Key Takeaways

- ESG scores assess industries based on environmental impact, social responsibility and governance practices.

- High ESG scores indicate increased risks in environmental, social and governance practices.

- Balanced improvements across environmental, social and governance areas are essential for reducing ESG risks.

Did you know that nearly 96% of the world’s leading 250 companies now report on their sustainability practices? This number is only set to rise across all companies in all sectors as new regulations tighten around non-financial reporting. Understanding these developments, particularly through the lens of Environmental, Social and Governance (ESG) scores, is becoming more and more important for businesses looking to stay competitive.

ESG scores provide a valuable snapshot of how well industries manage their impact on the environment, their relationship with stakeholders and their governance practices. These factors go beyond the balance sheet, influencing everything from compliance costs to market reputation. Understanding what drives these scores is fundamental for making informed choices that can improve growth, manoeuvre risks and help guide strategic planning.

What is an ESG score?

As the name suggests, an ESG score evaluates how well an industry or company manages risks related to ESG factors. These scores help assess how an industry or company is performing across the three key areas.

Each of these categories is assessed based on various metrics, like greenhouse gas emissions and waste management for environmental scores, fair labor standards and leave benefits for social scores, or modern slavery and regulatory complexity for governance scores. The overall ESG rating reflects a company's exposure to risks in these areas and helps identify potential vulnerabilities.

Data for these assessments can come from both quantitative and qualitative sources, including government agencies, Transparency International, company annual reports, industry associations and regulatory bodies. These varied sources provide a comprehensive view of a company’s ESG performance.

Scoring scales and how they differ

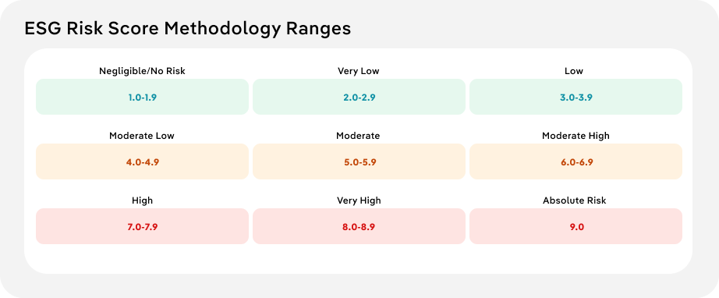

It’s important to note that ESG scoring systems can vary depending on the rating agency. For example, in IBISWorld’s methodology, higher scores indicate increased exposure to risks, like compliance issues or societal impacts.

A score ranging from 1 to 9 reflects the severity of these risks, with a higher score signaling a greater need for improvement. Other scoring systems sometime use a 0 to 100 scale, with higher scores indicating a better ESG performance. In contrast, some rating agencies indicate that lower scores reflect greater risk exposure. This means that when companies assess their ESG ratings, it's important to be mindful of how different scoring systems may highlight varying risks.

How ESG categories are weighted

How ESG categories are weighted

The importance of each ESG category can also vary across different methodologies. For example, IBISWorld places greater emphasis on environmental factors, which account for 70% of the overall score. Social factors account for 20%, with governance representing the remaining 10%. This reflects the significant impact that environmental risks have on business operations, though social and governance risks remain key elements of the overall evaluation. In contrast, sometimes other agencies will assign individual scores to the environmental, social and governance factors.

The cost of high ESG scores

While understanding the structure of ESG scores is important, it’s equally important to recognize the implications of a high score. Higher (or lower, in some cases) ESG ratings represent increased risk exposure, particularly in the areas of compliance, regulatory changes and market perception.

Regulatory and compliance risks

A high ESG score can attract greater scrutiny from regulators. Companies with elevated scores may face stricter compliance requirements, frequent audits and even legal action if their practices fall short. Additionally, as sustainability becomes a greater focus, regulators are also cracking down on greenwashing, making it even more vital for companies to align their ESG practices with real improvements.

