rates. While this rate cut is promising news for the new Labour government’s spending plans, assumptions of further cuts should be tempered.

The BoE’s Governor, Andrew Bailey, has expressed hesitation about additional cuts, stating that they “need to make sure that inflation stays low” and “be careful not to cut rates too much or too quickly.” The BoE’s Chief Economist, Huw Pill, supports this stance, emphasising that the UK economy may require monetary policy to remain tighter for longer.

Impact on the financial sector

Following the rate cut, financial agents are adjusting their strategies. Banks and lending institutions should be reassessing profitability and loan issuance, while investors should revise portfolios to navigate the changing economic landscape.

Interest rates determine the cost of borrowing set by banks and money lenders, including mortgage and credit card lenders. A rate cut prompts financial agents to lower loan rates, making borrowing more affordable and attractive for clients. While this can reduce banks' interest income and impact profitability, the increased demand for loans often offsets the loss.

Mortgage lenders are in the spotlight amid this rate cut. After several years of muted activity in the housing market, characterised by escalating repayments, major lenders have started to slash mortgage rates. According to a publication by Forbes Advisor, HSBC, Santander and Nationwide are among the lenders that have reduced repayment costs by 25 basis points. This development should provide some financial relief to households and enable more people to get on the property ladder, thanks to lower mortgage rates. Mortgage analyst Kylie-Ann Gatecliffe suggests that this may trigger a rate war among banks as competition intensifies, potentially stimulating house-buying activity in the coming months.

Strategies for success for finance professionals:

Diversify investment portfolios: Finance professionals can navigate future cuts by diversifying their investments and exploring opportunities in sectors that benefit from lower interest rates, like real estate. This will help them manage risk and maintain profitability.

Adjust lending strategies: Future rate cuts prompt lenders to promote refinancing options with more attractive terms and offer competitive fixed-rate products to attract borrowers seeking to take advantage of lower rates. Banks and mortgage lenders should regularly monitor BoE announcements to stay ahead of any necessary adjustments.

Focus on cost management: Financial institutions should streamline operations and invest in digital technologies to enhance service delivery and reduce costs. This can offset reduced profitability from interest income by achieving greater operational efficiency.

Impact on business

Understanding the effects of an interest rate cut on the financial sector provides a solid foundation for examining how cheaper credit influences businesses and their protentional for growth. Lowering borrowing costs diminish the expense of financing projects and investing in new technologies, infrastructure and even mergers and acquisitions. This can stimulate expansion and drive higher returns for businesses.

With the monetary policy still highly restrictive, companies should be cautious while borrowing costs remain elevated. That’s why significant changes in business strategies aren’t yet expected, especially with the BoE forecasting inflation to pick up in the second half of 2024. If inflation returns to the target level for a sustained period, further rate cuts will occur, supporting the performance of sectors with high financing costs.

Construction

In recent years, the construction sector has grappled with low output and escalating costs due to supply chain disruptions caused by the pandemic and the Russia-Ukraine conflict. These challenges have been compounded by rampant inflation, which has hit budgets.

However, easing inflation, the anticipated rate cut and the newly elected Labour government and its new building targets ignited growth in the sector over July. The latest publication from S&P Global indicates the Construction Purchasing Managers’ Index (PMI) shot up to 55.3 in July 2024 from 52.2 the previous month.

The August rate cut is set to stimulate continued growth by slightly reducing financing costs. Given the capital-intensive nature of construction, continued rate cuts would make financing more accessible, encouraging contractors to initiate new projects, ramp up investment and boost productivity.

Key manufacturing industries set to be affected by rate cuts:

Residential Building Construction

- Rate cuts will lower borrowing costs, making it more affordable for developers to finance new residential ventures, accelerating the construction of new homes.

- Falling interest rates signal a reduction in mortgage rates, easing the financial burden on homeowners. Increased affordability will drive greater demand for new homes and renovations as consumers capitalise on lower rates to finance their housing improvements.

- Reduced interest rates will support the new Labour government’s commitment to building 1.5 million homes over the next five years, aiding residential construction companies in securing financing and accelerating efforts to meet this target.

Commercial Building Construction

- Lower interest rates will reduce borrowing costs, making it more feasible for developers to undertake large-scale commercial building projects and expansions.

- Cheaper financing eases corporate budget constraints and increases demand for commercial developments, strengthening project pipelines.

- Trimmed rates alleviate the debt burden that many commercial construction companies have struggled with in recent years, improving cashflow and financial stability. This will promote investment in technologies that enhance operational efficiencies, like advanced AI-driven building management systems.

Strategies for success:

Capitalise on lower borrowing costs: Construction companies should leverage reduced interest rates to secure financing for new projects, positioning themselves to win contracts and stimulate growth. Future cuts will also enable contractors to refinance existing debt, improving cashflow and investment capabilities.

Invest in technology: Improved cashflow allows construction businesses to cover operational expenses more easily, giving them the funds they need to invest in new technologies and equipment. This not only enhances efficiency but also strengthens a contractor’s competitive advantage.

Accelerate project timelines: Reduced financing costs can boost consumer spending, creating more tender opportunities for construction contractors. With stronger pipelines, companies should capitalise on favourable rates and expedite project timelines to meet the mounting demand for residential and commercial properties.