Effects on market perception and stakeholder trust

High ESG scores not only raise compliance concerns but can also impact a company’s reputation in the marketplace. Investors and stakeholders are increasingly focusing on ESG metrics to assess long-term risk and stability. Companies suspected of greenwashing, or failing to follow through on sustainability claims, can suffer reputational damage. This, combined with high scores, may deter investors and lenders, leading to restricted access to capital, higher borrowing costs and diminished market confidence.

Scoring environmental factors

Environmental factors often carry the most weight in ESG scoring due to their substantial impact on sustainability and regulatory compliance. These metrics evaluate how industries manage their ecological footprint, covering direct impacts like emissions and waste, and indirect effects like commitment to environmental initiatives.

Higher environmental scores typically signal greater risk exposure, particularly in sectors with significant environmental footprints, like fossil fuels and agriculture.

What are the five ESG factors that are key drivers of a high environmental score? The below are frequently cited in legislation and are relevant across all industries:

Greenhouse gas emissions

When industries release large amounts of carbon dioxide and other greenhouse gases, they contribute to global warming, making them subject to stricter regulations. High-emission sectors like energy production and agriculture are especially at risk, as they often face mounting pressure to reduce their carbon footprints.

Strategies for risk reduction

- Adopt renewable energy contracts: Secure power purchase agreements with renewable energy providers to safeguard long-term access to clean energy.

- Electrify operations: Transition from fossil fuel-powered machinery and vehicles to electric alternatives, reducing direct emissions.

- Implement emissions reduction technologies: Install carbon capture and storage systems or upgrade to high-efficiency boilers and HVAC systems.

Energy efficiency

Energy efficiency measures how effectively industries use energy and their reliance on non-renewable sources. The oil and gas sector, which is a major energy consumer, faces greater risks if it fails to adopt more sustainable energy practices.

Strategies for risk reduction

- Perform energy audits: Conduct regular, comprehensive energy audits to identify inefficiencies and prioritize high-usage areas for improvement.

- Use smart technologies: Integrate IoT devices and smart meters to monitor and optimize energy use in real time, reducing waste.

- Implement demand response programs: Adjust energy use during peak demand times by automating systems to scale back non-essential energy loads.

Water efficiency

Sectors that use large amounts of water – like agriculture, textiles and energy – or contribute to water pollution are closely monitored. Water-intensive industries risk higher scores if they fail to improve their water conservation and pollution control practices.

Strategies for risk reduction

- Install water-efficient technologies: Upgrade to water-saving fixtures, smart irrigation systems and closed-loop water recycling systems in facilities.

- Monitor and optimize water usage: Use advanced water metering and monitoring systems to track usage, identify leaks and optimize water flow across operations.

- Source alternative water supplies: Invest in rainwater harvesting, greywater reuse or purification systems to reduce dependency on traditional water sources.

Waste management

Waste management focuses on how industries handle their waste, from hazardous materials to recycling practices. Sectors that generate large amounts of waste, like mining, healthcare and construction, are more susceptible to higher scores if they don’t implement effective waste reduction strategies.

Strategies for risk reduction

- Implement zero-waste initiatives: Set measurable goals to eliminate waste sent to landfills by reducing packaging, improving material reuse and enhancing recycling processes.

- Audit supply chains for waste reduction: Work with suppliers to minimize excess packaging and materials and implement take-back or reuse programs.

- Introduce waste-to-energy solutions: Invest in technology that converts organic waste into energy, like anaerobic digestion or biomass energy systems.

Commitment to environmental initiatives

Efforts to promote sustainability through reforestation, biodiversity conservation and habitat protection can affect scores. Sectors with a direct impact on ecosystems, like agriculture, construction and forestry, face higher risks if they neglect these environmental commitments.

Strategies for risk reduction

- Set science-based sustainability targets: Commit to science-based goals that align with international frameworks like the Paris Agreement or the UN Sustainable Development Goals.

- Integrate sustainability into R&D: Develop eco-friendly products and services that meet consumer demand and reduce environmental harm across the product lifecycle.

- Join industry collaborations: Participate in industry coalitions and sustainability certifications to drive environmental leadership and transparency.

Scoring social factors

Scoring social factors

While environmental factors often take the spotlight in ESG, social factors are also important to consider. These factors assess how industries manage internal relationships, particularly with their employees. Social factors focus on employee rights, diversity and overall well-being, which are increasingly important as societal expectations shift toward stronger social responsibility. Sectors with large workforces or labor-intensive operations are particularly under scrutiny in this area.

What are the five ESG factors that are key drivers of a high social score? The below are frequently cited in legislation and are relevant across all industries:

Fair labor standards

This factor assesses how well industries protect employee rights, guarantee fair wages, maintain safe working conditions and prevent exploitation. Heightened scrutiny of labor practices is given to sectors with high labor turnover, like retail and manufacturing, which makes them particularly at risk.

Strategies for risk reduction

- Auditing workplace conditions: Conduct regular audits to maintain compliance with international labor standards, covering fair wages, safe environments and ethical practices.

- Training programs: Implement ongoing employee training focused on safety protocols, labor rights and workplace ethics to create a culture of safety and fairness.

- Establishing grievance mechanisms: Create clear, accessible channels for employees to report issues and escalate complaints without fear of retaliation.

Pay equality

This factor assesses how well companies ensure equitable pay practices, focusing on gender and racial pay gaps. Sectors that have historically exhibited disparities in compensation (especially at leadership levels), like construction and finance, tend to face higher scrutiny in this area.

Strategies for risk reduction

- Conducting pay audits: Regularly analyze compensation data to identify and resolve gender and racial pay gaps at all levels of the organization.

- Implementing transparent pay scales: Develop clear, publicly communicated salary bands to ensure fairness and consistency in pay across gender and race.

- Establishing pay equity targets: Set specific targets to achieve gender and racial pay equity, with regular progress tracking and reporting.

First Nations participation

This factor, specific to Australia, assess how well industries incorporate Indigenous cultural values, consultation and representation into their practices. High levels of Indigenous workforce participation and culturally respectful engagement – like seeking input from Traditional Owners – reflect equitable involvement and contribute to a lower governance risk score. Sectors like mining, energy and construction, which often operate on Indigenous lands, face heightened expectations and scrutiny in this area.

Strategies for risk reduction

- Creating employment pathways: Partner with Indigenous communities to develop job opportunities and training programs that promote skill development and long-term employment.

- Prioritizing procurement: Implement policies that prioritize sourcing from Indigenous-owned businesses and suppliers, supporting economic empowerment within First Nations communities.

- Engaging in meaningful consultation: Promote ongoing dialogue with Indigenous leaders and communities to ensure business practices respect cultural values and contribute to local development goals.

Workforce composition

This factor looks at the diversity and inclusion of a company’s workforce, particularly in terms of gender, race and other underrepresented groups. Sectors with traditionally homogenous workforces, like technology and finance, are more likely to face scrutiny in this area.

Strategies for risk reduction

- Implement diversity hiring initiatives: Establish clear diversity hiring goals and implement programs to attract and retain candidates from underrepresented groups.

- Create inclusive workplace policies: Develop policies that create an inclusive environment, such as anti-discrimination training, flexible work arrangements and support for employee resource groups.

- Monitor and report on diversity metrics: Track and report diversity statistics to measure progress and enforce accountability across the organization.

Leave benefits

Leave benefits, like paid parental leave, sick leave and vacation time, are key indicators of employee well-being and are increasingly recognized as key social metrics. Sectors like hospitality and construction often score higher in this area when leave benefits don't meet workforce expectations.

Strategies for risk reduction

- Offering comprehensive paid leave: Offer paid parental leave, sick leave and vacation time that fully complies with local laws.

- Implementing carryover policies: Allow employees to carry over unused leave to future periods to provide greater flexibility.

- Introducing wellness or mental health leave: Provide additional paid days specifically for wellness or mental health, reflecting a growing focus on employee well-being.