Manufacturing

PwC’s 2024 executive survey revealed that over a third of manufacturers expected a rebound in activity if interest rates cooled, indicating hope for growth amid a stabilising economic climate. Manufacturing industries with high capital intensity, like automotive and machinery manufacturing, are the best placed to benefit from lower interest rates. Cheaper borrowing costs will help these manufacturers finance capital investment, while also boosting consumer spending on durable goods, driving sector output.

While manufacturers will welcome the recent interest rate cut, many will initially focus on capitalising on renewed consumer and business confidence rather than making large-scale investments. Other factors like global trade dynamics, input cost inflation and government policies will also influence the impact of the rate cut on the sector.

Key manufacturing industries set to be affected by rate cuts:

Motor Vehicle Manufacturing

- Motor vehicle manufacturing demands significant capital investment in machinery, technology and facilities. Lower financing costs should help stimulate investment in production and innovation, boosting output.

- Increased consumer spending should propel vehicle sales, supporting manufacturers’ output and revenue prospects.

Consumer Electronics Manufacturing

- Slashed interest rates lower the cost of financing new technology upgrades, invigorating demand for consumer electronics.

- Higher revenue prospects combined with cheaper credit encourage electronic manufacturers to invest in R&D and develop new product lines.

Strategies for success:

Enhance production capacity: With favourable financing options, manufacturers should invest in expanding production capacity and modernising processes to position themselves for growth as demand mounts. Exploring new markets can further enhance production capabilities.

Optimise supply chains: Manufacturers should take advantage of cheaper credit to enhance supply chain resilience and efficiency. By investing in more streamlined logistics operations, strengthening supplier relationships and diversifying their supply chains, they can better protect themselves against volatile economic conditions.

Strengthen R&D for innovation: Innovation is at the epicentre of success for manufacturers. By capitalising on cheaper financing to boost R&D efforts and focus on innovative designs and new product lines, manufacturers leave themselves well placed to beat the competition.

In sum, businesses across various industries will respond differently to the rate cut. It’s fair to say the reduction in interest payments will improve cashflow for many companies, especially SMEs, reigniting investment. However, the extent and timing of these benefits remains uncertain. Some view the rate cut as the start of a promising period for investments and opportunities, while others remain cautious about making drastic changes to their investment strategies while rates remain high.

Impact on Households

Households are among the first to feel the effects of lower interest rates, as these changes directly affect mortgage affordability and consumer purchasing power. However, because the initial interest rate cut is only marginal, the benefits will be limited in the face of ongoing financial instability.

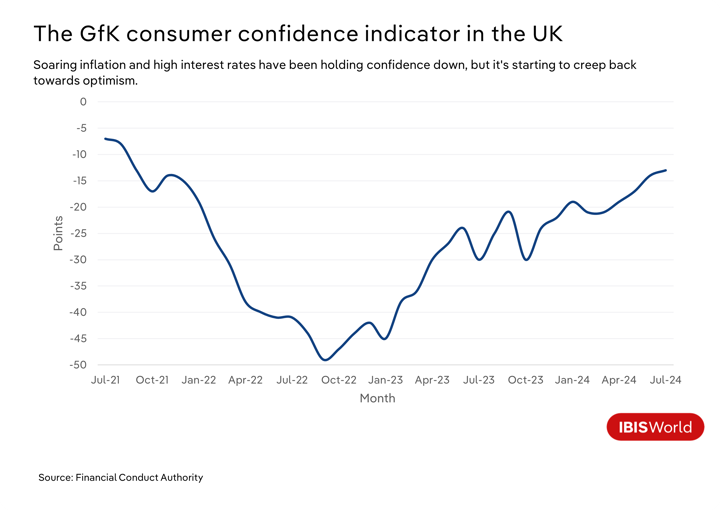

Climbing consumer confidence

Years of persistent inflation have strained consumer finances, but lower borrowing costs brought about by prospective rate cuts should provide some relief, supporting a modest rise in consumer confidence. As households see their financial burdens ease, they’re likely to spend more on goods and services, fostering growth in various sectors of the economy – businesses should seek to take advantage of this while they can; it could give them a much-needed boost after years of weak consumer spending.

Despite the rate cut, there are still significant upward pressures on inflation. The BoE forecasts that inflation will inch up to 2.75% by the end of 2024, driven by incoming energy price pressures in Q3 and Q4 and global political unrest inciting further price volatility. The forecast aligns with the latest CPI publication from the ONS, which shows that inflation edged up to 2.2% in July 2024. Currently, stubbornly high service price inflation – this sat at 5.2% in July 2024 - has led the MPC to exercise caution in lowering the rate any further in the near future.

While consumer confidence is on the rise, it’s unlikely to soar. Instead, consumers are expected to remain cautiously optimistic, closely monitoring future price fluctuations and their impact on personal finances. They might be slighter looser with their wallets in the short term, but they’ll be ready to rein in the spending again as soon as they need to.

Final Word

Now that the BoE has lowered the base rate, rejuvenating businesses' and consumers' sentiment, the outlook for the second half of 2024 appears promising. However, this optimism should be tempered with caution, given lingering service price inflation and strong wage growth is still exerting upwards pressures on prices.

Echoing the MPC’s warning, this rate cut should be viewed as a tentative first move, not the start of a series of cuts. Until there’s clear evidence that inflation has reached a sustainable level, monetary policy will remain tight and businesses and consumers alike should remain cautious with their spending.