Scoring governance factors

Scoring governance factors

Just as social factors assess how industries interact with employees, customers and communities, governance factors evaluate the internal structures that guide companies’ leadership and ethical practices. Governance scores focus on how well industries manage their internal controls, transparency and regulatory compliance. A high governance score can signal increased risks related to legal challenges, regulatory oversight or damage to a company's reputation.

What are the five ESG factors that are key drivers of a high governance score? The below are frequently cited in legislation and are relevant across all industries:

Regulatory complexity

Industries that operate under complex and frequently changing regulations are more likely to face governance challenges. When an industry has to comply with intricate legal frameworks, like those in pharmaceuticals, financial services and healthcare sectors, it becomes harder to maintain consistent regulatory compliance.

Strategies for risk reduction

- Invest in regulatory compliance software: Use advanced tools to track and manage evolving legal requirements across different regions.

- Establish a dedicated regulatory affairs team: Ensure consistent compliance by having a specialized team focused on staying ahead of regulatory changes.

- Conduct regular internal audits: Perform frequent audits to identify potential compliance gaps and address them proactively.

Tax corruption

Industries operating in regions with weak tax regulations or facing tax evasion risks often score higher in governance. Sectors like oil and gas, which operate across borders, must navigate complex tax laws and are exposed to risks related to uneven enforcement or corruption.

Strategies for risk reduction

- Perform third-party tax audits: Regular external audits help ensure adherence to local and international tax laws.

- Develop an anti-corruption program: Create strong ethics and anti-corruption policies to prevent unethical tax practices.

- Train employees on tax compliance: Offer regular training sessions to educate staff about the risks of tax evasion and corruption across global operations.

Modern slavery

Governance risks increase when companies fail to address issues related to forced labor, human trafficking or inadequate supply chain transparency. Companies that have global supply chains, as is often the case in sectors like manufacturing, construction and agriculture, are particularly vulnerable to modern slavery risks.

Strategies for risk reduction

- Implement supplier audits: Conduct strict audits of suppliers to ensure compliance with labor laws and ethical standards.

- Enforce a supplier code of conduct: Develop and enforce policies that prohibit forced labor and human trafficking in the supply chain.

- Partner with monitoring organizations: Collaborate with third-party groups specializing in certifying ethical labor practices and ensuring compliance.

Fines, penalties and enforceability

Industries facing significant fines or penalties for non-compliance often experience higher governance risks. Sectors like financial services, pharmaceuticals, and oil and gas are particularly exposed, frequently incurring large penalties for violations related to regulatory, environmental and safety standards.

Strategies for risk reduction

- Set up a compliance management system: Implement comprehensive systems to monitor and enforce regulatory compliance across all operations.

- Provide regulatory training: Offer regular training to employees on industry-specific regulations and safety standards.

- Use real-time compliance tracking tools: Invest in technology that provides real-time tracking and reporting on compliance issues to prevent violations.

Trade with risky geopolitical regions

Companies that conduct significant trade in regions with high corruption levels or political instability face higher governance risks. When a company often sources materials or labor from emerging markets, like the electronics sector, it is more exposed to governance risks.

Strategies for risk reduction

- Diversify supply chains: Reduce dependence on high-risk regions by sourcing from multiple, politically stable countries.

- Perform due diligence on partners: Conduct thorough background checks on international partners and suppliers to ensure compliance with anti-corruption laws.

- Develop contingency plans: Create risk mitigation strategies and contingency plans to address potential political or regulatory disruptions in high-risk areas.

Final Word

As ESG considerations continue to evolve, their influence on industry practices becomes more pronounced. From shifting regulations to changing stakeholder expectations, the focus on sustainability and ethical operations is reshaping how businesses approach long-term growth.

Navigating these changes requires a thoughtful approach – one that recognizes the value of improving environmental, social and governance performance not just as a means of reducing risks, but as a pathway to sustainable development. By proactively addressing ESG challenges, industries can position themselves for resilience and success as the market becomes increasingly conscious of these considerations.